Legendary Investors and their Genius in Asset Allocation during Turbulent Times

In the world of finance, the ability to navigate through turbulent times is a feat that only a few can master. The economic landscape is often marred by crises, recessions, and market downturns. However, amid these challenging periods, some individuals have not only weathered the storm but have also managed to thrive. These are the legendary investors who have demonstrated an unparalleled genius in asset allocation during turbulent times. This article explores the strategies of 6 such investors, their unique approaches and how they managed to turn crisis into opportunity. Their stories serve as a beacon of hope and a guide for budding investors to navigate through economic uncertainties.

1. Benjamin Graham and the Value Investing

Benjamin Graham, often referred to as the "father of value investing," had a knack for identifying undervalued stocks during market downturns. Graham believed in the philosophy of buying stocks at a price less than their intrinsic value, thereby creating a margin of safety. During the Great Depression, when most investors were panic-selling, Graham saw an opportunity. He meticulously analyzed the financials of companies, focusing on their assets and earnings potential. By doing so, he managed to invest in fundamentally strong companies at bargain prices, which later resulted in substantial returns.

2. Warren Buffett and the Buy-and-Hold Strategy

Warren Buffett, a student of Benjamin Graham, took the concept of value investing a step further. Buffett believes in the buy-and-hold strategy, where he invests in companies with a strong competitive advantage and holds onto these investments for a long period. This strategy was particularly effective during the 2008 financial crisis. While many investors were selling off their stocks, Buffett was busy buying. He invested in companies like Goldman Sachs and General Electric, which were fundamentally strong but undervalued due to market panic. This strategy paid off handsomely when the market eventually recovered.

3. George Soros and the Theory of Reflexivity

George Soros, known for his audacious bets, developed the theory of reflexivity. This theory posits that investors' perceptions can influence the fundamentals of the economy, leading to self-reinforcing feedback loops. Soros used this theory during the 1992 Black Wednesday crisis. He anticipated that the British government would have to devalue the pound due to economic pressures. Acting on this belief, Soros shorted the pound, and when the devaluation eventually happened, he made a profit of $1 billion.

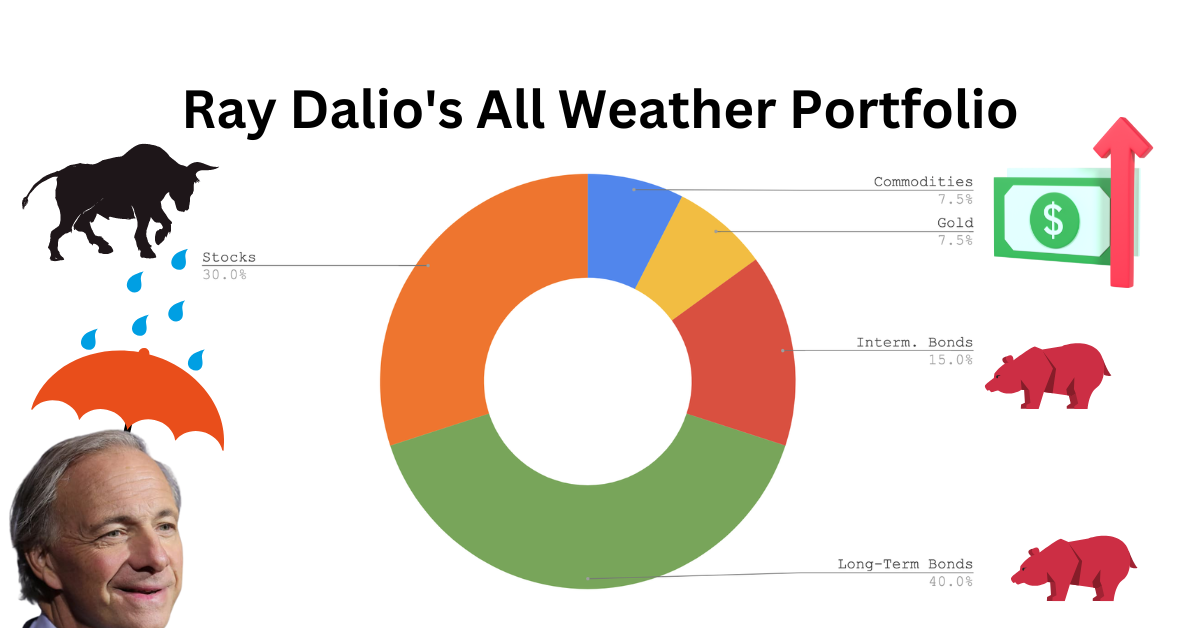

4. Ray Dalio and the All-Weather Portfolio

Ray Dalio, the founder of Bridgewater Associates, believes in the concept of risk parity. He created the All-Weather Portfolio, which aims to perform well across all economic environments. This portfolio consists of 30% stocks, 40% long-term bonds, 15% intermediate-term bonds, 7.5% gold, and 7.5% commodities. During the 2008 financial crisis, when most portfolios were bleeding, Dalio's All-Weather Portfolio managed to stay afloat, proving the effectiveness of his asset allocation strategy.

5. John Templeton and the Global Diversification

John Templeton was a pioneer in global diversification. He believed in the philosophy of investing in countries and sectors that were out of favor. Templeton's strategy was put to the test during the tech bubble of the late 1990s. While most investors were pouring money into the overvalued tech sector, Templeton was investing in out-of-favor countries and sectors. When the tech bubble eventually burst, Templeton's portfolio was largely unscathed, demonstrating the benefits of global diversification.

6. Peter Lynch and the Invest in What You Know Strategy

Peter Lynch, the legendary manager of the Fidelity Magellan Fund, believes in the strategy of investing in what you know. He argues that individual investors can outperform the market by investing in companies and sectors they are familiar with. During the 1987 Black Monday crash, Lynch's fund managed to recover faster than the market due to his deep understanding of the companies in his portfolio. His strategy demonstrates the importance of knowledge and research in investing, especially during turbulent times.

These legendary investors have shown that with the right strategy, it is possible to navigate through turbulent times and even turn crisis into opportunity. Their stories serve as a reminder that investing is not just about making quick profits, but about understanding the fundamentals, having a long-term perspective, and being prepared for all kinds of economic environments. Whether it is Graham's value investing, Buffett's buy-and-hold strategy, Soros's theory of reflexivity, Dalio's All-Weather Portfolio, Templeton's global diversification, or Lynch's invest in what you know strategy, each approach offers valuable lessons for investors.