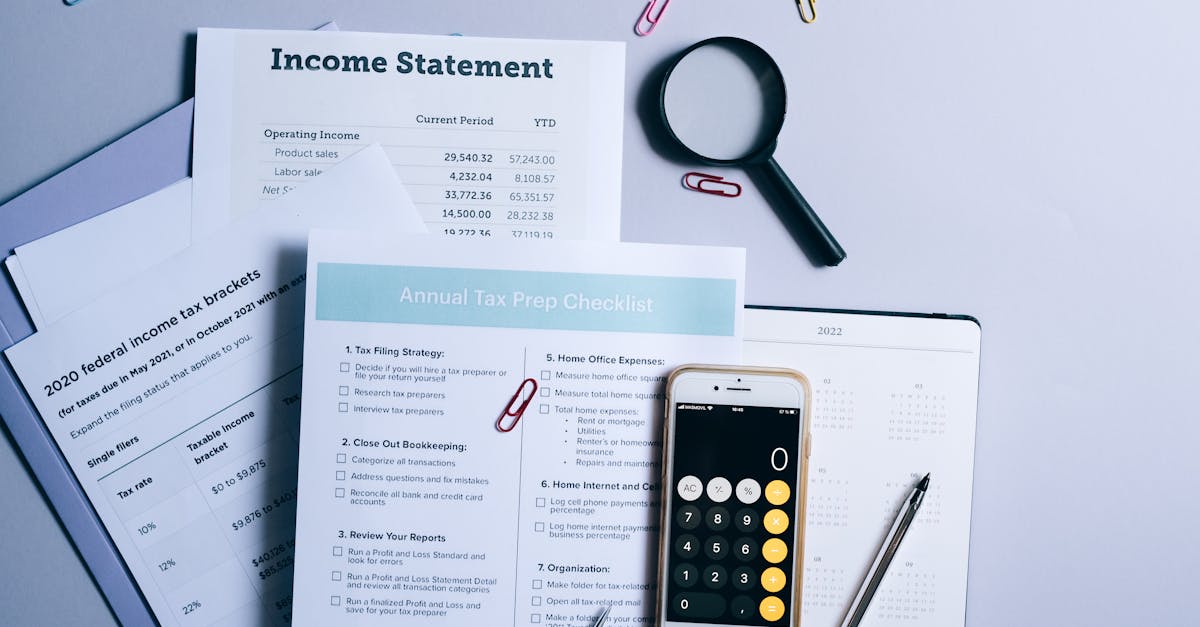

The 7 End-of-Year Banking Moves That Can Save You $1,000s on Taxes

As the year draws to a close, many individuals focus on holiday preparations and New Year resolutions, often overlooking a crucial opportunity to optimize their financial health. The end of the year is a critical time for tax planning, offering a chance to make strategic banking moves that can significantly reduce your tax liability. By understanding and implementing these key strategies, you can potentially save thousands of dollars. This comprehensive guide will explore seven essential end-of-year banking moves, illuminating how each can contribute to a healthier financial outlook and a lighter tax burden. Let's delve into these strategies and see how they can transform your financial year-end.

Maximize Retirement Contributions

One of the most effective ways to reduce taxable income is by maximizing contributions to retirement accounts such as a 401(k) or IRA. Contributions to these accounts are often tax-deductible, meaning they can lower your taxable income, which in turn reduces the amount of tax you owe. For 401(k) plans, the contribution limit for 2023 is $22,500, with an additional $7,500 catch-up contribution allowed for those aged 50 and over. For IRAs, the limit is $6,500, with a $1,000 catch-up. By contributing the maximum amount, you not only save on taxes but also enhance your retirement savings, benefiting from compounded growth over time.

Harvest Tax Losses

Tax-loss harvesting is a strategic move that involves selling investments at a loss to offset capital gains from other investments. This strategy can be particularly beneficial at year-end, allowing you to reduce your taxable income by offsetting gains with losses. If your losses exceed your gains, you can use up to $3,000 of the excess loss to offset other income. Any remaining losses can be carried forward to future tax years. This approach not only helps in reducing your current tax liability but also provides a strategic advantage for future tax planning, making it a powerful tool in your financial arsenal.

Review and Adjust Withholding

The end of the year is an excellent time to review your tax withholding to ensure you're not overpaying or underpaying taxes. Over-withholding means you're giving the government an interest-free loan, while under-withholding could result in penalties. By reviewing your withholding, you can adjust it to better match your actual tax liability. This can be done by submitting a new W-4 form to your employer. Making these adjustments ensures that you're optimizing cash flow and avoiding surprises come tax time, ultimately keeping more money in your pocket throughout the year.

Execute Charitable Contributions

Charitable contributions are not only a way to give back to the community but also a strategic tax-saving tool. Donations to qualified charities can be deducted from your taxable income, reducing your overall tax burden. It's important to keep detailed records of your contributions, including receipts and acknowledgment letters from the organizations. Additionally, consider donating appreciated assets, such as stocks, which can provide a double tax benefit: avoiding capital gains tax on the appreciation and receiving a deduction for the full fair market value. This strategy can significantly impact your tax savings while supporting causes you care about.

Optimize Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) offer a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. For 2023, the contribution limits are $3,850 for individuals and $7,750 for families, with an additional $1,000 catch-up contribution for those aged 55 and older. By contributing the maximum amount to your HSA, you can reduce your taxable income while saving for future healthcare expenses. This strategy not only optimizes your current tax situation but also provides a financial cushion for medical costs, which can be a significant expense in retirement.

Prepay Deductible Expenses

Prepaying deductible expenses, such as mortgage interest or property taxes, can be a savvy move to reduce your taxable income for the current year. By accelerating these payments into the current tax year, you can increase your itemized deductions, potentially lowering your overall tax bill. This strategy is particularly beneficial if you expect your income to increase in the following year, as it allows you to take advantage of deductions when your tax rate is higher. It's essential to consult with a tax advisor to ensure this strategy aligns with your financial situation and tax planning goals.

Evaluate and Rebalance Your Investment Portfolio

Year-end is an ideal time to evaluate and rebalance your investment portfolio to align with your financial goals and risk tolerance. Rebalancing involves adjusting the allocation of your investments to maintain your desired asset mix, which can shift over time due to market fluctuations. This process can also provide tax benefits by allowing you to strategically realize gains or losses. By selling investments that have underperformed, you can offset gains from those that have appreciated, optimizing your tax situation. Regular portfolio evaluation ensures that your investments are working efficiently towards your long-term financial objectives.

A Strategic Approach to Year-End Tax Savings

Implementing these seven end-of-year banking moves requires careful planning and consideration, but the potential tax savings and financial benefits make it a worthwhile endeavor. By maximizing retirement contributions, harvesting tax losses, adjusting withholding, executing charitable contributions, optimizing HSAs, prepaying deductible expenses, and rebalancing your investment portfolio, you can significantly impact your tax liability and enhance your financial health. As you prepare to close out the year, take the time to review these strategies and consult with financial and tax professionals to ensure you're making the most of your financial opportunities. With a strategic approach, you can enter the new year with confidence and a stronger financial foundation.