Top 7 Capital Gains Strategies Adopted by the Wealthiest Individuals

Capital gains, the profit that comes from the sale of an investment or property, play a significant role in wealth accumulation. But the real art lies not just in making these gains but managing them strategically to maximize returns. This article will delve into the top seven capital gains strategies adopted by the wealthiest individuals, revealing how they decode the billion-dollar savings mystery. We'll explore the intricacies of these strategies, their benefits, and the logical connections between them, providing you with a comprehensive guide to capital gains management.

Strategy 1: Buy and Hold

The first strategy is as simple as it sounds - buy and hold. The wealthiest individuals often invest in assets that appreciate over time, holding onto them for long periods. This strategy not only allows the asset to increase in value but also benefits from lower long-term capital gains tax rates. The tax rate for long-term investments is significantly lower than short-term, making this a lucrative strategy for wealth accumulation. It's not just about patience, but also about the foresight to choose assets that have the potential for long-term growth.

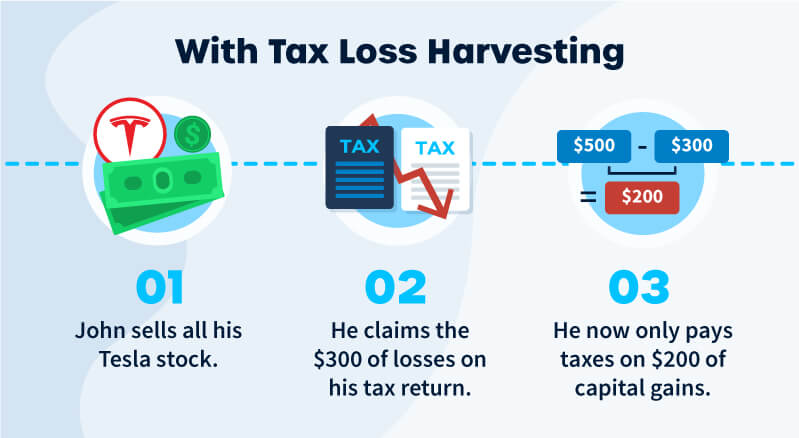

Strategy 2: Tax-Loss Harvesting

The second strategy is tax-loss harvesting, a method that involves selling securities at a loss to offset a capital gains tax liability. This strategy can effectively lower taxable income, reducing the amount of tax owed. Wealthy investors often use this strategy in conjunction with the buy and hold strategy, selling off underperforming assets to offset the gains from their long-term investments. It's a delicate balancing act that requires careful timing and strategic planning.

Strategy 3: Utilizing Tax-Advantaged Accounts

The third strategy involves the use of tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s. These accounts allow individuals to invest pre-tax dollars, which can grow tax-free until withdrawal. This strategy can significantly reduce the amount of tax paid on capital gains, allowing for greater wealth accumulation. The wealthiest individuals often max out contributions to these accounts to take full advantage of their tax benefits.

Strategy 4: Gifting and Inheritance

The fourth strategy involves gifting and inheritance. Wealthy individuals often transfer assets to their heirs, who may be in a lower tax bracket and therefore pay less capital gains tax when they sell the asset. Additionally, the 'step-up in basis' rule allows heirs to avoid capital gains tax on the appreciation that occurred during the previous owner's lifetime. This strategy involves careful estate planning and a deep understanding of tax laws.

Strategy 5: Real Estate Investments

Real estate is another avenue where the wealthy strategize their capital gains. By investing in real estate, individuals can take advantage of depreciation deductions, reducing their taxable income. Additionally, the tax code allows for a 1031 exchange, where the capital gains from the sale of one property can be rolled over into a new property, deferring the capital gains tax. This strategy requires a keen understanding of the real estate market and tax laws.

Strategy 6: Charitable Donations

The sixth strategy involves charitable donations. By donating appreciated securities to charity, wealthy individuals can avoid paying capital gains tax on those assets. Additionally, they can claim a tax deduction for the full fair market value of the donated securities. This strategy not only reduces tax liability but also allows the wealthy to contribute to causes they care about.

Strategy 7: Qualified Opportunity Zones

The final strategy revolves around investing in Qualified Opportunity Zones. These are economically distressed communities where new investments may be eligible for preferential tax treatment. Capital gains invested in these zones can defer and potentially reduce capital gains tax. This strategy is not just a savvy tax move, but it also contributes to social good by promoting economic development in underprivileged areas. The wealthiest individuals decode the billion-dollar savings mystery through a combination of strategic investments, tax planning, and a deep understanding of the financial landscape. These strategies, when used effectively, can significantly reduce capital gains tax liability, leading to substantial wealth accumulation.