6 Major Regulatory Transformations Triggered by Crypto Failures

The world of finance is in a constant state of evolution, and the advent of cryptocurrencies has accelerated this transformation. The inception of Bitcoin in 2009 was a pivotal moment that triggered a seismic shift in the global financial landscape. However, the journey hasn't been smooth. Various crypto failures have led to significant regulatory transformations that are reshaping the world of finance. This article aims to delve into 6 major regulatory changes triggered by crypto failures and their ripple effect on the global financial landscape.

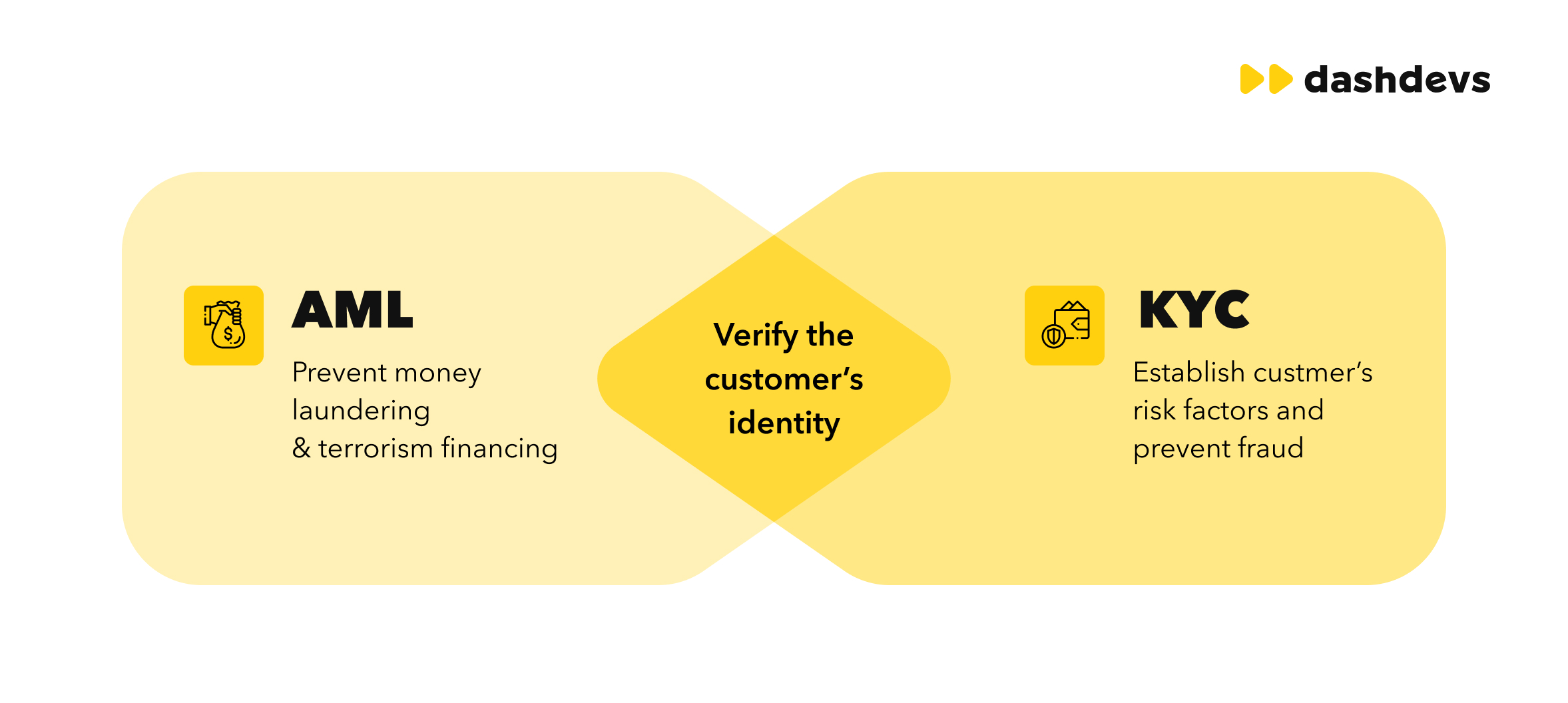

Regulatory Transformation 1: Stricter KYC and AML Regulations

The first transformation is the stricter enforcement of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Following several high-profile cases of money laundering involving cryptocurrencies, regulators worldwide have tightened the noose around KYC and AML. This has led to crypto exchanges and other service providers implementing more rigorous customer identification and verification processes. While these measures have increased operational costs for service providers, they have also enhanced the overall security of the crypto ecosystem, making it less attractive for illicit activities.

Regulatory Transformation 2: ICO Regulations

Initial Coin Offerings (ICOs) emerged as a popular fundraising method for blockchain startups, reaching a peak in 2017. However, the rampant fraud and scams associated with ICOs led to significant losses for investors. Regulators responded by enforcing regulations that treat ICOs similarly to securities offerings, requiring companies to comply with existing securities laws. This has led to a decrease in fraudulent ICOs, protecting investors and adding a layer of legitimacy to the crypto market.

Regulatory Transformation 3: Crypto Taxation

The third transformation is the introduction of crypto taxation. The anonymous nature of cryptocurrencies made them a popular medium for tax evasion. To counter this, tax authorities worldwide have introduced regulations requiring individuals and businesses to report their crypto holdings and transactions. This has not only increased government revenue but also integrated cryptocurrencies into the formal economy, further legitimizing them.

Regulatory Transformation 4: Central Bank Digital Currencies (CBDCs)

The rise of cryptocurrencies has prompted central banks worldwide to explore the possibility of issuing their own digital currencies (CBDCs). CBDCs aim to combine the convenience and security of digital currencies with the regulated, reserve-backed money supply of traditional money. While still in the experimental stage, CBDCs represent a significant regulatory transformation triggered by the rise and failures of cryptocurrencies.

Regulatory Transformation 5: Crypto Derivatives Regulation

Crypto derivatives, such as futures and options, have grown in popularity, providing traders with more sophisticated tools to hedge risk and speculate on price movements. However, the lack of regulation in this area has led to market manipulation and excessive risk-taking. Regulators are now moving to oversee these products, introducing rules around transparency, market integrity, and investor protection. This is reshaping the crypto derivatives market and bringing it in line with traditional financial markets.

Regulatory Transformation 6: Stablecoin Regulations

Stablecoins, which are cryptocurrencies pegged to stable assets like the US dollar, have gained popularity due to their reduced price volatility. However, regulatory concerns have arisen due to the potential for stablecoins to disrupt monetary policy and financial stability. Regulators are now moving to impose rules on stablecoin issuers, including capital requirements and risk management standards. This is reshaping the stablecoin market and may influence the development of future digital currencies.

The rise and subsequent failures of cryptocurrencies have triggered a wave of regulatory transformations. These changes are reshaping the global financial landscape, integrating cryptocurrencies into the formal economy, and enhancing the security and legitimacy of the crypto market. As the crypto ecosystem continues to evolve, so too will the regulatory environment, in a bid to balance innovation with risk management and investor protection.