Seven Liquidity Pools that Fueled a DeFi Summer Surge

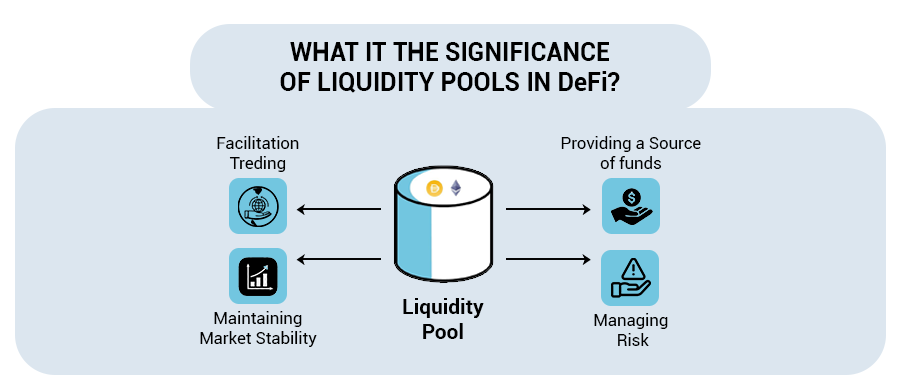

The world of Decentralized Finance (DeFi) saw a major boom in the summer of 2020, often called the 'DeFi Summer.' This period was marked by a rapid increase in total value locked (TVL) within DeFi platforms, and a major driving force behind this surge was the rise of liquidity pools. These decentralized marketplaces or exchanges enable users to lend, borrow, and trade cryptocurrencies in a permissionless manner. Liquidity pools have become the foundation of the DeFi ecosystem, making token exchanges smoother, providing liquidity, and rewarding users for their participation as liquidity providers. Below, we'll explore how liquidity pools contributed to the DeFi summer explosion.

Uniswap: The Game Changer

Uniswap, an Ethereum-based decentralized exchange, revolutionized the space with its automated market maker (AMM) model during the DeFi summer. Uniswap allowed anyone to become a liquidity provider by depositing pairs of tokens into a pool. In return, liquidity providers earned trading fees based on their contribution to the pool. This innovative approach, combined with lucrative rewards, brought in a massive amount of liquidity and played a crucial role in the DeFi surge.

Balancer: The Flexible AMM

Balancer enhanced Uniswap's AMM model by offering more flexibility to liquidity providers. Unlike Uniswap, which requires a 50:50 token ratio, Balancer allowed up to eight tokens in varying proportions in a liquidity pool. This flexibility attracted a broader range of users, who appreciated the ability to customize pools to their needs. Balancer's unique offering added further momentum to the DeFi summer growth.

Curve Finance: The Stablecoin Specialist

Curve Finance focused on stablecoins, offering low-slippage trades and minimal fees for swapping stable assets like USDC, DAI, and USDT. Its efficient trading mechanisms attracted liquidity providers and traders seeking to maximize returns from stablecoin transactions. Curve’s specialization in stablecoins made it a popular platform during the DeFi summer, contributing significantly to the influx of liquidity.

Yearn.finance: The Profit Maximizer

Yearn.finance emerged as a powerful yield aggregator, helping users optimize their returns by automatically reallocating funds between different liquidity pools and DeFi protocols. By maximizing profit potential for its users, Yearn.finance quickly became a central player during the DeFi summer. Its ability to automate yield strategies attracted many liquidity providers, driving the overall DeFi boom.

SushiSwap: The Vampire Protocol

SushiSwap, a fork of Uniswap, shook up the DeFi space with its notorious 'vampire attack,' where it incentivized liquidity providers to leave Uniswap in exchange for SUSHI tokens. Despite the controversy, SushiSwap's extra rewards successfully attracted a substantial amount of liquidity. This migration boosted SushiSwap’s growth and made it a key player during the DeFi summer surge.

Compound: The Pioneer

Compound was one of the early innovators in the DeFi space, introducing 'liquidity mining,' a system where users earned COMP governance tokens alongside their regular interest for providing liquidity. Compound’s model of rewarding participation set a precedent for many other protocols, laying the groundwork for the DeFi summer boom and inspiring various liquidity pool strategies across the ecosystem.

The Impact of Liquidity Pools on DeFi

Liquidity pools were instrumental in the explosive growth of the DeFi sector during the summer of 2020. These pools enabled decentralized exchanges to operate efficiently, attracted large amounts of capital with innovative reward mechanisms, and fueled the rise of DeFi protocols. As the DeFi space continues to evolve, liquidity pools will remain a core element of its growth and future innovation, driving further developments in decentralized finance.