Seven Powerhouse Support Levels That Skyrocketed Bitcoin's Value

Bitcoin, the world’s most recognized cryptocurrency, has experienced a wild ride since its launch in 2009. Its value has skyrocketed from fractions of a penny to tens of thousands of dollars, solidifying its role as a major player in the financial world. But its rise to fame wasn't a fluke; it was driven by key support levels that have shaped its growth. In this article, we’ll break down seven key support levels that have fueled Bitcoin’s remarkable journey, explaining how they’ve contributed to its meteoric rise and how they are connected.

The Genesis Block

Bitcoin’s foundation lies in the Genesis Block, the first block mined in its blockchain. This innovation is the backbone of Bitcoin’s decentralized structure, revolutionizing finance by introducing transparency, security, and immutability. The blockchain ensures every transaction is permanently recorded, giving Bitcoin credibility and helping attract early adopters, which has been critical to its long-term value growth.

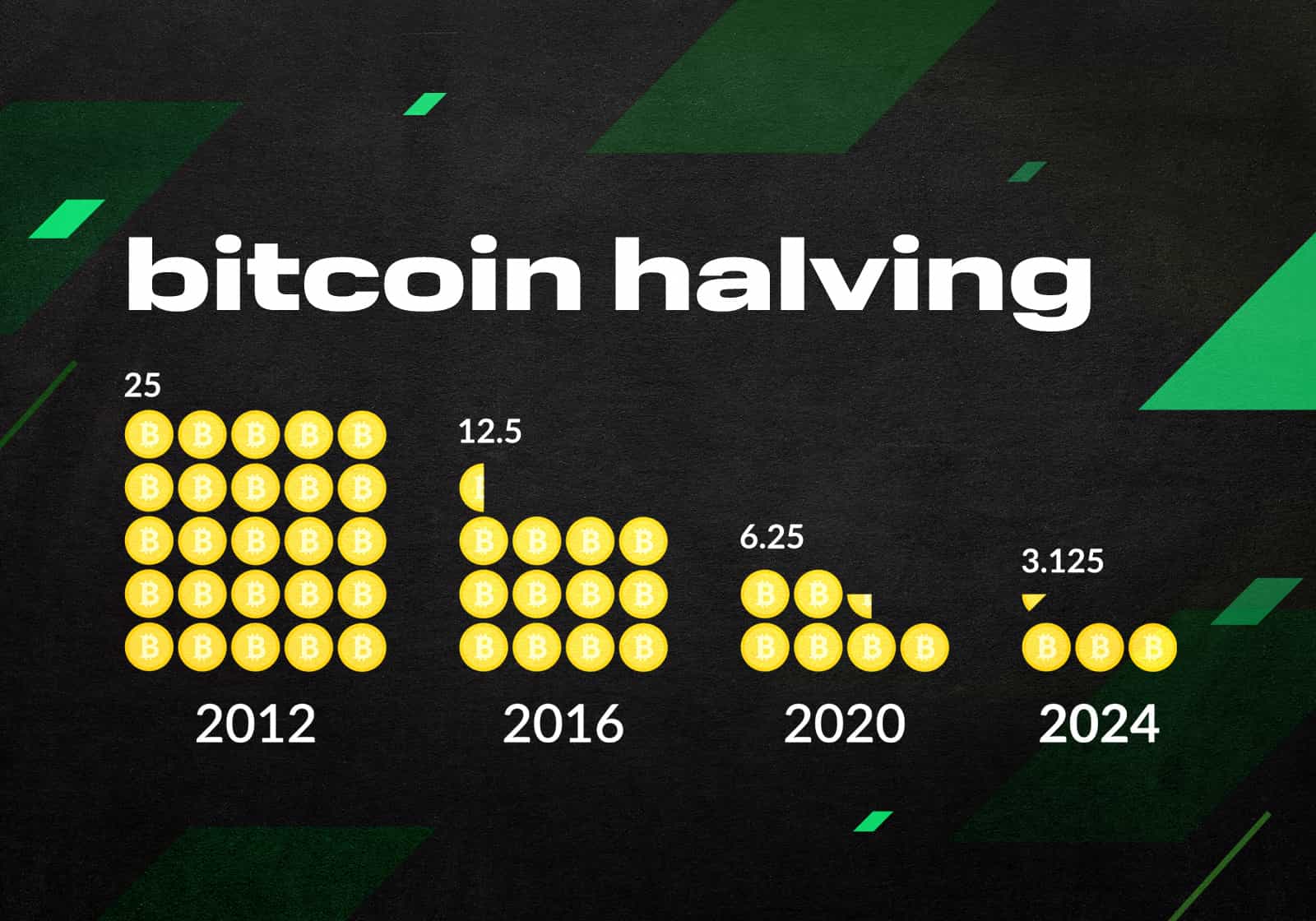

Halving Events

Bitcoin’s halving events are another crucial support level. These events occur roughly every four years, cutting the reward miners receive by half. This built-in scarcity heightens Bitcoin’s appeal, driving demand and typically causing price surges following each event. The halving mechanism shows how supply and demand fundamentals have a direct impact on Bitcoin's price, creating a cycle of appreciation over time.

Institutional Adoption

One of the biggest drivers of Bitcoin’s value has been institutional adoption. When major players like Tesla, MicroStrategy, and Square added Bitcoin to their balance sheets, it legitimized the cryptocurrency in the eyes of traditional investors. This move encouraged more participation, especially from retail investors who saw Bitcoin being embraced by established companies. Institutional backing has cemented Bitcoin’s status as a serious investment vehicle, propelling its value further.

Regulatory Clarity

Regulation is often seen as a double-edged sword, but in Bitcoin’s case, it has provided much-needed legitimacy. As governments began to craft laws around cryptocurrencies, it reduced the fear of the unknown for investors. Clearer regulations have allowed more cautious investors to enter the market, boosting overall demand and confidence. This regulatory framework is an often-underestimated factor that has had a positive impact on Bitcoin’s value.

Technological Advancements

Advancements in blockchain technology and the development of crypto exchanges have also been key to Bitcoin’s growth. These innovations have made it easier for people to buy, sell, and store Bitcoin, enhancing its usability and accessibility. The growing sophistication of exchanges and wallets has lowered barriers to entry for new investors, which has played a critical role in increasing Bitcoin’s market reach and value.

Market Sentiment

Market sentiment is a huge driver in Bitcoin’s price fluctuations. Positive news, like endorsements from celebrities or high-profile investors, can trigger price spikes, while negative headlines can cause panic selling. Understanding how investor sentiment affects Bitcoin's price is key to navigating its volatility. This emotional component can amplify Bitcoin’s highs and lows but also offers insight into its future movements.

Conclusion

Bitcoin’s rise has been influenced by a variety of factors, each intertwined and essential. From the Genesis Block that started it all to the ongoing effects of market sentiment, these support levels have driven Bitcoin’s evolution. As Bitcoin continues to mature, understanding these factors is crucial for anyone looking to grasp its journey and potential future highs. These foundational elements don’t just explain where Bitcoin has been, but also give a glimpse into where it might go next.