Predicting Pitfalls: The Chronicles of Major Market Reversals - 7 Case Studies Unfolded

In the world of financial markets, the only thing you can count on is uncertainty. The ability to predict when markets will reverse direction is a highly sought-after skill that can either bring great wealth or lead to huge losses. This article dives into seven major market reversals, offering key lessons for investors and traders. We'll look at what caused these reversals, the warning signs that were overlooked, and what happened afterward. Each case study provides valuable insights from the past, helping guide future predictions of market trends.

The Dot-Com Bubble Burst (2000)

In the late 1990s, there was a frenzy of speculation surrounding Internet-based companies. Investors were drawn in by promises of high returns from the growing tech sector. However, by 2000, it became clear that many of these companies were vastly overvalued. The NASDAQ, which had a heavy concentration of tech stocks, fell from a peak of over 5,000 in March 2000 to just above 1,000 by October 2002. The aftermath of the dot-com bubble is a clear reminder of the dangers of speculative investing and the need for solid financial analysis.

The Housing Market Crash (2007-2008)

The 2007-2008 housing market crash is one of the most memorable market reversals in recent times. It was fueled by lax lending standards, speculation, and a belief that housing prices could only rise. The bubble burst when the subprime mortgage market collapsed, leading to a steep decline in U.S. housing prices and triggering a global financial crisis. This case study shows the systemic risks that can arise from market excesses and the far-reaching consequences of financial contagion.

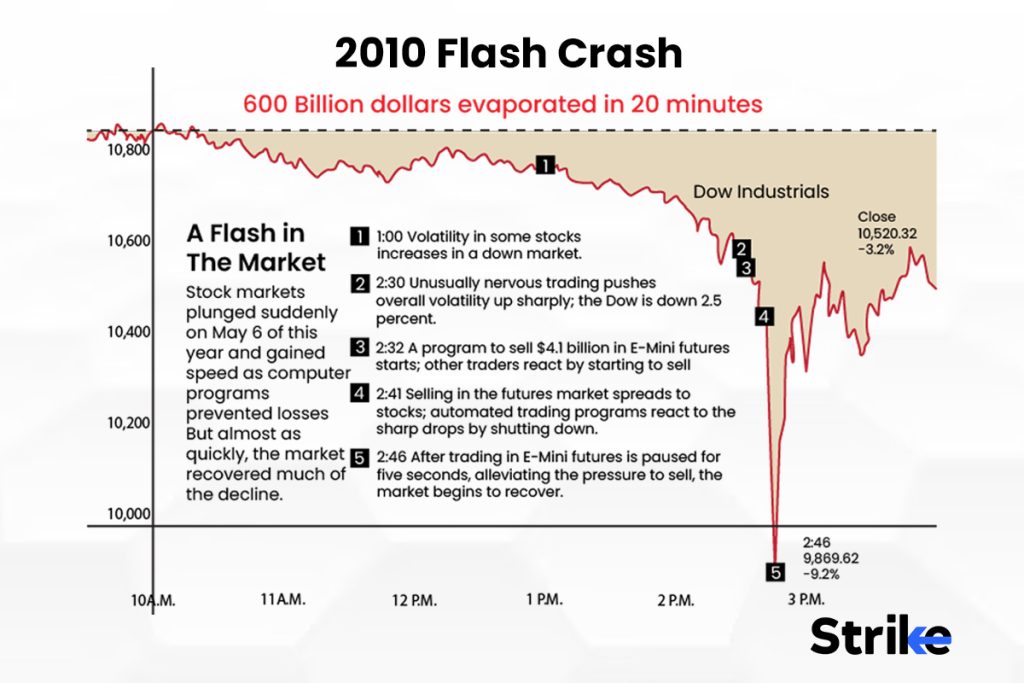

The Flash Crash (2010)

On May 6, 2010, the U.S. stock market experienced a rapid and dramatic drop, with the Dow Jones Industrial Average plunging nearly 1,000 points within minutes. This "Flash Crash" was caused by high-frequency trading algorithms and highlighted the fragility of our increasingly automated financial markets. While the market quickly bounced back, the Flash Crash serves as a warning about the risks posed by algorithmic trading and the importance of having strong market protections in place.

The Chinese Stock Market Crash (2015)

In mid-2015, the Chinese stock market saw a sharp decline, with the Shanghai Composite Index dropping more than 30% in a single month. The crash was triggered by a mix of an economic slowdown, high debt levels, and rampant speculative trading. Attempts by the Chinese government to stabilize the market only worsened the situation, leading to more losses. This case study emphasizes the dangers of government intervention in markets and the risks of high levels of debt.

The Oil Price Crash (2020)

The oil price crash of 2020 was caused by a combination of an oversupply of oil and a sudden drop in demand due to the COVID-19 pandemic. The price of West Texas Intermediate (WTI), a key benchmark for oil, even went negative for the first time in history. This case study illustrates the impact that external shocks can have on financial markets and the importance of diversifying investments to manage risk.

The GameStop Short Squeeze (2021)

In 2021, a group of retail investors on Reddit orchestrated a short squeeze on GameStop stock, driving its price up dramatically and causing major losses for hedge funds that had bet against it. This event underscored the growing power of retail investors and showed how social media can disrupt traditional market dynamics. It also raised important questions about market manipulation and whether new regulatory measures are needed.

These case studies provide critical insights into how market reversals happen. They highlight the importance of proper financial analysis, the risks of speculation, the dangers of systemic market excess, the vulnerabilities of automated trading, the complications of government intervention, the effects of external shocks, and the rising influence of retail investors. Understanding these factors can help investors and traders better navigate financial market uncertainties and potentially predict future market shifts.