Seven Market Crash Recovery Miracles That Shook the Financial World

The financial world is a volatile landscape, prone to dramatic swings and market crashes. These crashes, often triggered by factors like economic imbalances, policy mistakes, or speculative bubbles, can lead to severe downturns. Yet, amidst the turmoil, there have been instances where the markets have staged remarkable recoveries, defying bleak forecasts and restoring investor confidence. These market crash recovery miracles are not just about numbers; they reflect resilience, strategic decision-making, and the enduring strength of the global economy. This article highlights seven extraordinary market crash recoveries that reshaped financial history.

The Great Depression Recovery (1932-1937)

The Great Depression, which began in 1929, was the most prolonged economic downturn in the industrialized world. Yet, the recovery from 1933 to 1937 was nothing short of miraculous. The U.S. economy bounced back, with real GDP growing at an average rate of 9.5% annually. This recovery was driven by expansionary fiscal and monetary policies, particularly President Franklin D. Roosevelt's New Deal. Consumer spending and confidence also rebounded, fueling business activity and job creation, which helped lift the economy out of the depression.

Post-War Boom (1945-1960)

After World War II, many economies were left in ruins, but what followed was an unparalleled period of economic growth known as the post-war boom. Reconstruction efforts, technological advancements, increased consumer spending, and favorable government policies all contributed to this remarkable recovery. GDP, wage levels, and living standards surged, particularly in the U.S. and Western Europe, marking one of the most prosperous periods in modern economic history.

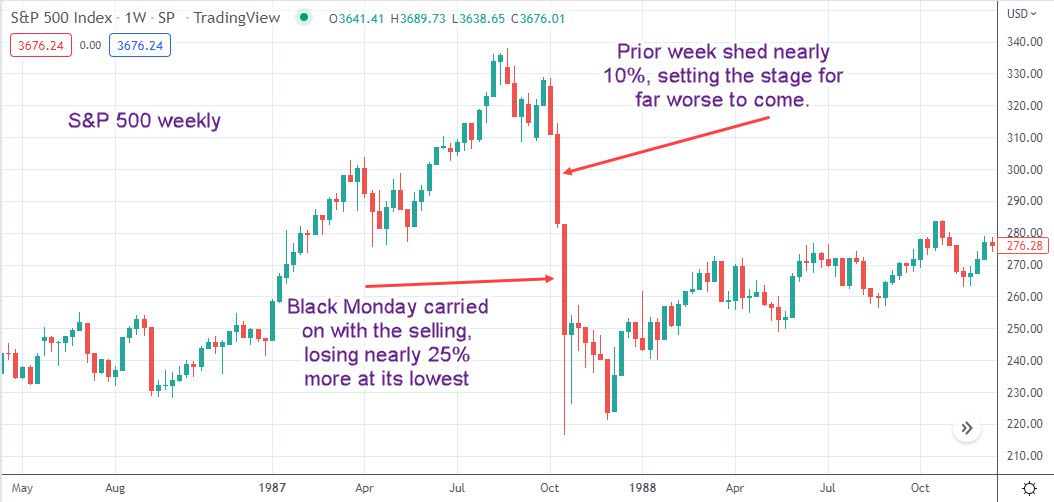

The 1987 Black Monday Recovery

On October 19, 1987, known as Black Monday, stock markets worldwide crashed, with the Dow Jones Industrial Average (DJIA) dropping by 22.6%, its largest one-day percentage loss. However, the recovery was swift. By September 1989, the DJIA had recouped its losses, thanks to the Federal Reserve's decisive actions, including lowering interest rates and injecting liquidity into the market. This rapid response helped restore investor confidence and stabilize the markets.

The Dot-com Bubble Burst Recovery (2002-2007)

The collapse of the dot-com bubble in the early 2000s triggered a severe downturn in the tech sector and led to a U.S. recession. However, the recovery that followed was remarkable. From 2002 to 2007, the U.S. economy rebounded, driven by technological innovation, the growing influence of the internet, and accommodative monetary policies. The stock market surged, unemployment fell, and GDP growth remained strong during this period of recovery.

The Great Recession Recovery (2009-2019)

The Great Recession, sparked by the subprime mortgage crisis, led to the most severe economic downturn since the Great Depression. Despite a slow start, the recovery from 2009 to 2019 was steady and resilient. Central banks implemented unprecedented monetary easing, and governments launched massive fiscal stimulus measures. Technological innovation and the rise of the digital economy also contributed to the recovery, enabling the global economy to regain strength and stability over the decade.

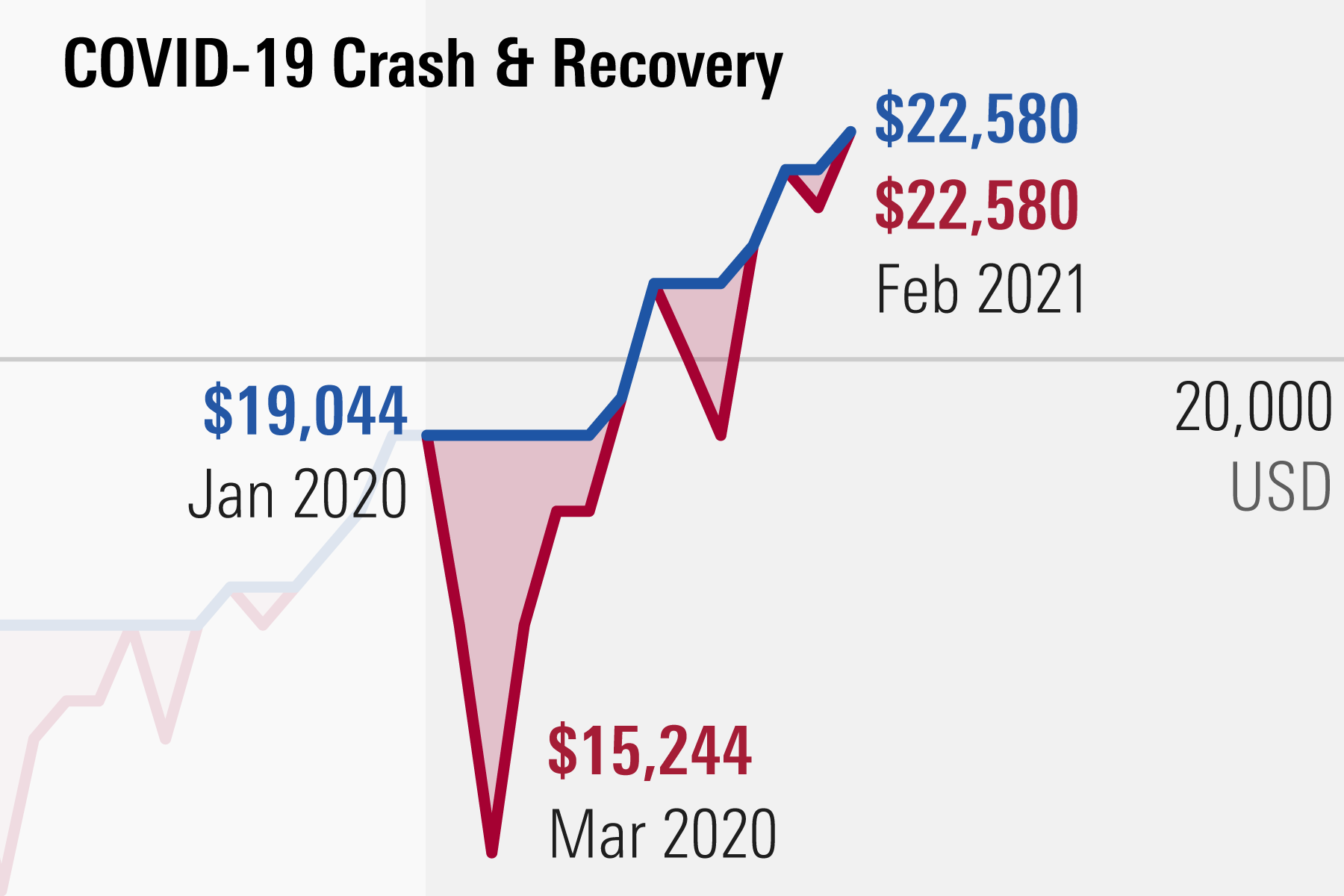

The COVID-19 Crash Recovery (2020-Present)

The COVID-19 pandemic caused an abrupt global economic crisis in early 2020, with stock markets plunging in March. However, the recovery has been unexpectedly robust, with major indices such as the S&P 500 and DJIA reaching new highs within months. This swift recovery was driven by massive fiscal and monetary stimulus, the rapid adoption of digital technologies, and optimism surrounding vaccine developments. Despite ongoing challenges, the economy has displayed remarkable resilience in bouncing back from this unprecedented shock.

These seven market crash recovery miracles demonstrate the resilience and dynamism of the global economy. Strategic policy interventions, technological progress, and human resilience have turned around some of the most challenging economic situations. As we continue to navigate today's uncertainties, these recovery stories serve as a testament to the global economy's ability to rebound, adapt, and emerge stronger than before.