6 Times When Financial Derivatives Teetered the World's Economy on the Brink of Ruin

Financial derivatives, complex financial instruments that derive their value from underlying assets, have been a focal point of global economics for decades. These instruments, including futures, options, and swaps, are designed to manage risk or speculate on the future price of an asset. However, when mismanaged or misunderstood, they can destabilize the world's economy. This slideshow will take you on a journey through seven critical moments in history when financial derivatives teetered the world's economy on the brink of ruin.

1. Black Monday, 1987

Our first stop is October 19, 1987, a day known as 'Black Monday.' On this day, stock markets around the world crashed, shedding a significant percentage of their value. At the heart of this crash was portfolio insurance, a financial derivative used to limit a portfolio's downside risk. However, as the markets started to fall, these derivatives triggered massive sell-offs, exacerbating the crash. This event served as a stark reminder of the potential dangers of financial derivatives when used irresponsibly.

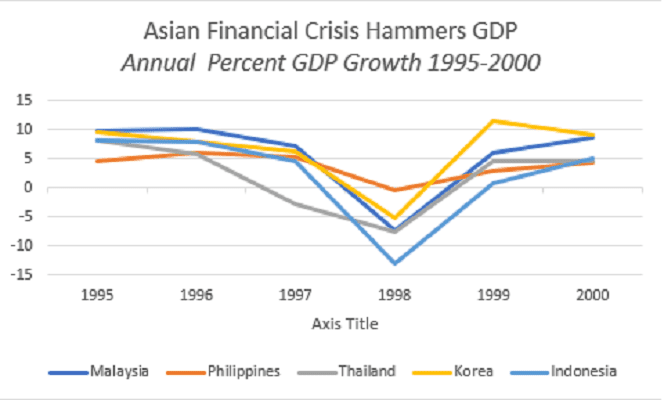

2. The Asian Financial Crisis, 1997

Fast forward a decade to 1997, when the Asian Financial Crisis shook the world economy. This crisis was triggered by speculative attacks on currencies pegged to the U.S. dollar, using financial derivatives. Hedge funds, and other speculators, used these instruments to bet against these currencies, leading to devaluations and economic turmoil across Asia. This event highlighted how financial derivatives could be used to exploit weaknesses in economic systems, with devastating consequences.

3. The Dotcom Bubble, 2000

The turn of the millennium saw the bursting of the dotcom bubble. During this period, derivatives such as options were widely used to speculate on the rapidly inflating prices of technology stocks. However, when the bubble burst, these derivatives amplified the impact, leading to significant losses for investors and a downturn in the global economy. This event underscored the potential for financial derivatives to fuel speculative bubbles, with disastrous results when these bubbles burst.

4. The Enron Scandal, 2001

In 2001, the Enron scandal shocked the world. This energy company used complex financial derivatives to hide debt and inflate profits, leading to one of the largest bankruptcies in U.S. history. The fallout from this scandal had far-reaching implications, affecting energy markets and leading to tighter regulations on the use of financial derivatives. This event demonstrated how financial derivatives could be used to manipulate financial statements, undermining trust in financial markets.

5. The Subprime Mortgage Crisis, 2008

The Subprime Mortgage Crisis in 2008 was a devastating example of financial derivatives gone awry. Financial institutions used derivatives known as mortgage-backed securities to speculate on the U.S. housing market. However, when the housing bubble burst, these derivatives amplified the impact, leading to a global financial crisis. This event highlighted the systemic risk posed by financial derivatives and led to a significant overhaul of financial regulations.

4. The European Sovereign Debt Crisis, 2010

In 2010, the European Sovereign Debt Crisis was another instance where financial derivatives played a significant role. Speculators used credit default swaps, a type of derivative, to bet against the debt of struggling European countries. This speculation exacerbated the crisis, leading to bailouts and austerity measures across Europe. This event underscored the potential for financial derivatives to destabilize economies, even on a continental scale.

As we've journeyed through these 6 critical moments in history, it's clear that financial derivatives can have a profound impact on the world economy. When used responsibly, these instruments can help manage risk and facilitate economic growth. However, when misused or misunderstood, they can lead to economic crises and financial ruin. As we move forward, it's crucial that we learn from these events to ensure a more stable and prosperous economic future.