How Credit Scores Transformed into Financial Buoys amidst Economic Downfalls

In the world of personal finance, credit scores have evolved from a simple numerical representation of creditworthiness to a critical lifeline during times of economic turmoil. This transformation has been driven by the increasing reliance on credit in our society, as well as the growing awareness of the importance of maintaining a healthy credit score. As we navigate the stormy seas of economic downturns, credit scores have become our financial buoys, providing a sense of security and stability amidst the uncertainty. The significance of credit scores has been further highlighted in recent years, as global economies have faced unprecedented challenges. During these times, a strong credit score can be the difference between financial survival and disaster. This article explores how credit scores have transformed into financial buoys amidst economic downfalls, and how individuals can leverage their credit scores to navigate these challenging times.

1. The Evolution of Credit Scores

Credit scores have come a long way since their inception. Initially, they were merely a tool for lenders to assess the risk of potential borrowers. However, over time, they have evolved into a critical component of personal finance, influencing not just lending decisions, but also employment opportunities, insurance premiums, and even housing options. The evolution of credit scores can be attributed to several factors, including the increasing reliance on credit, the growing complexity of financial systems, and the rise of financial technology. These factors have collectively transformed credit scores from a simple risk assessment tool into a comprehensive measure of financial health.

2. The Impact of Economic Downturns on Credit Scores

Economic downturns often lead to job losses, reduced income, and financial insecurity. These factors can have a significant impact on credit scores, as individuals may struggle to meet their financial obligations. However, a strong credit score can act as a buffer during these challenging times, providing access to credit and financial assistance when it is most needed. During economic downturns, lenders often tighten their lending standards, making it more difficult for individuals with low credit scores to access credit. However, those with high credit scores are more likely to be approved for loans and credit cards, providing a lifeline during difficult times.

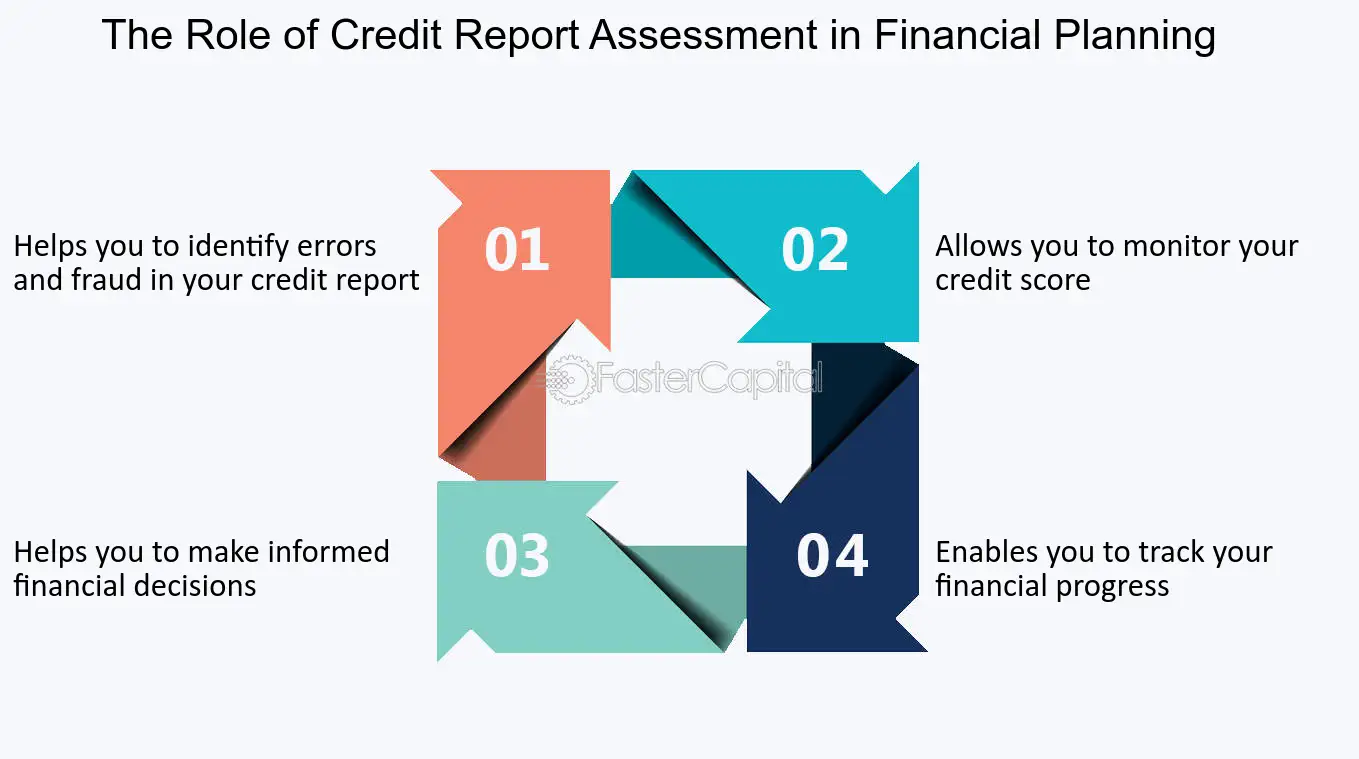

3. The Role of Credit Scores in Financial Planning

Credit scores play a critical role in financial planning. They influence the availability and cost of credit, which can have a significant impact on an individual's financial stability and future prospects. A strong credit score can provide access to lower interest rates and better loan terms, making it easier to manage debt and save for the future. Moreover, credit scores can serve as a barometer of financial health, providing a snapshot of an individual's financial situation. This information can be used to make informed financial decisions, helping individuals navigate the complexities of personal finance and prepare for potential economic downturns.

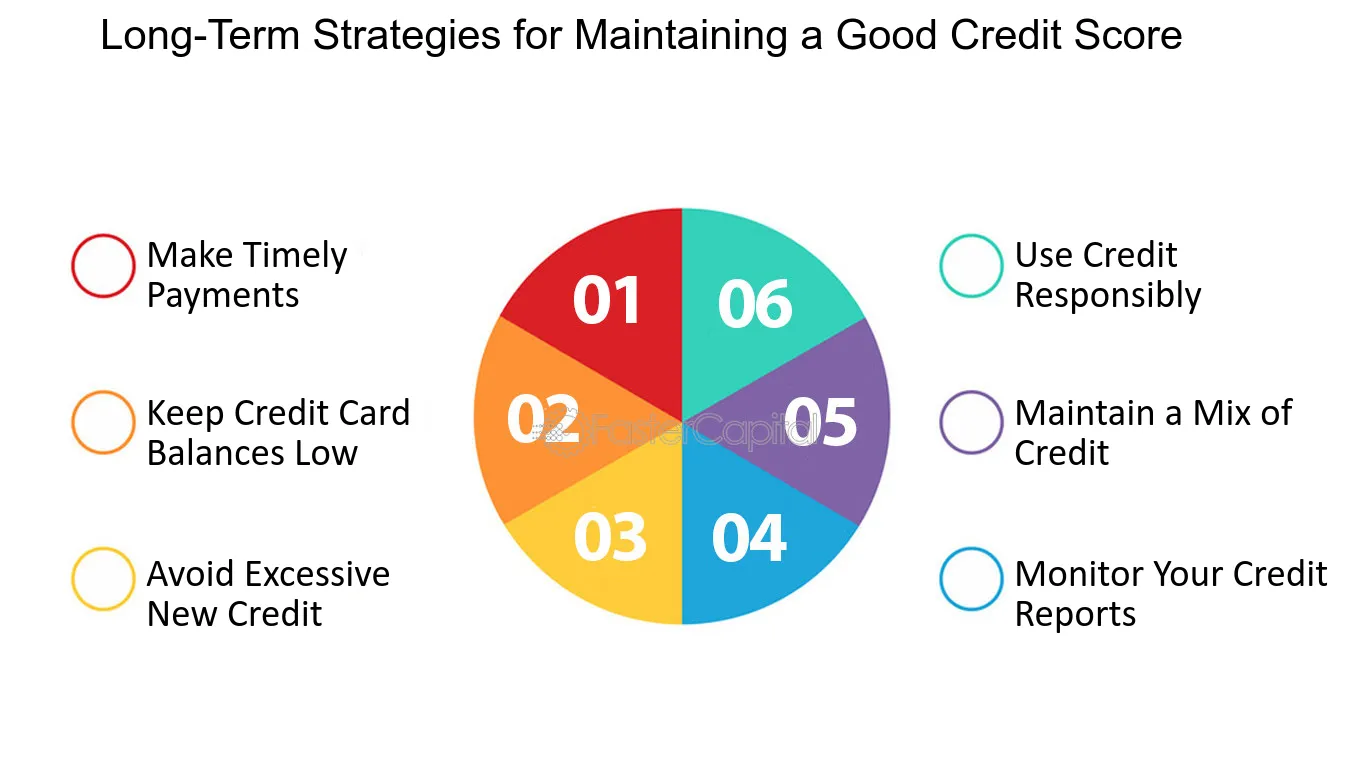

4. Strategies for Maintaining a Strong Credit Score

Maintaining a strong credit score is crucial for financial stability, particularly during times of economic uncertainty. Some strategies for maintaining a strong credit score include paying bills on time, keeping credit card balances low, avoiding unnecessary debt, and regularly checking credit reports for errors. Moreover, it is important to diversify credit, as different types of credit contribute to your credit score. This includes revolving credit, such as credit cards, and installment credit, such as mortgages and auto loans. Diversifying credit can help improve your credit score and provide a buffer during economic downturns.

5. The Role of Financial Technology in Credit Scoring

Financial technology, or fintech, has transformed the credit scoring landscape. Fintech companies have developed innovative credit scoring models that use alternative data, such as utility payments and social media activity, to assess creditworthiness. These models can provide a more comprehensive and accurate picture of an individual's financial health, particularly for those with limited credit history. Moreover, fintech has made credit scores more accessible to consumers, allowing them to monitor their credit score and understand the factors that influence it. This increased transparency can empower individuals to take control of their credit score, helping them navigate the financial challenges of economic downturns.

6. The Future of Credit Scores

As financial systems continue to evolve, so too will credit scores. The increasing use of alternative data in credit scoring models is likely to continue, providing a more comprehensive measure of creditworthiness. Moreover, the rise of fintech is set to further democratize access to credit scores, empowering individuals to take control of their financial health. However, the future of credit scores also holds challenges. As credit scores become increasingly influential in personal finance, it is crucial that they are accurate, transparent, and fair. Ensuring this will require ongoing regulation and oversight, as well as continued innovation in the credit scoring industry.

Credit scores have transformed from a simple measure of creditworthiness into a critical financial buoy amidst economic downfalls. As we navigate the stormy seas of economic uncertainty, a strong credit score can provide a lifeline, offering access to credit, financial stability, and a sense of security. However, maintaining a strong credit score requires ongoing effort, including responsible financial behavior, regular credit monitoring, and an understanding of the factors that influence credit scores. With the right strategies and tools, individuals can leverage their credit score to navigate the challenges of economic downturns and secure their financial future.