Riding the Bulls: 7 Era-Defining Markets from the Roaring Twenties to the Digital Age

In the world of finance, a "bull market" is a term used to describe an economic environment in which prices are rising or are expected to rise. It's a period marked by optimism, investor confidence, and expectations that strong results will continue. This article takes you on a journey through seven of the most significant bull markets in history, starting from the Roaring Twenties to the Digital Age. Each era has its unique characteristics, shaped by the socio-economic conditions of the time and the innovative technologies that fueled growth. This exploration will not only provide an understanding of these periods but also draw connections and lessons that could be valuable for the future.

1. The Roaring Twenties Bull Run (1921-1929)

The Roaring Twenties was a decade of economic growth and widespread prosperity. The bull market of this era was fueled by an explosion in new consumer goods such as automobiles, radios, and appliances. This era also saw the rise of the stock market as a popular investment vehicle, with ordinary people investing their savings in stocks in hopes of quick riches. However, this era ended with the infamous Wall Street Crash of 1929, which plunged the world into the Great Depression.

2. The Post-War Bull Market (1949-1966)

The bull market that followed World War II was driven by a booming economy, fueled by the rebuilding efforts in Europe and Japan. The war had also led to significant technological advancements, which transformed industries and boosted productivity. This era saw the rise of the middle class, with increasing wages and consumer spending. However, this period ended with a bear market triggered by economic stagnation and inflation.

3. The Reagan Era Bull Market (1982-2000)

The Reagan Era, also known as the longest bull market in history, was characterized by deregulation, tax cuts, and technological innovation. The introduction of personal computers and the internet revolutionized industries and led to unprecedented econ-omic growth. This period also saw the rise of globalization, with companies expanding their operations worldwide. However, the dot-com bubble burst marked the end of this era.

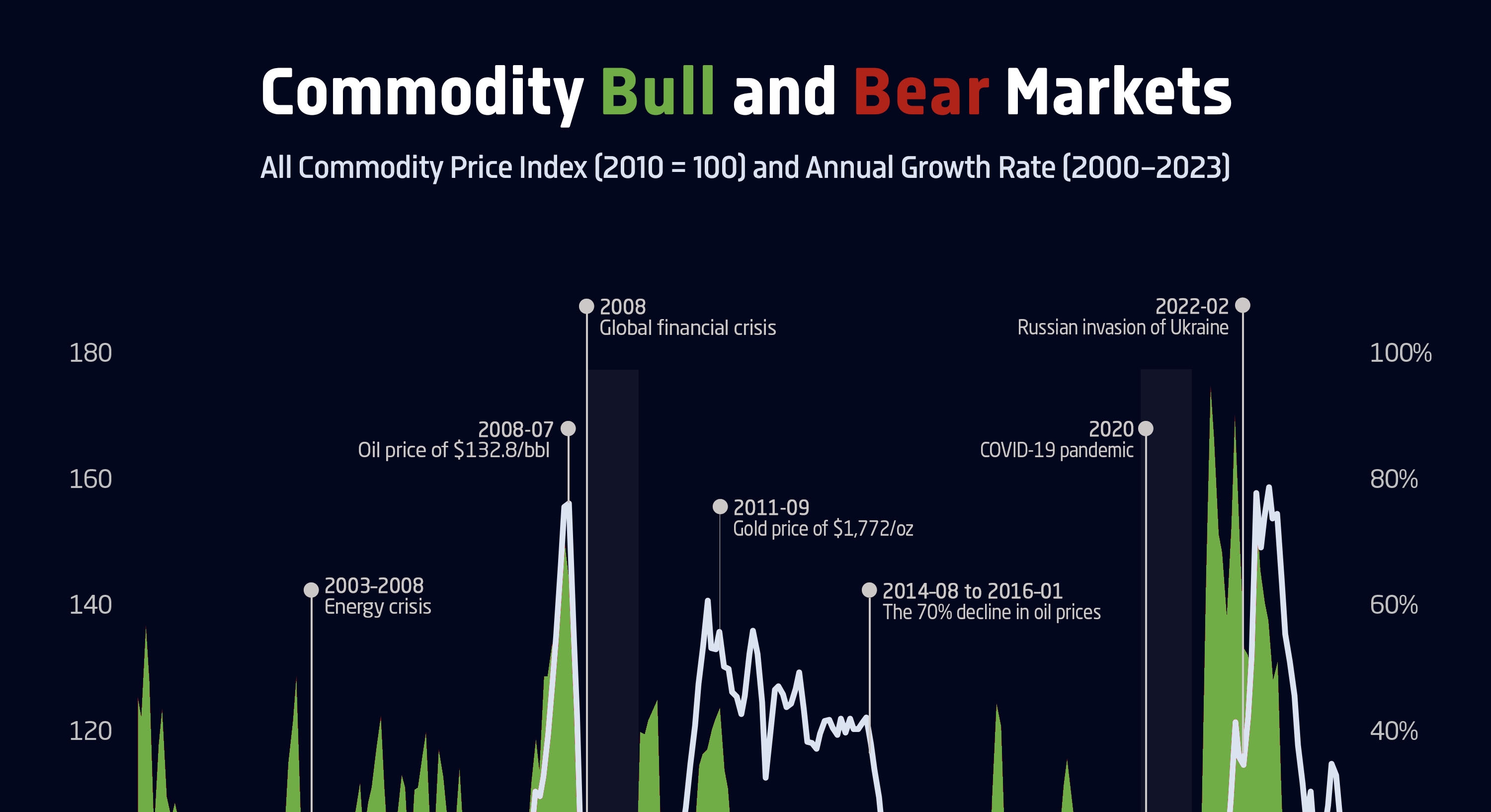

4. The Commodities Bull Market (2002-2008)

The early 2000s marked the start of a commodities bull market, driven by the rapid economic growth of emerging markets like China and India. Demand for commodities like oil, metals, and grains soared, leading to a boom in commodity prices. However, this period ended with the Global Financial Crisis of 2008, triggered by the subprime mortgage crisis in the US.

5. The Post-Financial Crisis Bull Market (2009-2020)

The bull market that followed the Global Financial Crisis was fueled by unprecedented monetary stimulus from central banks worldwide. Low-interest rates and quantitative easing policies led to a surge in asset prices. This era also saw the rise of the tech giants, with companies like Amazon, Apple, Google, and Facebook dominating the market. However, this period ended abruptly with the COVID-19 pandemic.

6. The Digital Age Bull Market (2020-Present)

The current bull market, characterized as the Digital Age, has been driven by the acceleration of digital transformation across industries due to the COVID-19 pandemic. Technologies like AI, machine learning, and cloud computing have become essential, leading to a boom in tech stocks. The rise of cryptocurrencies and the adoption of blockchain technology have also marked this era.

7. Lessons from History and Looking Ahead

Each bull market in history has been unique, shaped by the social, economic, and technological conditions of the time. However, they all share common characteristics - periods of optimism, investor confidence, and economic growth, followed by a downturn. Understanding these patterns can provide valuable insights for investors and policymakers. As we navigate through the Digital Age, the lessons from these past bull markets could guide us towards a more sustainable and inclusive economic future.