Riding the Rollercoaster of Wild Expectations: Seven Mood Swings That Inflated the Dot-Com Bubble Beyond Belief

The dawn of the internet era in the late 1990s birthed a new wave of optimism, innovation, and wild expectations. This period, known as the dot-com bubble, was an economic rollercoaster characterized by a rapid rise and fall in the equity value of companies dealing in internet-related services. This section sets the stage for an in-depth exploration of the seven mood swings that inflated the dot-com bubble beyond belief. It will delve into the origins, the hype, the crash, and the lessons learned from this tumultuous period in the history of the World Wide Web.

The excitement of the internet's potential led to a rush of investments in tech companies, with investors hoping to cash in on the next big thing. This speculative frenzy was fueled by a combination of overconfidence, irrational exuberance, and a fear of missing out. The result was an economic bubble that, when it burst, led to the loss of billions of dollars and the collapse of many internet companies.

The Age of Innocence

The dot-com bubble began in an era of innocence and optimism. The internet was seen as a revolutionary tool that would change the world, and investors were eager to be part of this change. This section will explore the early days of the dot-com bubble, the rise of internet companies, and the mood of unbridled optimism that pervaded the industry.

Investors, entrepreneurs, and the media were all swept up in the excitement of the internet's potential. Companies with little more than a business plan and a dot-com in their name were receiving millions in venture capital. The stock prices of these companies soared, despite many of them having no profits or even a clear path to profitability.

The Hype Cycle

As the dot-com bubble continued to inflate, the hype around internet companies reached fever pitch. This section will delve into the role of the media in hyping up these companies and the impact this had on investor behavior.

Media outlets, eager to capitalize on the public's interest in the internet, often published uncritical and overly optimistic reports about internet companies. This contributed to a cycle of hype that further inflated the bubble. Investors, buoyed by these positive reports, continued to pour money into dot-com stocks, pushing their prices up even further.

The Fear of Missing Out

The fear of missing out, or FOMO, played a significant role in inflating the dot-com bubble. This section will explore how this psychological phenomenon influenced investor behavior and led to irrational investment decisions.

As dot-com stocks continued to soar, many investors, driven by a fear of missing out on the internet gold rush, began to invest recklessly. This led to a buying frenzy that further inflated the bubble. Even as warning signs began to appear, many investors chose to ignore them, convinced that the internet was a game-changer that would defy traditional economic rules.

The Reality Check

The dot-com bubble couldn't last forever. This section will delve into the factors that led to the bubble's burst and the harsh reality check that followed.

By the early 2000s, it became increasingly clear that many dot-com companies were overvalued. As profits failed to materialize and investor confidence waned, the bubble began to burst. The collapse was swift and brutal, wiping out billions in market value and leading to the failure of many dot-com companies.

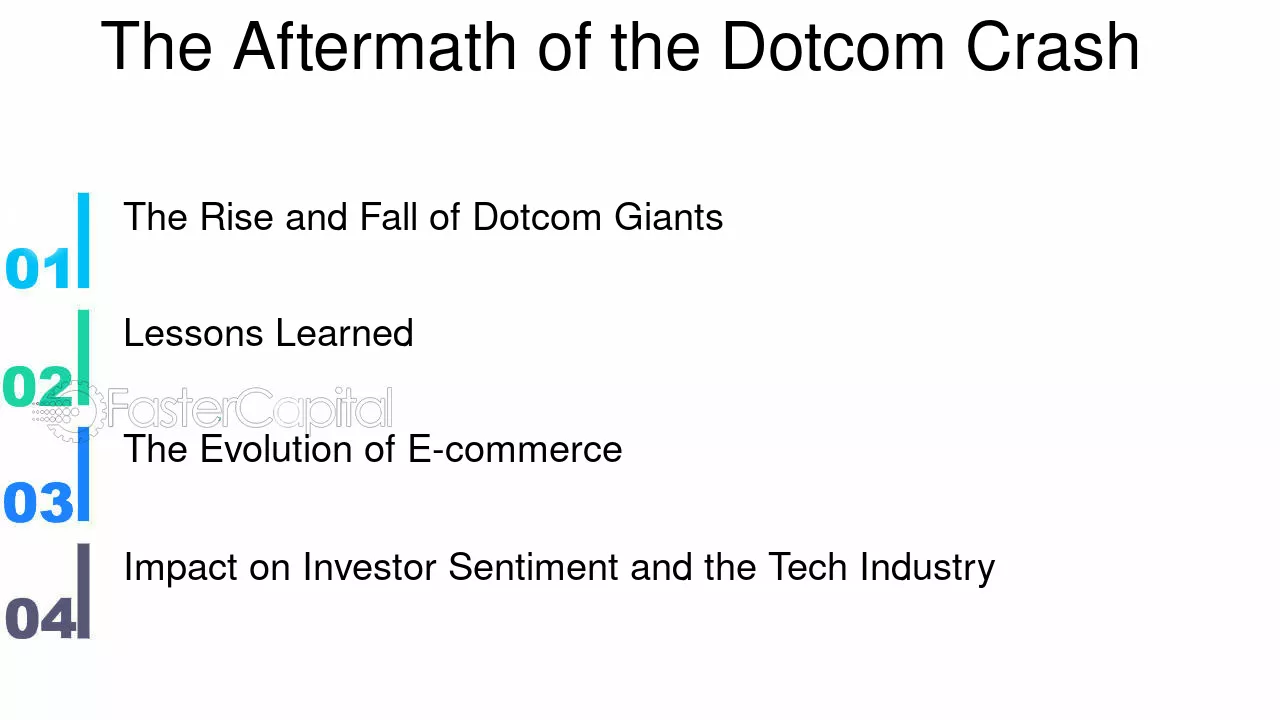

The Aftermath

The aftermath of the dot-com bubble was a period of reckoning. This section will explore the impact of the bubble's burst on the tech industry and the wider economy.

The collapse of the dot-com bubble led to a severe economic downturn, known as the dot-com crash. Many investors lost significant amounts of money, and confidence in the tech industry was shaken. However, the crash also led to a period of consolidation and reflection in the tech industry, paving the way for the rise of a new generation of internet companies.

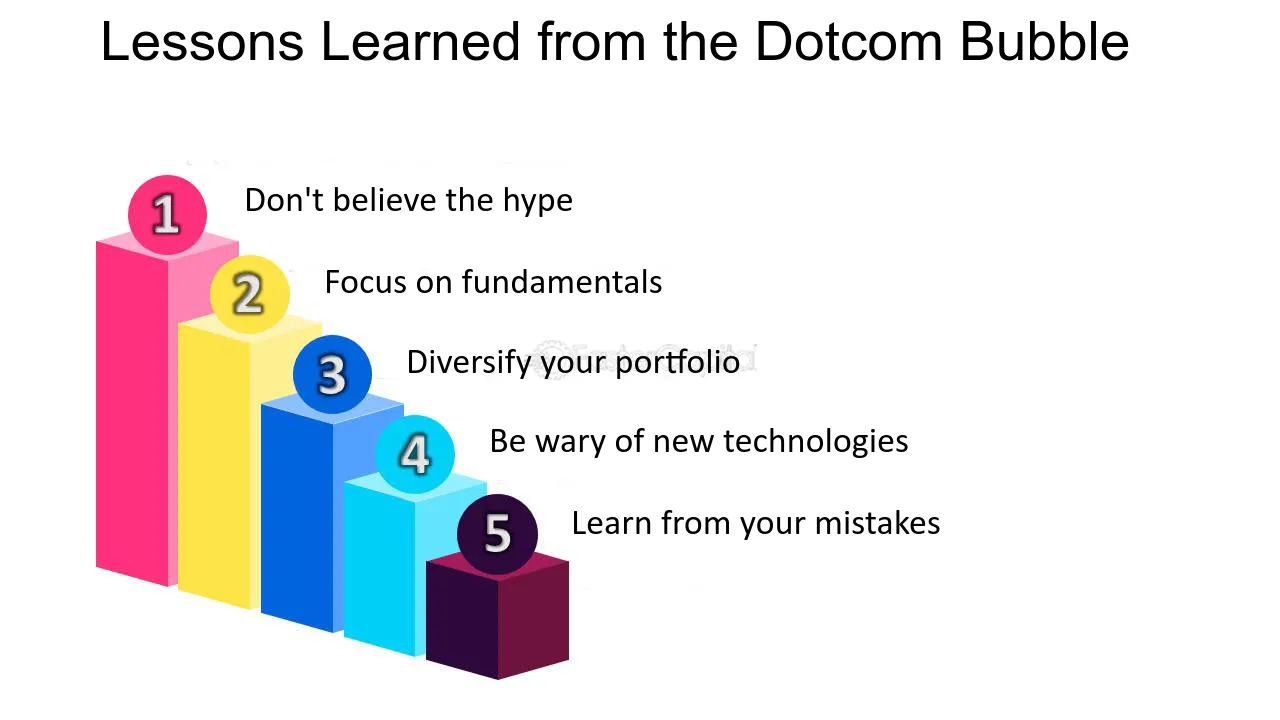

Lessons Learned

The dot-com bubble was a cautionary tale about the dangers of speculation and irrational exuberance. This section will delve into the lessons learned from this period and how they continue to influence the tech industry today.

The dot-com bubble taught investors the importance of due diligence and the dangers of hype and speculation. It also highlighted the need for tech companies to have a clear path to profitability. These lessons continue to resonate today, influencing how investors and tech companies approach the internet economy.

The dot-com bubble was a rollercoaster ride of wild expectations and harsh realities. This section will provide a summary of the insights gained from this deep dive into the dot-com bubble and its impact on the tech industry.

The dot-com bubble was a period of extreme optimism, speculation, and eventual disappointment. However, it also served as a catalyst for change in the tech industry, leading to a more cautious and sustainable approach to internet entrepreneurship. The lessons learned from the dot-com bubble continue to shape the tech industry today, serving as a reminder of the importance of rationality in the face of hype and speculation.