Top 6 Economic Crises Sparked by Skyrocketing Interest Rates

In the world of economics, few things can cause as much upheaval and uncertainty as skyrocketing interest rates. These dramatic increases can lead to a domino effect, causing a cascade of economic crises that can impact countries and individuals alike. This article will explore seven of the most significant economic crises sparked by soaring interest rates, providing a comprehensive look at the causes, impacts, and aftermath of each event. By examining these crises, we can gain a deeper understanding of the complex relationship between interest rates and economic stability, and perhaps glean insights into how to navigate future financial storms.

1. The Great Depression (1929-1939)

The Great Depression, which began in 1929 and lasted until 1939, is often cited as the most devastating economic crisis in Western history. While many factors contributed to this crisis, a key trigger was the US Federal Reserve's decision to raise interest rates in 1928 and 1929. This move was intended to curb stock market speculation but ended up causing a severe contraction in the economy. The fallout was immense, with widespread unemployment, bank failures, and a significant decrease in economic activity. The Great Depression serves as a stark reminder of the potential consequences of sudden interest rate hikes.

2. The Latin American Debt Crisis (1980s)

In the 1980s, Latin America experienced a severe economic crisis, largely due to a sudden increase in global interest rates. This crisis was triggered by the Federal Reserve's decision to aggressively raise interest rates to combat inflation. As a result, the cost of servicing external debt rose sharply for Latin American countries, leading to a widespread debt crisis. This crisis had profound social and economic impacts, including hyperinflation, economic contraction, and increased poverty rates.

3. The Asian Financial Crisis (1997)

The Asian Financial Crisis of 1997 was another major economic crisis sparked by high interest rates. In this case, high interest rates were used by several Asian countries to attract foreign investment. However, when these rates were suddenly increased, many companies found themselves unable to repay their debts, leading to a wave of bankruptcies and a severe economic downturn. The crisis spread rapidly, affecting economies across the region and leading to significant social and political upheaval.

4. The Dot-Com Bubble (2000)

The Dot-Com Bubble of the late 1990s and early 2000s was a speculative bubble in the shares of early internet companies, or "dot-coms." When the Federal Reserve began to increase interest rates in 1999, many of these companies, which had been operating at a loss, were unable to secure further funding and went bankrupt. The bursting of the Dot-Com Bubble resulted in a mild recession and a significant reevaluation of internet-based businesses.

5. The Global Financial Crisis (2008)

In 2008, the world was hit by the most severe financial crisis since the Great Depression. This crisis was triggered by a collapse in the US subprime mortgage market, which was closely linked to the Federal Reserve's decision to raise interest rates. The crisis quickly spread to other economies, leading to a global recession. The aftermath of this crisis is still being felt today, with many countries experiencing slow economic recovery and ongoing financial instability.

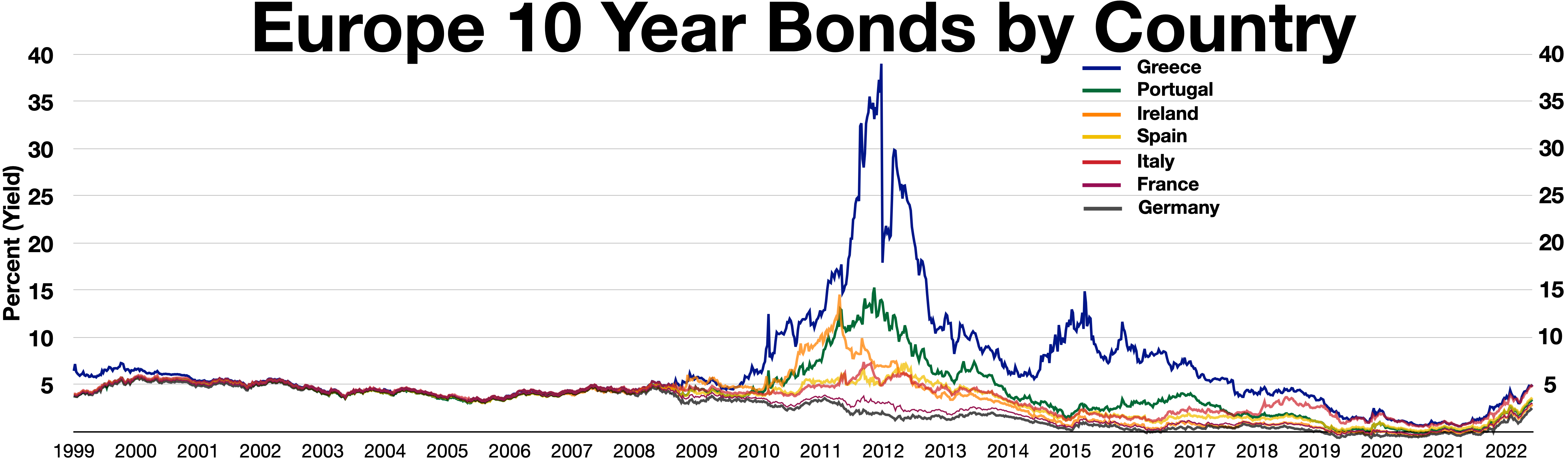

6. The European Sovereign Debt Crisis (2010)

The European Sovereign Debt Crisis, which began in 2010, was triggered by high interest rates on government bonds for countries in the Eurozone. As these countries struggled to repay their debts, the crisis spread across the continent, leading to economic contraction, high unemployment rates, and political instability. The crisis also exposed structural weaknesses in the Eurozone's economic and political systems, leading to ongoing debates about the future of the European Union.

From the Great Depression to the European Sovereign Debt Crisis, history is filled with examples of economic crises triggered by skyrocketing interest rates. These events highlight the powerful role that interest rates play in economic stability, and the potential for sudden increases to trigger widespread financial turmoil. As we move forward, it is crucial that we learn from these past crises, developing strategies and safeguards to mitigate the impact of future interest rate hikes. Only by doing so can we hope to navigate the stormy waters of the global economy, steering towards a future of financial stability and prosperity.