Decoding the Lehman Brothers Catastrophe: Seven Global Aftershocks That Shook the World

The 2008 financial crisis was a tumultuous period in global history, marked by severe economic instability and a widespread sense of uncertainty. The collapse of Lehman Brothers, a titan in the financial world, was a pivotal event that sent shockwaves across the globe. The Lehman Brothers catastrophe didn't just mark the largest bankruptcy filing in U.S. history, but it also triggered a series of global aftershocks that shook the world. This article aims to decode the Lehman Brothers catastrophe and explore the seven global aftershocks that had far-reaching implications.

The Lehman Brothers, founded in 1850, had grown into a behemoth in the global banking sector by the early 21st century. However, their heavy investment in mortgage-backed securities and involvement in the subprime mortgage crisis led to their downfall. The bankruptcy of Lehman Brothers was a key catalyst that precipitated the 2008 financial crisis, leading to a domino effect that impacted economies worldwide.

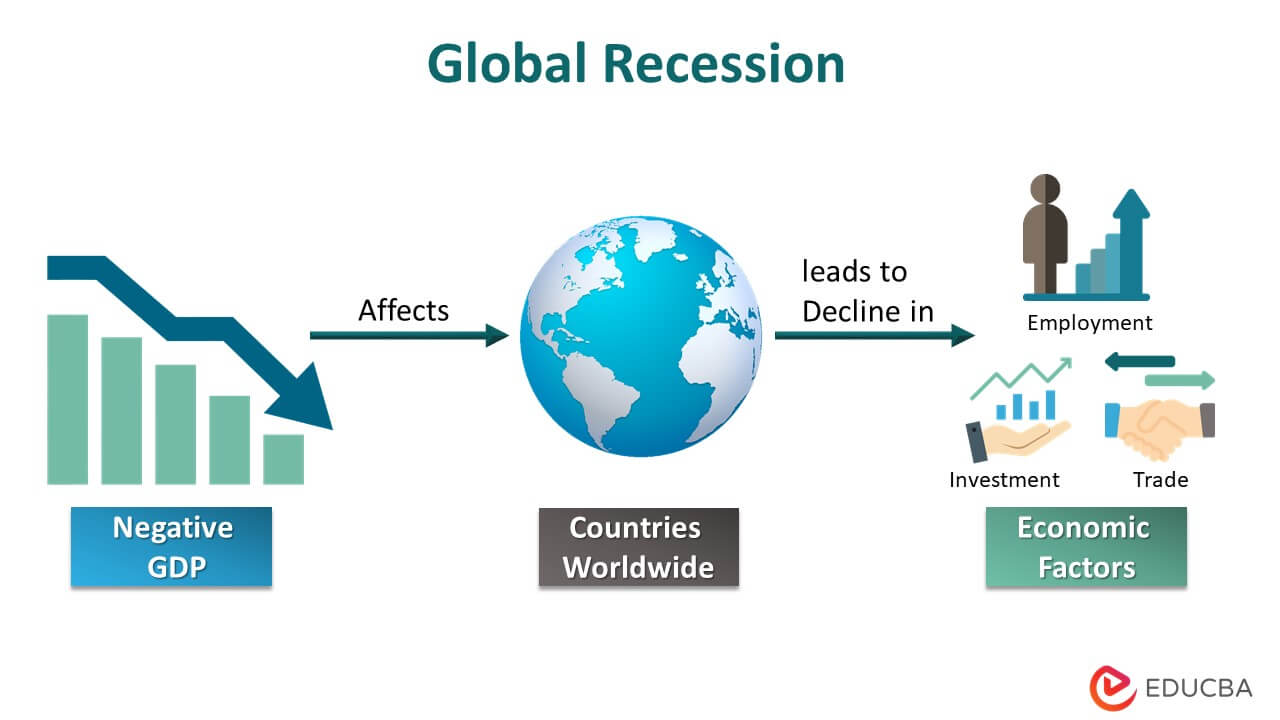

Global Recession

The first major aftershock of the Lehman Brothers collapse was the onset of a global recession. Economies worldwide contracted as credit markets froze, consumer confidence plummeted, and businesses scaled back production. Unemployment rates soared as companies, struggling to stay afloat, laid off employees in droves. The recession was a direct result of the financial instability caused by the collapse of Lehman Brothers and the subsequent loss of confidence in the global banking system.

Countries like Spain, Italy, and Greece were hit particularly hard, with unemployment rates reaching record highs. The global recession also led to a significant increase in government debt as countries pumped money into their economies to stimulate growth and prevent further economic decline.

Sovereign Debt Crisis

The second aftershock was the sovereign debt crisis that engulfed many European countries. Governments had to step in to bail out their failing banks, leading to a significant increase in public debt. The situation was exacerbated by the global recession, which led to decreased tax revenues and increased welfare spending. Countries like Greece, Ireland, and Portugal were unable to repay their debts, leading to a full-blown sovereign debt crisis.

The European Central Bank and the International Monetary Fund had to step in with bailout packages to prevent the collapse of these economies. This crisis exposed the vulnerabilities in the Eurozone's economic structure and led to significant policy changes.

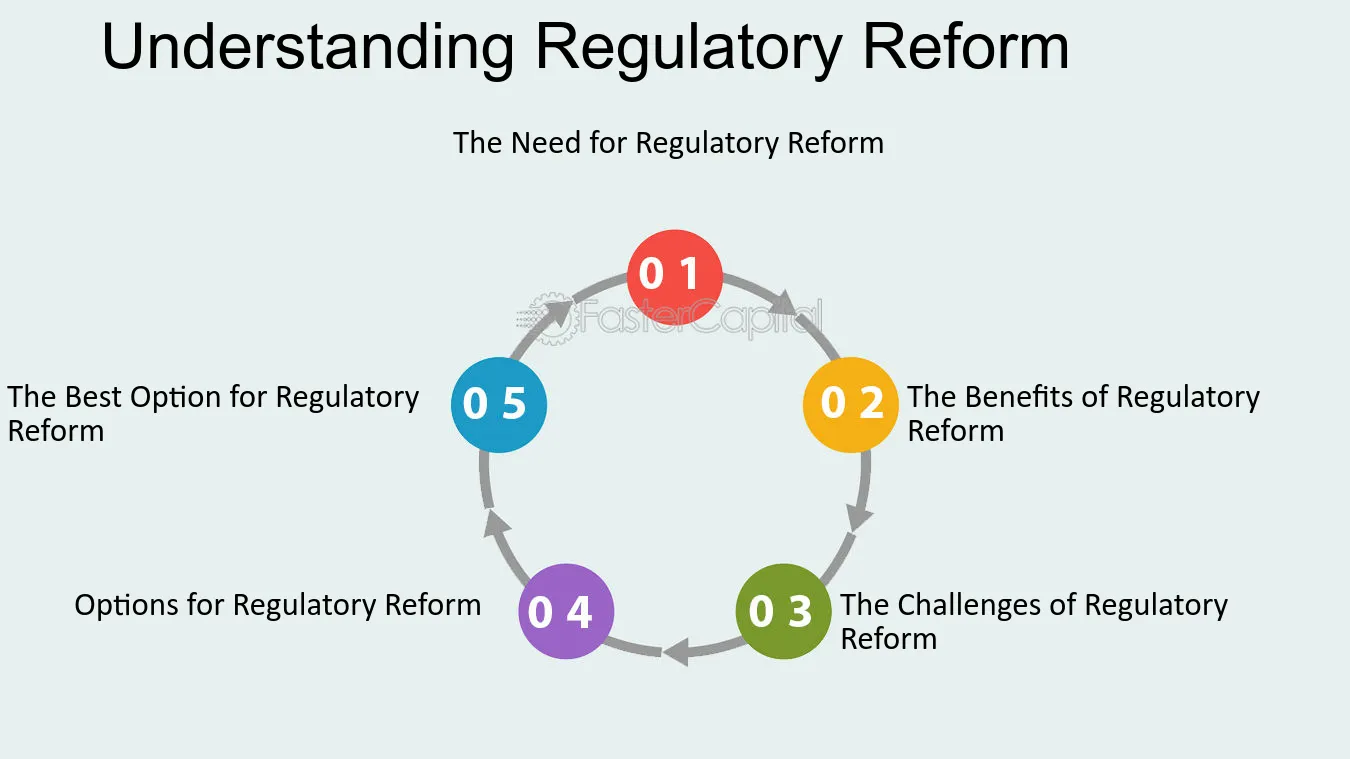

Regulatory Overhaul

The Lehman Brothers catastrophe revealed significant shortcomings in the regulatory framework governing financial institutions. In response, governments worldwide initiated a comprehensive overhaul of financial regulations. The U.S. passed the Dodd-Frank Act, which aimed to reduce systemic risks and prevent a similar crisis in the future.

This regulatory overhaul also led to the creation of the Consumer Financial Protection Bureau, tasked with protecting consumers from unfair, deceptive, or abusive practices in the financial sector. Other countries also implemented similar reforms, reflecting a global shift towards tighter financial regulation.

Shift in Monetary Policy

The fifth aftershock was a significant shift in monetary policy worldwide. Central banks slashed interest rates to historic lows in an attempt to stimulate economic activity. This era of cheap money led to an asset price boom, with stock markets reaching record highs.

However, this policy also had its drawbacks. Low-interest rates led to increased borrowing, which in turn led to higher debt levels. This has raised concerns about the sustainability of such policies and their potential to create future financial bubbles.

Rise of Populist Politics

The economic hardship brought about by the Lehman Brothers collapse and the subsequent recession led to widespread public discontent. This discontent manifested itself in the rise of populist politics, both on the right and the left of the political spectrum.

In the U.S., this led to the emergence of movements like Occupy Wall Street and the Tea Party. In Europe, populist parties gained ground in countries like Greece, Spain, and Italy. This shift in the political landscape has had profound implications on policy-making and international relations.

Emergence of Cryptocurrencies

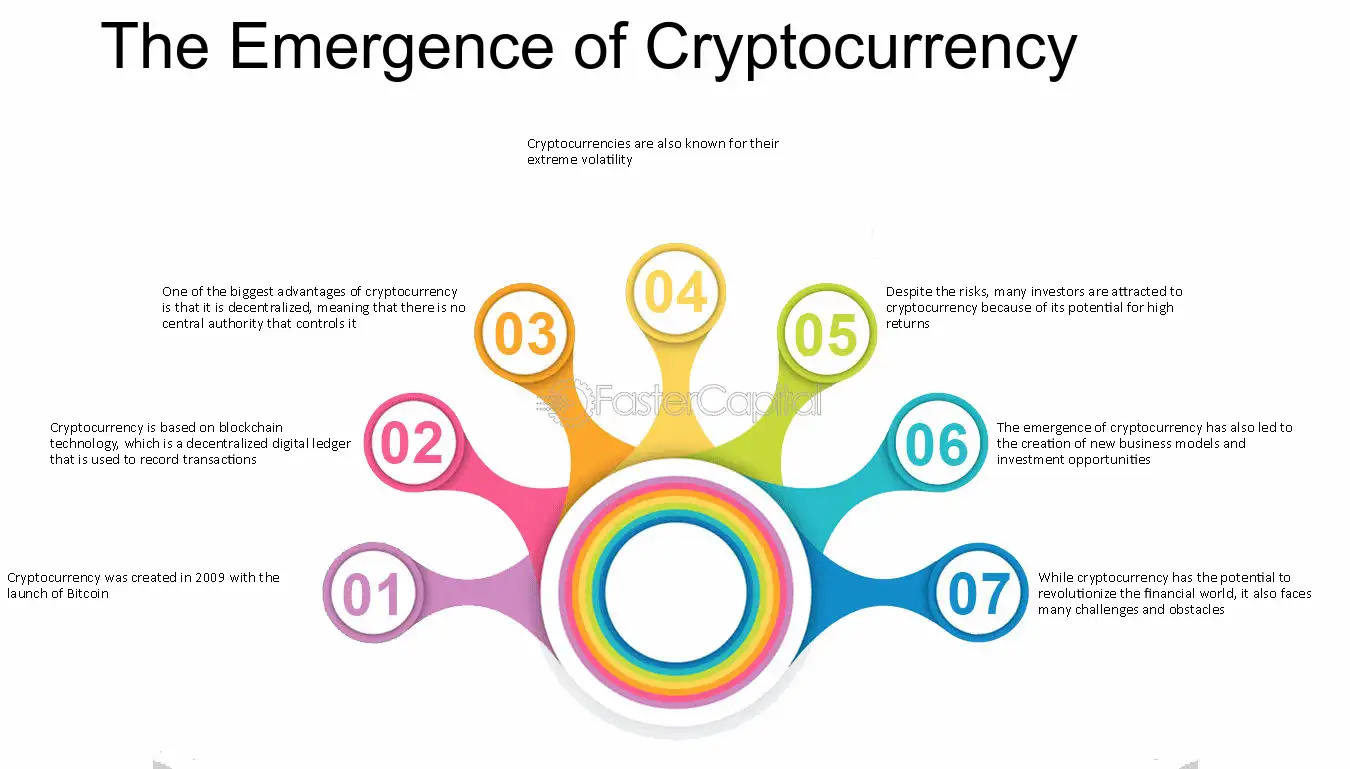

The financial crisis and the subsequent loss of trust in traditional banking systems led to the emergence of cryptocurrencies. Bitcoin, the first and most well-known cryptocurrency, was launched in 2009, just months after the Lehman Brothers collapse.

Cryptocurrencies offered a decentralized alternative to traditional banking systems, attracting those disillusioned by the financial crisis. While cryptocurrencies have been controversial and their adoption has been fraught with challenges, their emergence is a significant development in the financial landscape.

The collapse of Lehman Brothers was a watershed moment in global economic history. Its aftershocks were felt across the globe, leading to a global recession, a sovereign debt crisis, regulatory overhauls, shifts in monetary policy, the rise of populist politics, and the emergence of cryptocurrencies.

While the world has recovered from the immediate aftermath of the crisis, its effects are still being felt today. The lessons learned from the Lehman Brothers catastrophe continue to shape economic and financial policies worldwide, underscoring the significance of this event in global history.