Seven Shocking Chapters from the Savings and Loan Crisis that Transformed the Banking Landscape Irrevocably

The Savings and Loan (S&L) Crisis of the 1980s stands as a defining moment in U.S. financial history. It reshaped banking and financial institutions, leaving a lasting mark on the economy. This crisis involved a series of shocking developments over several years, each adding a new layer of complexity. In this article, we explore seven pivotal chapters that changed the banking landscape forever, shedding light on the lessons learned and the long-term effects on the industry.

The Deregulation Dilemma

The first chapter begins in the late 1970s, when deregulation of the Savings and Loan industry was introduced to spur competition and innovation. While well-intentioned, it unintentionally opened the door to risky financial behaviors. Many S&Ls shifted focus from traditional, stable loans to high-risk real estate investments. Without adequate oversight, these speculative ventures often failed, sparking a wave of insolvencies that would set the stage for the crisis.

The Real Estate Bubble

The second chapter centers around the real estate bubble of the 1980s. Deregulation and loose lending practices fueled a dramatic rise in property values. As S&Ls heavily invested in real estate, the bubble grew. But when it burst, many institutions found themselves saddled with devalued, non-performing assets. The collapse of the real estate market deepened the insolvency of S&Ls, worsening the financial fallout.

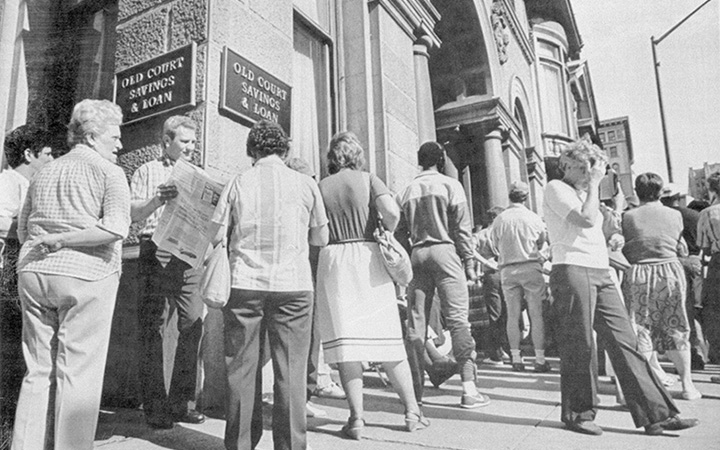

The Government Bailouts

The third chapter looks at the government’s controversial response to the crisis—massive bailouts. To prevent total collapse, the government stepped in with taxpayer-funded rescue packages that eventually cost billions. This intervention sparked public outrage and triggered debates on the role of government in rescuing financial institutions. It also set a precedent for future government bailouts in financial crises, such as those seen during the 2008 financial meltdown.

The Fraudulent Activities

The fourth chapter focuses on the widespread fraud uncovered during the crisis. Investigations revealed rampant corruption, with some S&L executives engaging in fraudulent schemes, contributing to the industry's collapse. Public trust in the banking system eroded further as these executives were prosecuted, underscoring the need for tighter regulations and stronger enforcement of banking laws.

The Regulatory Reforms

The fifth chapter examines the regulatory reforms enacted in response to the S&L Crisis. These reforms included stricter oversight and higher capital requirements for financial institutions, aimed at preventing a repeat of the disaster. While they stabilized the industry, they also led to the consolidation of smaller S&Ls, absorbed by larger financial institutions. This wave of mergers played a key role in the rise of mega-banks that dominate today’s financial landscape.

The Lasting Impact

The sixth chapter delves into the long-term effects of the crisis. The rise of mega-banks following the consolidation has had a lasting influence on the financial industry. Public skepticism toward the banking system increased, and trust in financial institutions weakened. Additionally, the regulatory changes put in place reshaped how banks operate, with stricter compliance requirements and greater accountability.

Conclusion: A Watershed Moment

The Savings and Loan Crisis was a turning point in American financial history, illustrating the dangers of deregulation, unchecked risks, and weak oversight. It led to a period of financial instability, widespread fraud, and costly government interventions. Yet, the crisis also prompted crucial reforms and set the stage for the modern banking system. Despite its dark legacy, it provided vital lessons that continue to shape the financial sector and regulatory landscape today.