Seven Shocking Chapters in the MF Global Downfall Saga and the Unsuspecting Victims Left in its Wake

In 2011, MF Global, a prominent multinational futures broker and bond dealer, collapsed in one of the most shocking financial implosions in history. This wasn't a single catastrophic event but rather a series of unsettling developments that gradually brought the firm to its knees. Below are the seven most shocking chapters of the MF Global downfall and the unsuspecting victims caught in the storm.

Chapter One - The Risky Bet

MF Global’s undoing began with a high-stakes gamble on European sovereign debt. Jon Corzine, the company’s CEO and former New Jersey governor, made a massive wager on bonds from troubled European nations, assuming the European Union would never allow defaults. Unfortunately, the ongoing European debt crisis worsened, and MF Global’s huge bet backfired, resulting in severe financial losses. This chapter highlights the perils of excessive risk-taking and how it can lead to the downfall of even the largest financial institutions.

Chapter Two - The Accounting Scandal

Next came the revelation of an accounting scandal. MF Global was found to have engaged in "creative" accounting practices, obscuring the true extent of its losses. By manipulating its financial statements, the company presented a healthier financial picture to investors and regulators than what was true. This deception kept many in the dark about the precarious state of the firm, ultimately contributing to its downfall when the truth came out.

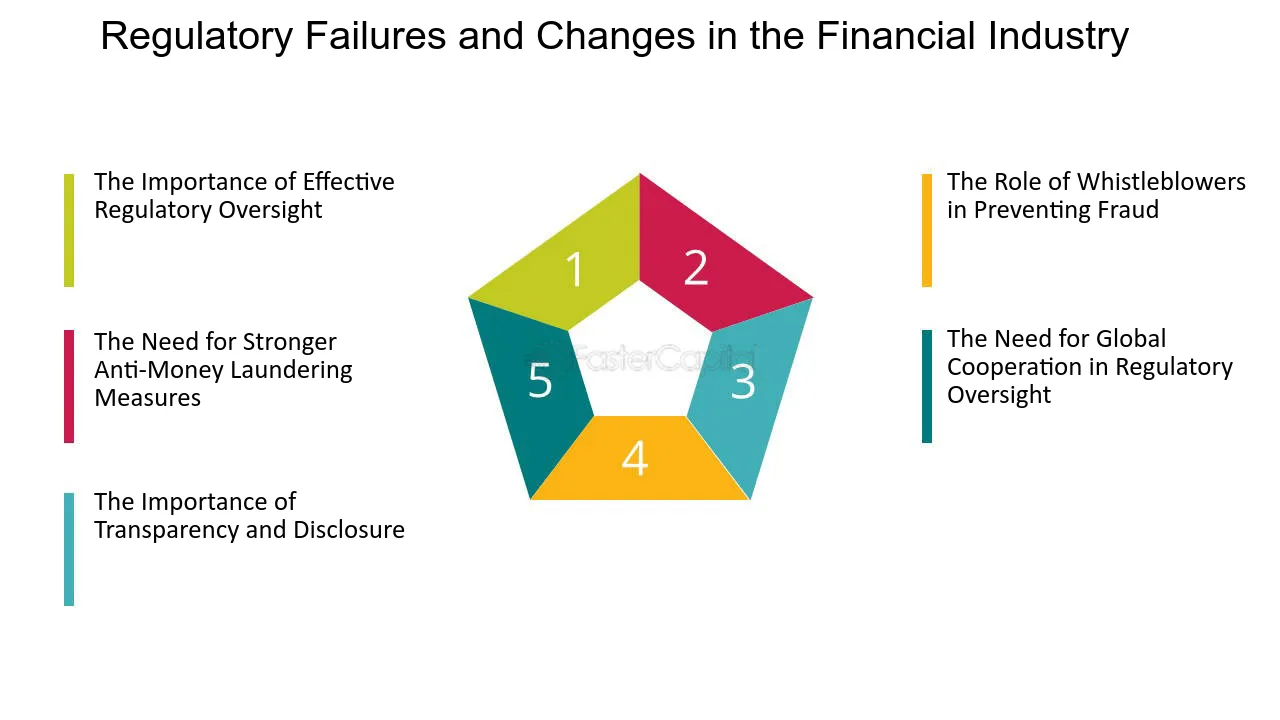

Chapter Three - The Regulatory Failures

Despite being monitored by several regulatory agencies, MF Global managed to engage in risky behavior and fraud without being caught early enough. This chapter sheds light on the gaps in the regulatory system that allowed the company’s reckless behavior to continue unchecked. The failures of oversight in MF Global’s case have since raised serious questions about the adequacy of financial regulations and whether they truly protect against corporate misdeeds.

Chapter Four - The Bankruptcy Filing

MF Global officially filed for bankruptcy on October 31, 2011, after its desperate attempts to find a buyer or secure a bailout failed. This chapter covers the events leading up to the bankruptcy filing, the financial turmoil that followed, and the immediate impact on the firm’s employees, shareholders, and clients. The filing was the eighth-largest bankruptcy in U.S. history, leaving a significant mark on the financial sector.

Chapter Five - The Missing Money

One of the most stunning discoveries following MF Global's collapse was the disappearance of $1.6 billion in customer funds. This chapter dives into the mystery of the missing money, the investigations that ensued, and the devastating consequences for clients who entrusted their money to MF Global. The inability to account for these funds shook confidence in the financial system and raised concerns about the safety of customer assets held by brokerages.

Chapter Six - The Legal Battles

After the company’s collapse, a flurry of lawsuits was filed against MF Global’s executives, auditors, and others involved. Allegations ranged from fraud and negligence to breach of fiduciary duty. This chapter looks into the ensuing legal battles, including high-profile trials and settlements, and how they helped reshape corporate accountability in the financial world.

Chapter Seven - The Unsuspecting Victims

In the end, it was the unsuspecting victims—customers, employees, and shareholders—who bore the brunt of MF Global's reckless actions. Customers lost access to their funds, employees lost their jobs, and shareholders saw their investments evaporate. This chapter tells the human stories behind the headlines, illustrating the real-world consequences of corporate failure and the need for more robust protections for investors and consumers alike.

The collapse of MF Global is a cautionary tale of unchecked risk-taking, regulatory failures, and corporate malfeasance. It revealed deep vulnerabilities within the financial system and exposed the dangers that arise when companies prioritize short-term gains over long-term stability. As the dust settled, the lessons from this disaster have informed regulatory changes, but it remains a stark reminder of the ongoing need for vigilant oversight and accountability in financial institutions.