Seven Shocking Truths From the Enron Scandal that Caused Global Corporate Trust to Crumble

The Enron scandal of the early 2000s sent shockwaves through the global corporate community, exposing the dark side of corporate ambition and deceit. Enron, once celebrated as a paragon of innovation and success, crumbled in a spectacular downfall that shattered public trust. This article explores seven shocking truths from the Enron scandal, unraveling the layers of deception and failure that led to the collapse of both a corporate giant and the trust in corporate governance worldwide.

Enron’s False Profit Reporting

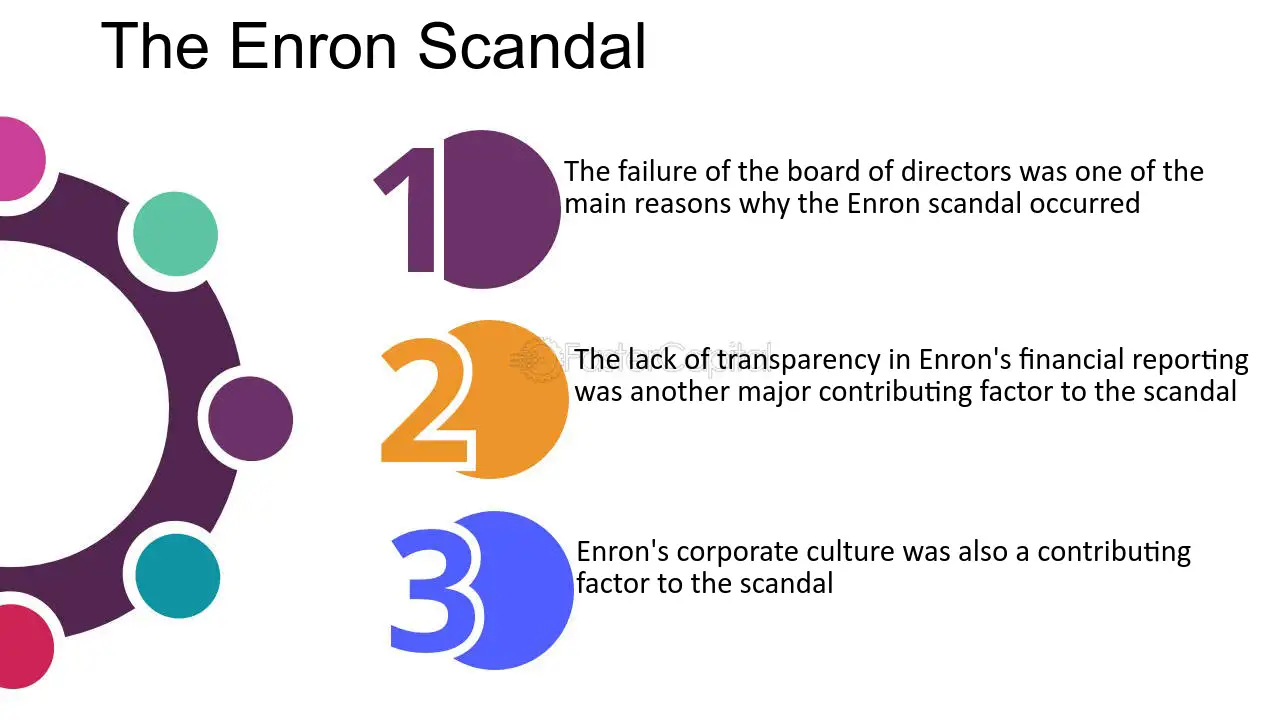

The first shocking revelation was how Enron manipulated its financial statements to appear more profitable than it was. The company employed a dubious accounting practice known as "mark-to-market" accounting, which allowed it to record projected future profits as current income. This practice grossly inflated Enron's earnings, misleading investors and analysts alike. The deceptive nature of this reporting sparked fears that other companies might be engaging in similar unethical accounting practices, further eroding corporate trust.

The Role of Arthur Andersen

Arthur Andersen, one of the largest and most respected accounting firms globally at the time, played a critical role in the Enron debacle. Rather than acting as an impartial watchdog, Arthur Andersen not only sanctioned Enron's deceptive accounting but also actively participated in destroying crucial documents as the scandal unfolded. This blatant conflict of interest between auditing and consulting services tarnished the reputation of auditing firms worldwide, leading to increased scrutiny and skepticism of their role in corporate oversight.

Wall Street’s Complicity

The Enron scandal also implicated Wall Street in enabling the company's rise and eventual downfall. Many of the largest investment banks and financial analysts continued to promote Enron’s stock as a strong buy, despite clear warning signs that the company was in trouble. This revelation exposed how investment banks, driven by their own financial interests, can mislead the public, resulting in devastating consequences for investors who trusted their recommendations.

The Failure of Regulatory Bodies

The Enron scandal cast a harsh light on the failure of regulatory agencies, particularly the Securities and Exchange Commission (SEC), to prevent corporate fraud. Despite numerous warning signs, including whistleblower alerts and discrepancies in Enron's financial statements, the SEC failed to take action until it was too late. This failure highlighted the limitations of regulatory bodies in safeguarding against corporate malfeasance, deepening the crisis of trust in both corporations and the institutions meant to oversee them.

The Role of Corporate Leadership

Enron’s senior executives, particularly CEO Jeffrey Skilling and Chairman Kenneth Lay, were at the heart of the scandal. They created a toxic corporate culture that prioritized short-term gains and stock price manipulation over long-term stability and ethical business practices. The leadership's involvement in orchestrating complex financial schemes to hide the company's true financial health exposed the dangers of unchecked corporate power, forever altering perceptions of CEO accountability.

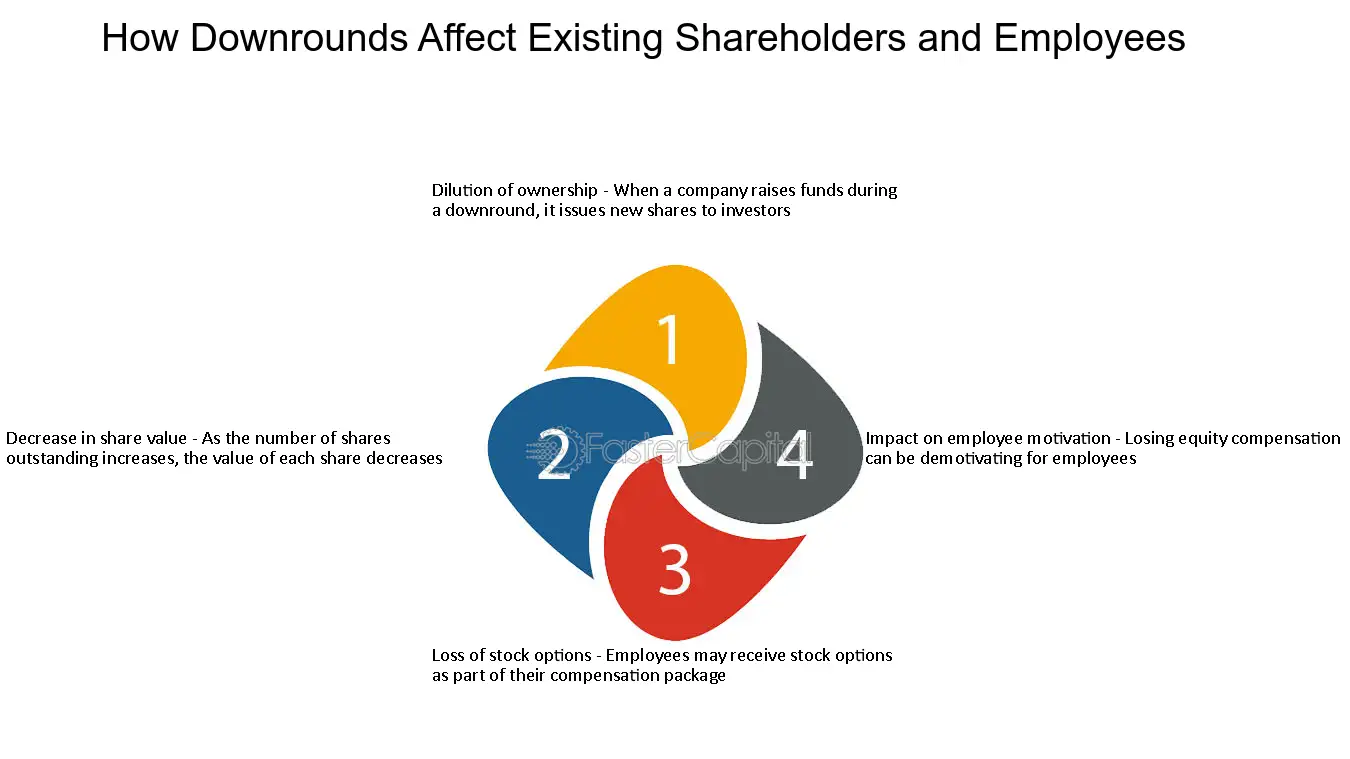

Impact on Employees and Shareholders

The human toll of the Enron scandal was another shocking truth. Thousands of employees lost their jobs, and many saw their life savings evaporate, as they had been encouraged to invest heavily in Enron stock for their retirement. Shareholders were equally devastated, with the company's stock becoming worthless almost overnight. This chapter of the scandal underscored the real-world consequences of corporate misconduct, where ordinary people suffered the most from decisions made at the top.

The Aftermath and Corporate Reforms

The Enron scandal led to one of the most significant reforms in corporate governance and financial oversight. In 2002, the U.S. Congress passed the Sarbanes-Oxley Act, which introduced stringent regulations to increase transparency in financial reporting and hold corporate executives accountable for their company’s actions. While these reforms helped restore some level of trust, the damage caused by Enron's actions left a lasting mark on the corporate world, serving as a grim reminder of the consequences of greed and unethical behavior.

The Enron scandal not only revealed widespread corruption within the company but also exposed systemic weaknesses in the corporate world, from audit firms and regulatory bodies to Wall Street itself. It was a watershed moment that led to lasting changes in corporate governance, but it also left an indelible scar on the trust that investors, employees, and the public place in corporations. The lessons learned from Enron's collapse continue to resonate today, reminding businesses of the importance of transparency, accountability, and ethics.