Top 7 Shock Waves: How Parmalat's Financial Deception Rattled Italy and The Global Economy

The Parmalat scandal erupted in 2003 is one of the most significant financial frauds in modern history. Once celebrated as a symbol of Italian entrepreneurial success, the Italian dairy giant was revealed to have a staggering $14 billion hole in its accounts, resulting in one of Europe’s largest corporate bankruptcies. This scandal sent shockwaves throughout Italy and the global economy, shaking investor confidence and prompting major regulatory changes. This article will examine the seven major impacts of the Parmalat scandal, from its effects on Italy's economy and reputation to its influence on global financial regulations and corporate governance.

The Unraveling of a Giant

Parmalat’s fall from grace was dramatic. Originally starting as a small dairy business in the 1960s, it had grown into a multinational conglomerate with operations in over 30 countries. However, Parmalat was essentially a house of cards underneath this impressive facade. The company had been employing complex financial tactics to obscure its mounting debts, creating fictitious assets and inflating its revenues. When the truth was finally uncovered, Parmalat was forced into bankruptcy, leaving thousands of employees without jobs and millions of investors facing significant losses.

Impact on Italy's Economy

The Parmalat scandal profoundly affected Italy's economy. The bankruptcy of one of the country's largest companies triggered a sharp decline in the stock market and a tightening of credit conditions. Additionally, the scandal exposed the vulnerability of Italy's corporate sector, which heavily depended on debt financing. The fallout also led to a slowdown in economic growth, as investor confidence in Italian businesses plummeted.

Damage to Italy's Reputation

Beyond the economic implications, the Parmalat scandal severely damaged Italy's reputation. It revealed deep-rooted issues in the country’s corporate governance and regulatory oversight, raising concerns about the integrity of Italian businesses. This scandal tarnished Italy's image on the international stage, making foreign investors increasingly hesitant to invest in Italian companies. The reputational damage has had long-lasting effects, and Italy struggles to regain investor trust.

Global Impact on Investor Confidence

The Parmalat scandal was not just a national issue; it had global repercussions. The magnitude of the deception rattled investor confidence worldwide, leading to a sell-off in global stock markets. It also underscored the risks of investing in multinational corporations, especially those with complex financial structures. In the aftermath of the scandal, investors became more cautious, demanding enhanced company transparency and accountability.

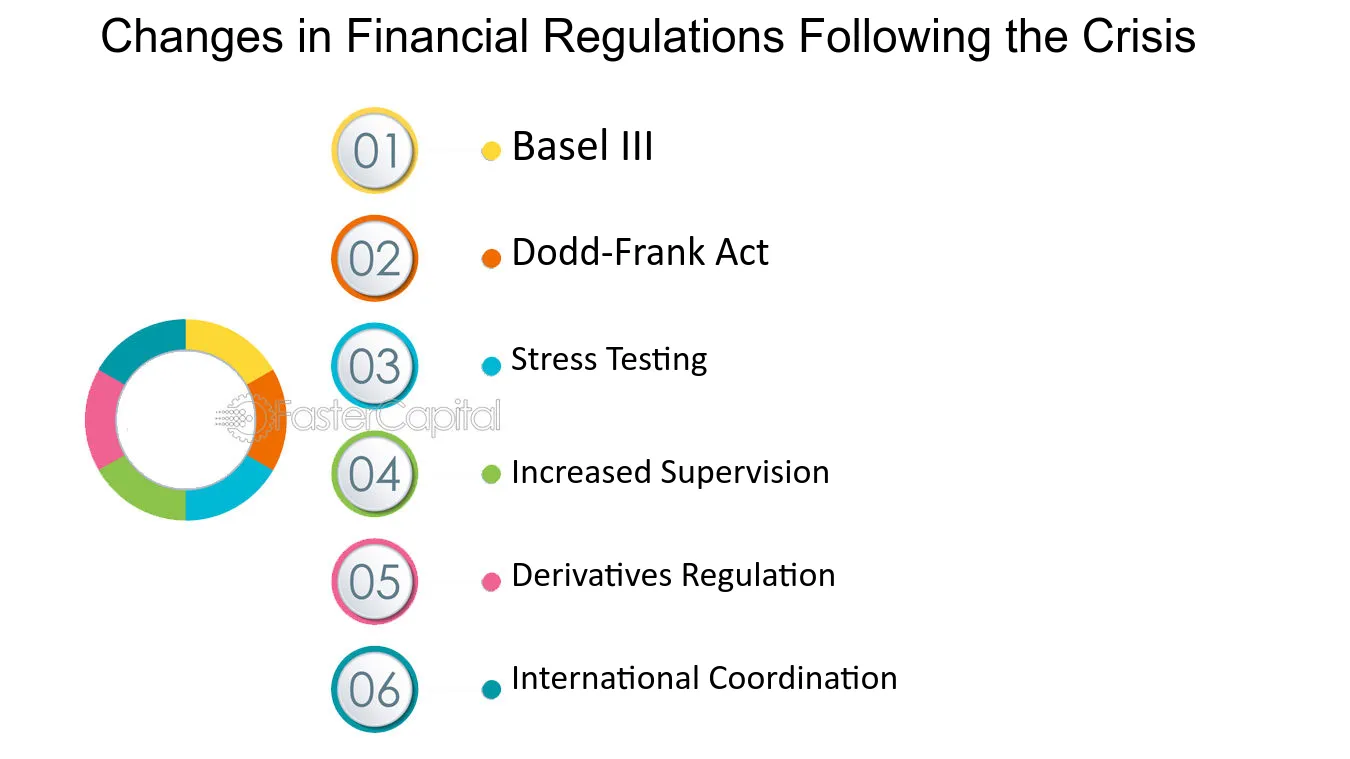

Changes in Financial Regulations

One of the most significant outcomes of the Parmalat scandal was the regulatory changes it prompted. In Italy, the scandal led to stricter corporate governance rules and greater oversight of accounting practices. On a global scale, it fueled the push for stronger financial regulations, including more rigorous auditing standards and enhanced disclosure requirements. The Parmalat scandal served as a clear reminder of the potential consequences of lax financial oversight, resulting in substantial reforms within the global financial system.

Lessons in Corporate Governance

The Parmalat scandal also imparted crucial lessons in corporate governance. It highlighted the necessity for effective oversight and accountability to prevent corporate fraud. The scandal underscored the importance of strong internal controls, independent audits, and vigilant boards of directors. It also drew attention to the dangers of excessive debt and intricate financial structures, prompting a reevaluation of corporate finance practices worldwide.

The Legacy of the Parmalat Scandal

The Parmalat scandal marked a watershed moment in finance. It exposed vulnerabilities in the global financial system, leading to significant changes in financial regulations and corporate governance. While the scandal devastated Italy’s economy and reputation, it also served as a wake-up call for businesses and regulators globally. The legacy of the Parmalat scandal continues to shape the financial landscape, reminding us of the importance of transparency, accountability, and effective oversight in the corporate world.