Shifting Tides: When Simply Saving Fell Short and the Power of Investment Transformed Financial Outcomes

In the past, achieving financial security was straightforward: save consistently and build a financial cushion over time. However, as we’ve moved into the 21st century, this traditional approach has become less effective. Merely saving money is no longer enough to maintain a comfortable lifestyle in today’s fast-moving, inflation-driven world. With this growing realization, a new financial strategy has taken center stage: investing. This shift from a savings-focused mindset to an investment-driven approach has reshaped financial outcomes for many, ushering in a new era of financial empowerment.

Unlike saving, which is more about preserving money, investing focuses on growing it. While savings offer a safety net, they don’t help build wealth over time. Investing involves putting money into assets like stocks, bonds, or real estate, with the goal of earning a return. This shift in thinking has dramatically changed how people manage their finances, leading to wealth-building opportunities that weren’t possible through saving alone.

The Limitations of Saving

The drawbacks of relying solely on saving are becoming more evident in today’s economy. With inflation consistently rising faster than the interest earned on savings, the buying power of money sitting in a savings account diminishes over time. This means that the dollars you save today won’t stretch as far in the future.

Additionally, today’s low-interest-rate environment has made savings accounts less appealing. Interest rates are at historic lows, meaning that savings grow very little, if at all. This section explores how these limitations have spurred the shift toward investing as a more effective financial strategy.

The Power of Investment

Investing has the potential to deliver far better returns than saving, particularly over the long term. This is largely due to compounding, where the returns earned on an investment are reinvested, causing the initial investment to grow at an accelerating rate.

In addition, investing allows for diversification—spreading money across different assets like stocks, bonds, or real estate to reduce financial risk. This section highlights how the power of investing can transform financial outcomes, offering the potential for much greater growth than savings alone.

The Risks and Rewards of Investing

Investing does come with risks. The value of investments can fluctuate, and there is always a chance of loss. However, the potential rewards can be substantial.

Investments in assets like stocks or real estate can yield significant returns over time, particularly for those who invest for the long term. Furthermore, investing can provide a passive income stream, contributing to financial security. This section provides a balanced view of the risks and rewards, helping readers understand both the benefits and challenges of investing.

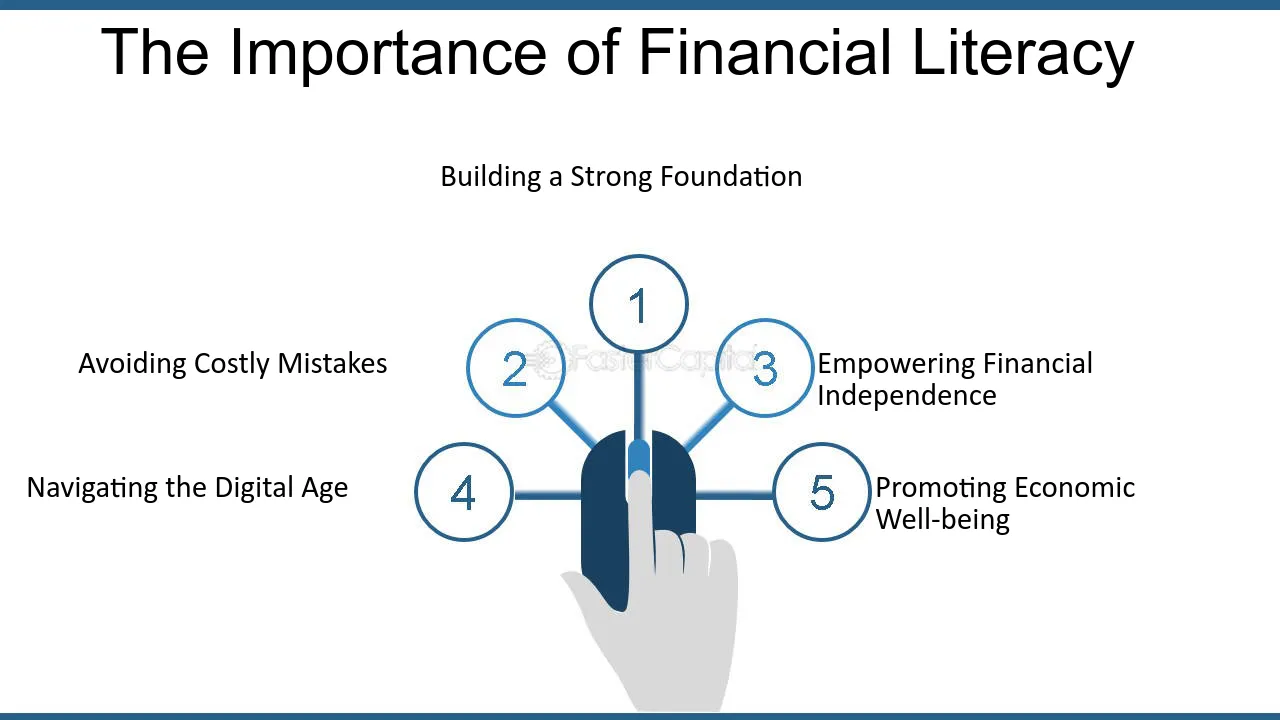

The Role of Financial Literacy

Financial literacy is key to successfully shifting from a saving to an investing mindset. Understanding concepts such as risk versus return, diversification, and the power of compounding is crucial for making informed investment choices.

Being financially literate also helps individuals navigate the complexities of investing, such as selecting the right investment options and keeping up with market trends. This section emphasizes the importance of financial literacy as an essential tool for successful investing.

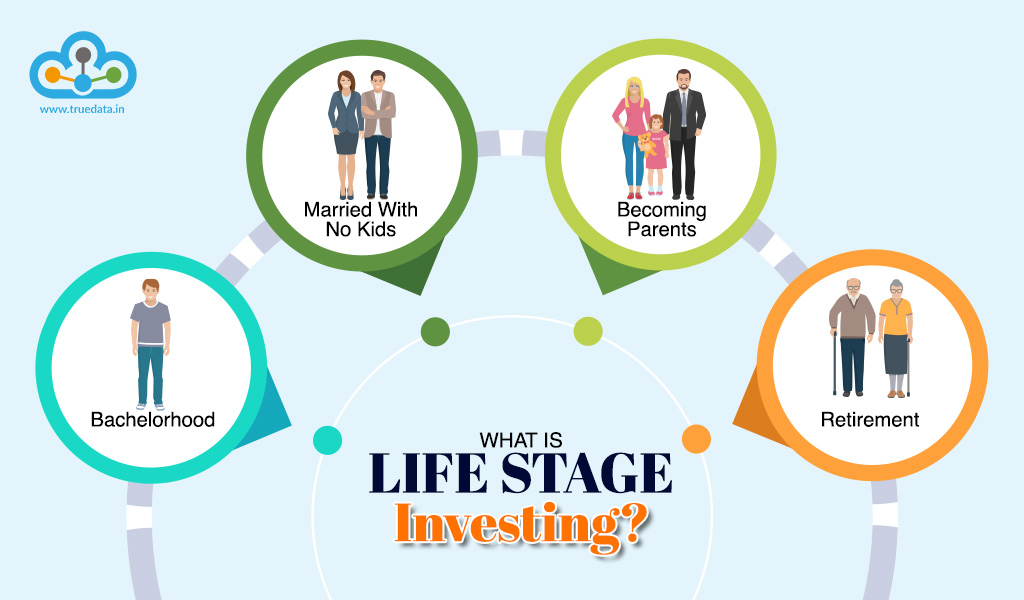

Investment Strategies for Different Life Stages

Investment strategies should vary based on where someone is in their life. For example, younger investors with longer time horizons and higher risk tolerance may favor growth investments like stocks. Meanwhile, individuals closer to retirement often prioritize safer, income-generating investments such as bonds.

This section provides practical advice on how to tailor investment strategies to different life stages, offering guidance for readers at various points in their financial journey.

The Role of Technology in Investment

Technology has revolutionized investing by making it more accessible. With the rise of robo-advisors and user-friendly investment apps, more people can start investing with minimal knowledge or effort.

These platforms offer access to a variety of investment products, alongside tools and resources that help guide users’ decisions. This section explores how technology has democratized investing, making it easier and more efficient for people to get started.

Navigating the Shifting Tides

The shift from saving to investing is a significant transformation in personal finance. While saving still provides a crucial safety net, investing offers the potential for substantial wealth creation. However, successful investing requires education, financial literacy, and careful planning.

As we navigate these changing financial tides, equipping ourselves with the right knowledge and tools is essential. By embracing the power of investing, we can improve our financial outcomes and work toward a more secure and prosperous future.