6 Major Financial Crises Averted Through Strategic Steps in Risk Management

In the unpredictable landscape of global finance, risk management has emerged as a vital tool to navigate the tumultuous waves of economic uncertainty. The ability to identify, assess, and prioritize risks can spell the difference between financial prosperity and ruin. Throughout history, there have been numerous instances where strategic risk management has successfully averted major financial crises. This slideshow will delve into 6 such instances, providing a riveting insight into how strategic steps in risk management have helped in safe fiscal navigation. Each of these cases will serve as a testament to the power of effective risk management and its crucial role in maintaining financial stability.

1. The 1998 Long-Term Capital Management Crisis

Long-Term Capital Management (LTCM) was a hedge fund that nearly collapsed in 1998 due to high-risk arbitrage trading strategies. The crisis was averted when the Federal Reserve intervened, coordinating a bailout by 14 financial entities. This event underscored the importance of stress testing and scenario analysis in risk management. By simulating potential adverse events, these tools allow firms to assess their risk exposure and take appropriate preventive measures. The LTCM crisis served as a wakeup call for the financial world, highlighting the importance of these risk management techniques.

2. The 2002 Argentine Economic Crisis

In 2002, Argentina was on the brink of a severe economic crisis due to a massive debt default. The International Monetary Fund (IMF) stepped in with a strategic risk management plan that included a debt restructuring program and a series of fiscal measures. This intervention not only prevented a full-blown crisis but also paved the way for Argentina's economic recovery. The Argentine case demonstrates the importance of external risk management and the role of international financial institutions in maintaining global economic stability.

3. The 2008 Global Financial Crisis

The 2008 Global Financial Crisis was a devastating event that shook the world economy. However, it could have been much worse if not for the strategic steps taken by central banks worldwide. These institutions implemented a series of unconventional monetary policies, including quantitative easing and lowering interest rates, to prevent a complete economic meltdown. This crisis underscored the importance of monetary policy as a risk management tool and highlighted the crucial role of central banks in crisis prevention.

4. The 2010 European Sovereign Debt Crisis

The European Sovereign Debt Crisis of 2010 was another instance where strategic risk management played a crucial role in preventing a major financial catastrophe. The European Central Bank (ECB), along with other European institutions, implemented a series of measures, including the creation of the European Financial Stability Facility (EFSF). This crisis highlighted the importance of regional cooperation and collective action in risk management, demonstrating how a united front can effectively mitigate the impact of a financial crisis.

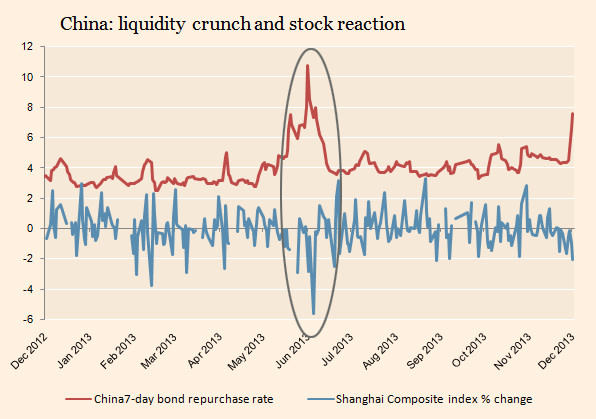

5. The 2013 Chinese Liquidity Crunch

In 2013, China faced a severe liquidity crunch, threatening the stability of its financial system. The People's Bank of China (PBOC) intervened, injecting liquidity into the banking system and implementing a series of regulatory measures to prevent a crisis. This event emphasized the importance of liquidity management in risk management, showing how timely intervention can avert a financial catastrophe.

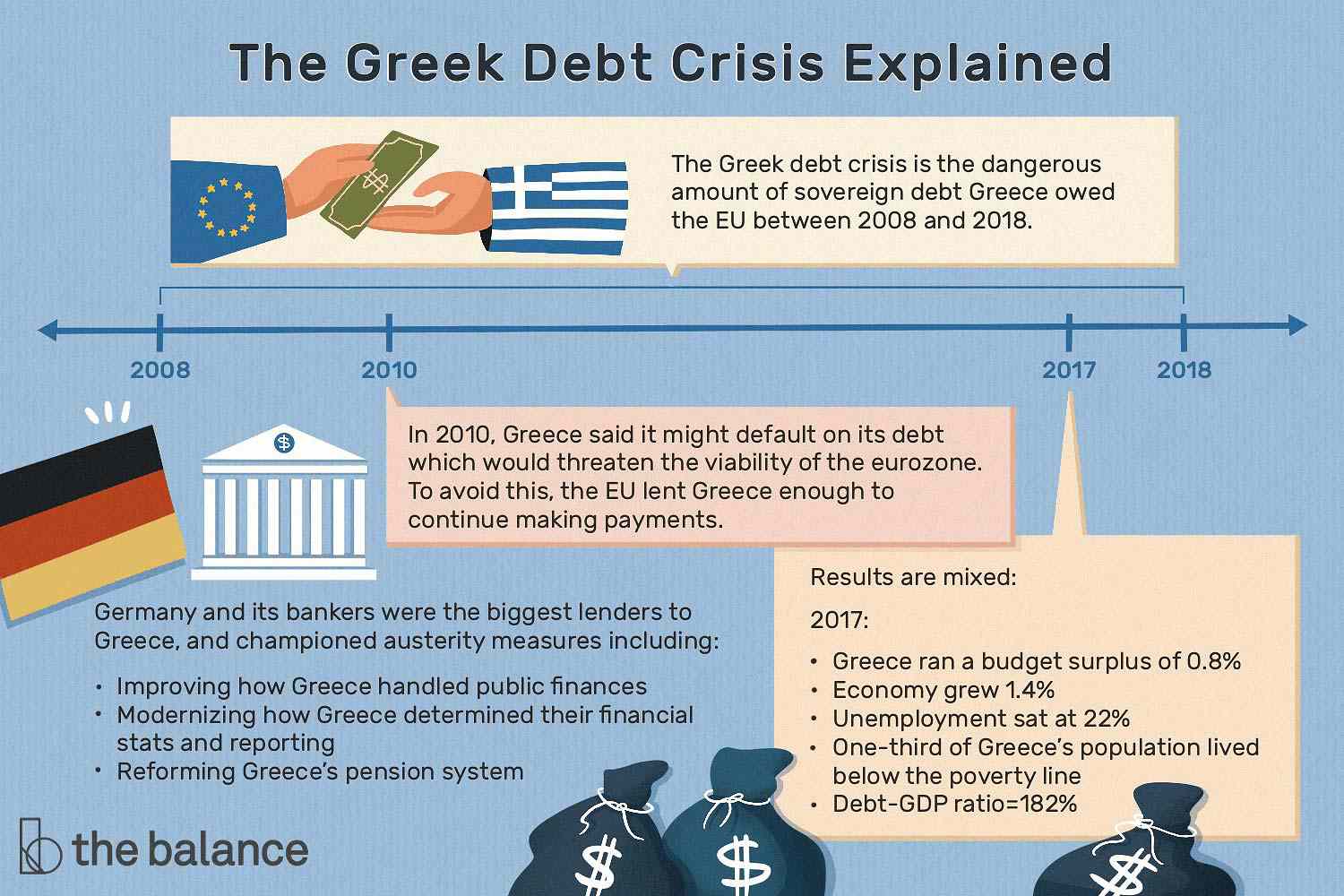

6. The 2015 Greek Debt Crisis

The Greek Debt Crisis of 2015 was another instance where strategic risk management prevented a major financial crisis. The European Central Bank (ECB), the European Commission, and the International Monetary Fund (IMF) – collectively known as the Troika – implemented a series of measures, including a bailout package and debt restructuring program, to prevent a Greek default. This crisis highlighted the importance of debt management in risk management, demonstrating how effective debt restructuring can prevent a financial crisis.

The seven instances highlighted in this slideshow underscore the importance of strategic risk management in averting major financial crises. They demonstrate the various tools and strategies that can be employed, from stress testing and scenario analysis to monetary policy and debt management. As we move forward in an increasingly interconnected global economy, the role of risk management will only become more crucial. It is our hope that these case studies will provide valuable insights and lessons for future fiscal navigation.