7 Game-Changing Mutual and Index Funds Revolutionizing the Sphere of Investing

The world of investing is continuously evolving, with the advent of financial technology and a shift in investor sentiment. The focus has now moved towards mutual and index funds, which offer a diversified portfolio and lower risk compared to traditional stocks. These funds have revolutionized the investment sphere, offering opportunities to novice investors and seasoned professionals alike. This article will delve into 7 game-changing mutual and index funds that are reshaping the investing landscape. With a blend of analysis, insights, and expert opinions, we'll explore how these funds are transforming the investment ecosystem.

1. The Rise of ESG Funds

Environmental, Social, and Governance (ESG) funds have gained significant traction over the past few years. Investors are increasingly conscious of the impact their investments have on society and the environment. The Vanguard FTSE Social Index Fund (VFTSX) is a prime example of an ESG fund that's making waves in the investment sphere. This fund invests in socially responsible companies, offering investors an opportunity to align their portfolio with their values. VFTSX has consistently outperformed its benchmark, making it a popular choice among ESG-conscious investors.

2. The Power of Technology Funds

Technology-focused funds like the Fidelity Select Technology Portfolio (FSPTX) have been at the forefront of the investing revolution. FSPTX invests in companies engaged in research, development, and distribution of technological services and equipment. This fund provides investors with exposure to the booming tech sector, which has been the engine of growth for the global economy. The robust performance of FSPTX underscores the potential of tech-focused funds in an increasingly digital world.

3. Embracing Global Opportunities with International Funds

The Vanguard Total International Stock Index Fund (VGTSX) offers investors a chance to diversify their portfolio beyond domestic markets. This fund invests in a wide range of non-U.S. equities, providing exposure to developed and emerging markets. VGTSX allows investors to tap into the growth potential of international markets, offering a balanced portfolio that can weather market volatility. The fund's broad diversification and low expense ratio make it a compelling choice for investors seeking global exposure.

4. The Appeal of Healthcare Funds

The healthcare sector has always been a staple of the investment world. Funds like the T. Rowe Price Health Sciences Fund (PRHSX) allow investors to gain exposure to this evergreen sector. PRHSX invests in a diverse range of healthcare-related companies, including pharmaceuticals, biotechnology, and healthcare services. The fund's strong performance and the essential nature of the healthcare sector make it a reliable choice for investors seeking steady growth.

5. Harnessing the Potential of Small-Cap Funds

Small-cap funds like the iShares Russell 2000 ETF (IWM) offer investors a chance to invest in the growth potential of small U.S. companies. These funds are known for their high-risk, high-reward nature. IWM provides exposure to 2000 small-cap domestic companies, which are often overlooked by investors. The fund's focus on small-cap stocks offers a unique opportunity for investors seeking to diversify their portfolio and potentially earn above-average returns.

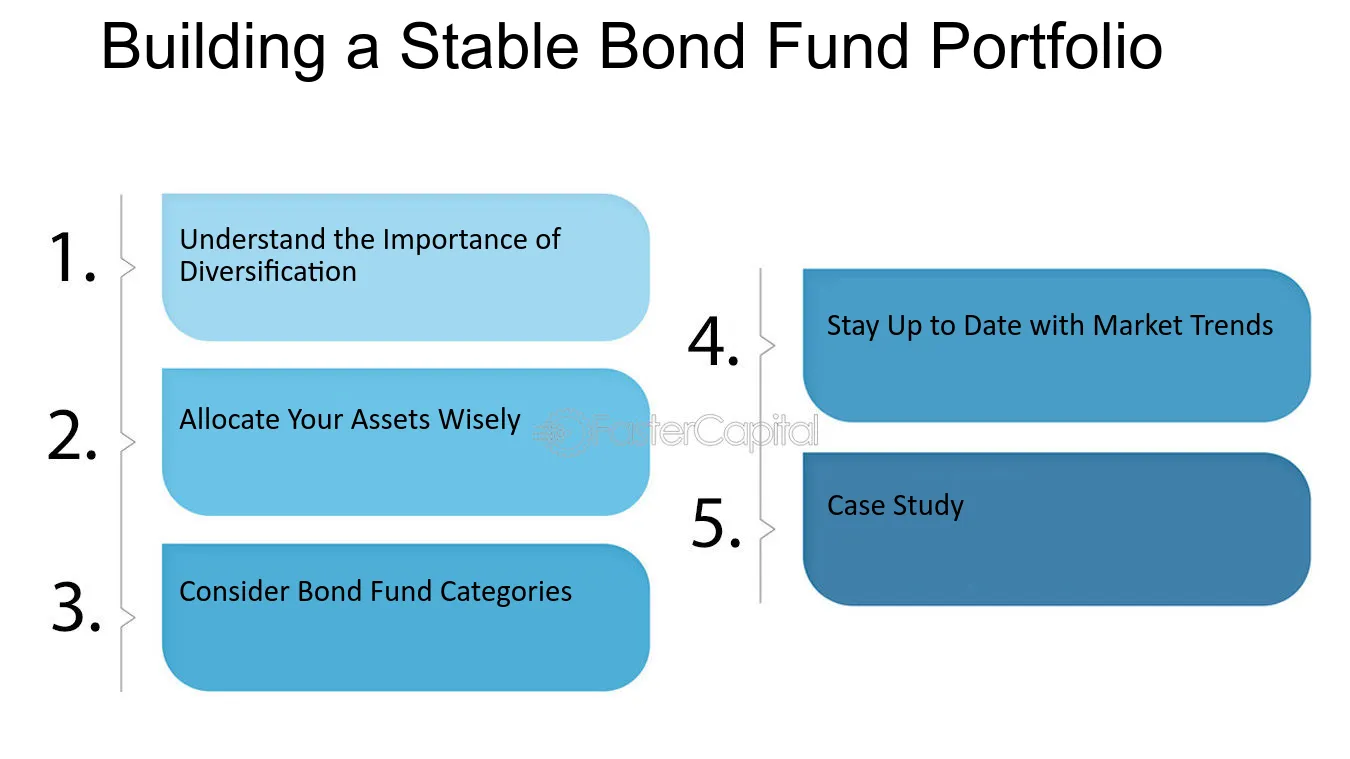

6. The Stability of Bond Funds

In a volatile market, bond funds like the Vanguard Total Bond Market Index Fund (VBTLX) offer stability and predictable returns. VBTLX offers broad exposure to U.S. investment-grade bonds, which are less risky than stocks. The fund's focus on high-quality bonds and its low expense ratio make it an attractive option for conservative investors seeking steady income.

7. The Future of Investing

The rise of mutual and index funds has democratized the investment landscape, allowing everyday investors to build diversified portfolios that were once the preserve of institutional investors. These seven funds represent the future of investing, offering a blend of risk and reward that caters to a wide range of investor preferences. As the investing world continues to evolve, these funds are likely to play a pivotal role in shaping the investment strategies of the future.