Diving into the Profits: Seven Banks that Turned the Tables with Libor Rate Manipulation

The London Interbank Offered Rate (Libor) is a benchmark interest rate that is used globally to set the price of everything from student loans to derivatives. However, in the late 2000s, a scandal emerged that implicated some of the world's largest banks in a scheme to manipulate this critical rate. This scandal revealed the dark underbelly of the banking industry, exposing a culture of greed and deception that had far-reaching implications for financial markets and the global economy. This article will delve into the details of this scandal, focusing on seven banks that were at the heart of this controversy and how they turned the tables to profit from the manipulation of the Libor rate.

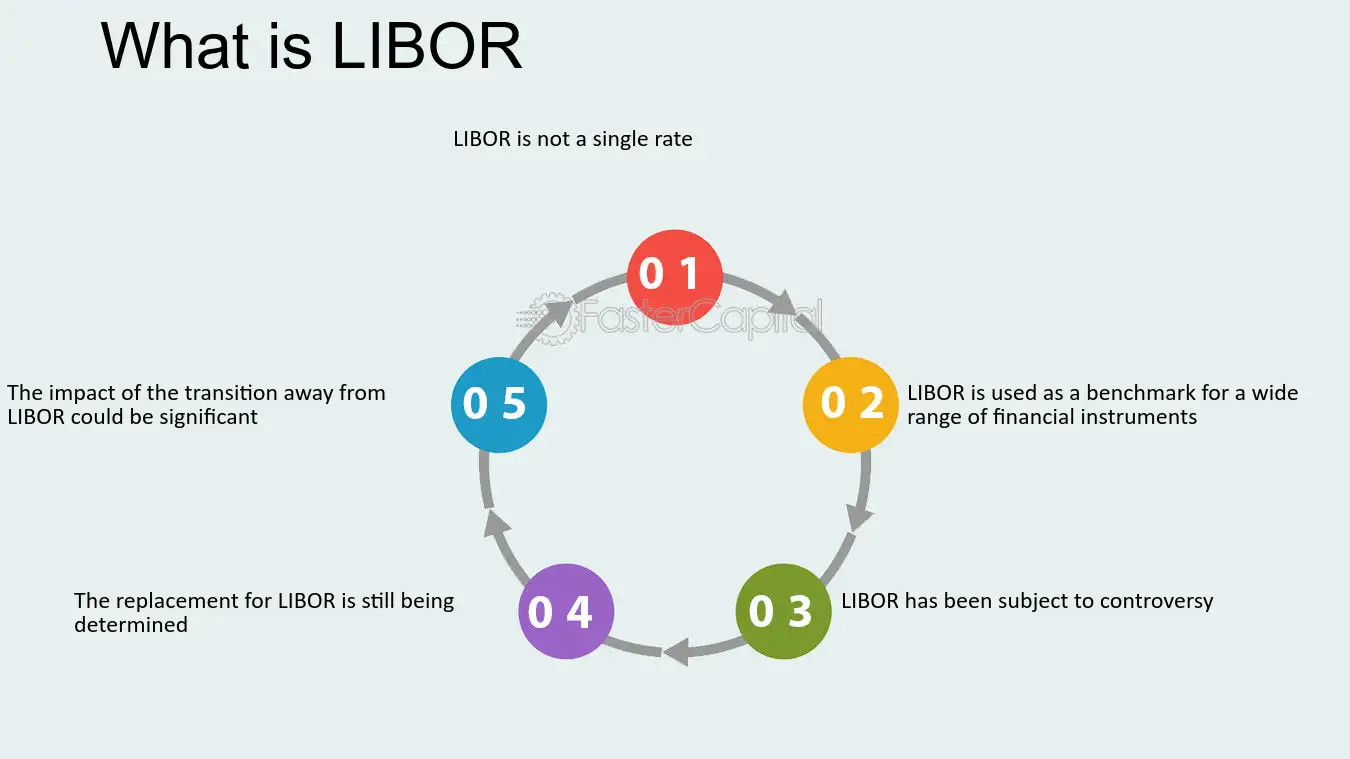

Understanding the Libor Rate

The Libor rate is the average interest rate at which major global banks borrow from one another. It is calculated daily by the British Bankers' Association (BBA) based on submissions from a panel of banks. These banks estimate the rate at which they could borrow unsecured funds from other banks in the London interbank market. However, the scandal revealed that these estimates were not always accurate and were often manipulated to benefit the banks' trading positions.

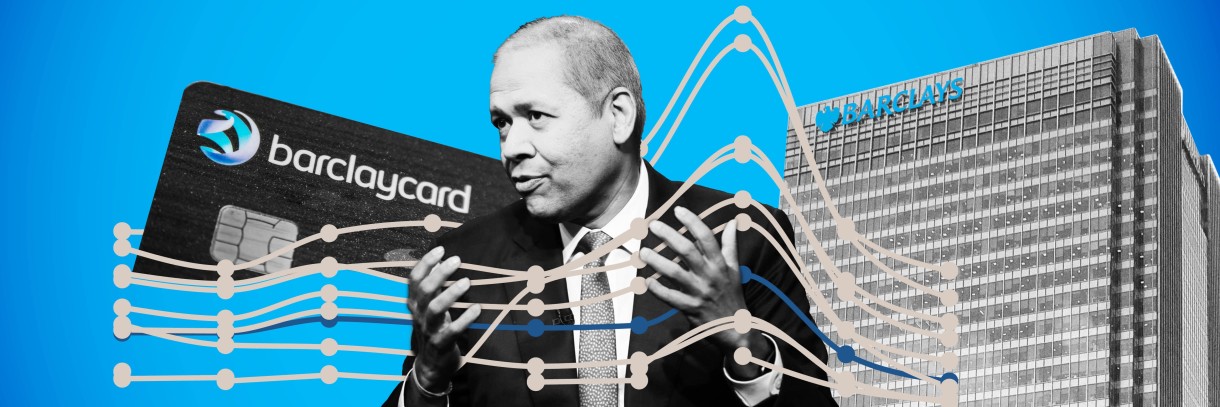

The Role of Barclays in the Scandal

Barclays, a British multinational banking and financial services company, was one of the first banks to be implicated in the Libor scandal. In 2012, Barclays admitted to manipulating the Libor rate and agreed to pay $450 million in fines to UK and US regulators. This admission sent shockwaves through the financial industry and led to the resignation of Barclays' CEO, Bob Diamond.

The Involvement of Deutsche Bank

Deutsche Bank, Germany's largest bank, was also heavily involved in the Libor scandal. In 2015, Deutsche Bank agreed to pay $2.5 billion in fines to regulators in the US and UK for its role in manipulating the Libor rate. The bank's involvement in the scandal was particularly egregious, with evidence suggesting that the manipulation of the Libor rate was a widespread practice within the bank.

The Case of UBS

Swiss bank UBS was another major player in the Libor scandal. In 2012, UBS agreed to pay $1.5 billion in fines to regulators in the US, UK, and Switzerland for its role in manipulating the Libor rate. The bank's traders were found to have colluded with brokers to manipulate the rate, with the profits from this manipulation going straight into the pockets of the traders.

Other Banks Involved

The Libor scandal was not limited to Barclays, Deutsche Bank, and UBS. Other banks involved in the scandal include Royal Bank of Scotland, Citigroup, JPMorgan Chase, and Rabobank. These banks all faced significant fines for their role in manipulating the Libor rate, with the total fines paid by all banks involved in the scandal reaching over $9 billion.

The Aftermath of the Scandal

The Libor scandal had far-reaching implications for the banking industry and the global economy. It led to a loss of trust in banks and financial markets, and sparked calls for greater regulation of the banking industry. It also led to significant changes in the way the Libor rate is calculated, with the aim of making it more transparent and less susceptible to manipulation.

The Libor scandal revealed the extent to which greed and deception had permeated the banking industry. It showed that some of the world's largest banks were willing to manipulate a critical global interest rate to boost their profits, with little regard for the wider implications of their actions. However, the scandal also led to significant changes in the banking industry and the way the Libor rate is calculated, which will hopefully prevent such manipulation from happening in the future.