Seven Economic Bubbles That Burst and Forever Altered the Course of History

The world of economics is a complex web of trends, patterns, and cycles, with one of the most fascinating and devastating phenomena being the economic bubble. A bubble forms when the price of an asset, such as real estate or stocks, skyrockets well beyond its actual value, creating an unsustainable situation that ultimately collapses. When the bubble bursts, it triggers widespread financial turmoil. This slideshow will take you through seven of the most significant economic bubbles in history, each of which caused immense financial damage in its time and left a lasting impact on both economic and social structures.

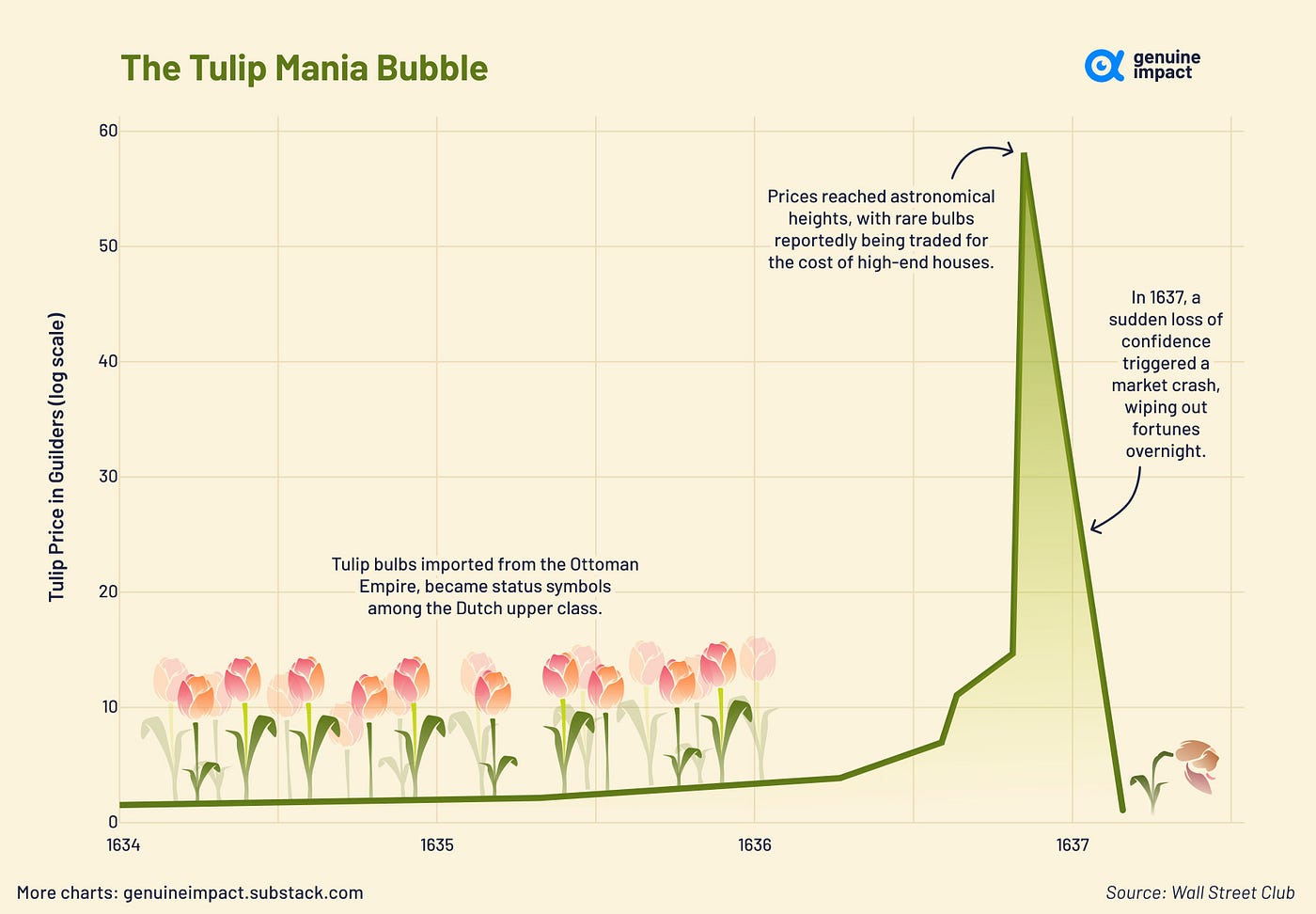

The Tulip Mania (1637)

The first recorded economic bubble was the Dutch Tulip Mania of the 17th century. Tulip bulbs became highly sought-after status symbols among the Dutch elite, driving their prices to absurd levels. At the peak of the frenzy, a single tulip bulb could be worth more than a house. However, the market crashed in February 1637, leaving many investors in financial ruin. Tulip Mania stands as a classic example of how speculation can cause asset prices to become detached from reality. The aftermath led to changes in Dutch economic policy and a lasting skepticism toward speculative investments.

The South Sea Bubble (1720)

In 1720, Britain was hit by the South Sea Bubble, a financial debacle centered around the South Sea Company, which had monopoly trading rights with South America. Investors were drawn in by exaggerated claims of massive profits, inflating the company's stock price. When these promises proved false, the bubble burst, causing an economic collapse in Britain. This event prompted the British government to increase regulation of financial markets, setting a global precedent for market oversight.

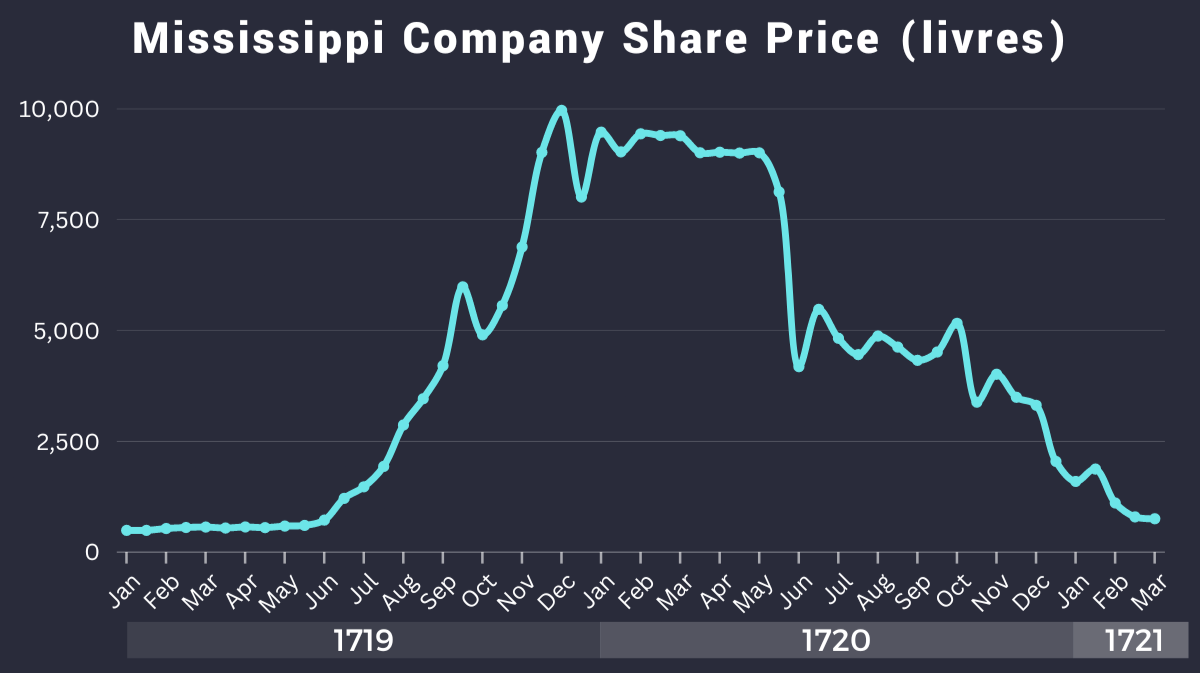

The Mississippi Bubble (1720)

Around the same time as the South Sea Bubble, France experienced its own financial disaster with the Mississippi Bubble. This bubble was fueled by the Mississippi Company, which had monopoly rights over trade with French colonies in North America. The company, led by economist John Law, used paper money to stimulate the economy and pay off national debt. However, when investors realized that profits were overblown, the bubble popped, plunging France into economic depression. The crisis undermined confidence in paper money, pushing France back toward gold and silver as primary currencies.

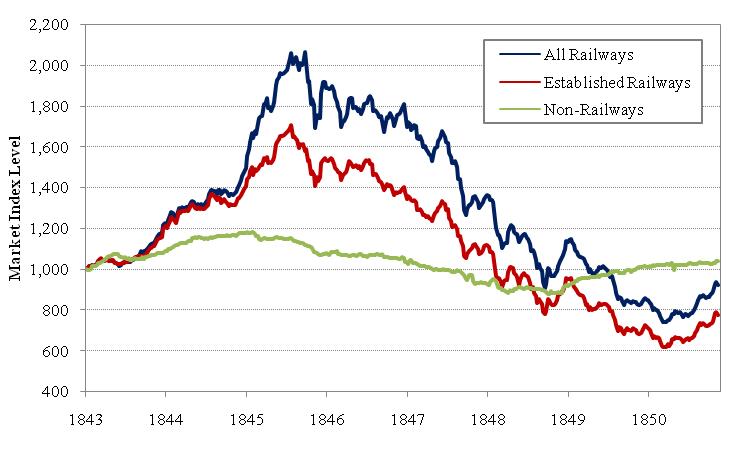

The Railway Mania (1840s)

In the 1840s, Britain saw an explosion in railway construction that led to the Railway Mania. Investors flocked to buy shares in new railway companies, expecting large returns. However, many of these companies were unprofitable, and the bubble eventually burst, causing a severe economic slump. This collapse led to stricter regulations on company prospectuses and more cautious scrutiny of infrastructure projects in the future.

The Roaring Twenties and The Wall Street Crash (1929)

The Roaring Twenties was a time of economic boom in the U.S., with the stock market soaring to new heights. However, this growth was unsustainable, and in 1929, the stock market crashed, marking the beginning of the Great Depression. The collapse led to widespread economic hardship and sparked major changes in U.S. financial policy, including the creation of the Securities and Exchange Commission (SEC) to oversee and regulate the stock market, aiming to prevent future crashes.

The Dot-Com Bubble (2000)

In the late 1990s, a surge in the valuation of technology companies, driven by the rise of the internet, led to the Dot-Com Bubble. Investors poured money into tech startups, many of which lacked profitability. The bubble burst in 2000, causing a major downturn in the tech industry. The fallout from this event shifted the focus in tech investing toward sustainable business models and profitability, reshaping Silicon Valley's approach to innovation and investment.

The Housing Bubble (2008)

The U.S. housing bubble in the mid-2000s is one of the most recent and globally impactful economic bubbles. Housing prices surged due to speculative investments and subprime mortgage lending. When the bubble burst in 2008, it triggered the Global Financial Crisis, the most severe economic downturn since the Great Depression. The crisis prompted significant reforms, including the introduction of the Dodd-Frank Act, which aimed to regulate the financial industry and reduce the risks associated with speculative investments.

Economic bubbles have played a major role in shaping financial history. While they often result in financial devastation, they also lead to crucial regulatory reforms. By examining these historical events, we can better understand the dynamics of financial markets and work toward preventing similar crises in the future.