Seven Dramatic Showdowns of Bonds and Stocks Amidst Historic Market Crashes

The financial markets have witnessed numerous dramatic showdowns between bonds and stocks, particularly during historic market crashes. These confrontations not only reveal how these two key investment assets behave during times of economic turmoil but also offer important lessons for investors on risk management, diversification, and portfolio strategy. This article takes you through seven of the most significant showdowns between bonds and stocks during major market crashes, highlighting the factors that fueled these conflicts and the valuable takeaways for modern investors.

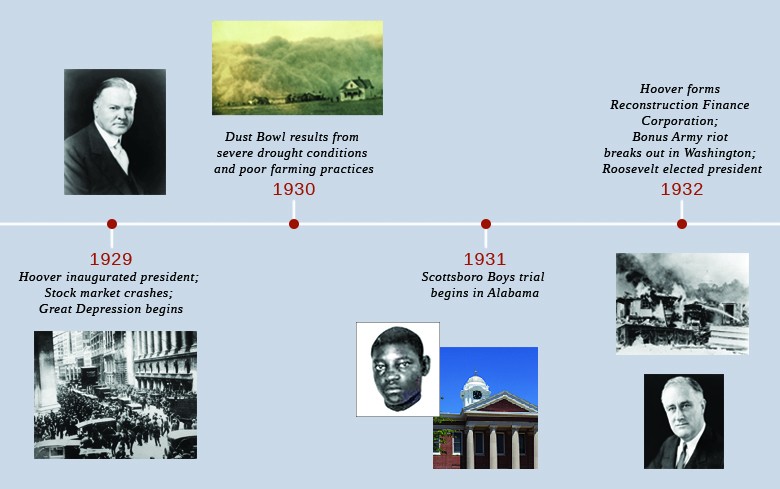

The Great Depression (1929-1932)

The Great Depression remains one of the most catastrophic economic downturns in modern history. As stock markets crashed, many investors sought refuge in bonds, especially government bonds. However, this showdown was anything but straightforward. While bonds initially gained favor due to their perceived safety, the deepening depression eroded confidence even in these safer assets, leading to faltering bond prices. This period underscored the danger of relying too heavily on any single asset class and emphasized the importance of diversification.

The Oil Crisis (1973-1974)

The oil crisis of the 1970s created a dramatic confrontation between bonds and stocks. With oil prices soaring, inflation quickly became a major issue, reducing the value of fixed-income investments like bonds. Stocks suffered as well, with corporate profits shrinking under the weight of high energy costs. This era highlighted the susceptibility of both asset classes to external shocks and reinforced the necessity for investors to hold diversified portfolios that can withstand such disruptions.

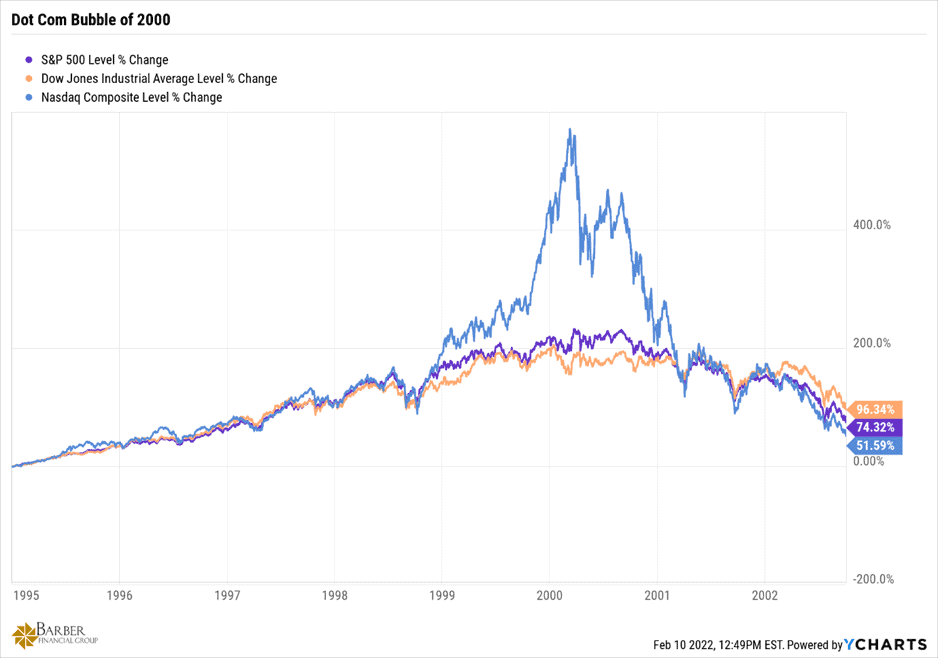

The Dot-com Bubble (2000-2002)

The collapse of the dot-com bubble at the dawn of the 21st century marked yet another showdown. As the tech stock market collapsed, investors fled to bonds, driving bond prices higher. In response to the crisis, central banks slashed interest rates, resulting in a bond market rally. This episode demonstrated the crucial role of monetary policy in shaping both the bond and stock markets during times of crisis and showed the balance between risk and safety in portfolio management.

The Global Financial Crisis (2007-2009)

The Global Financial Crisis featured one of the most intense confrontations between bonds and stocks. As the housing market collapsed and financial institutions teetered on the edge of collapse, stock markets suffered devastating losses. In contrast, government bonds emerged as a safe haven for investors looking to protect their wealth. However, the crisis also revealed hidden risks in other types of bonds, such as mortgage-backed securities, which were at the epicenter of the crisis. This period reinforced the need for caution when investing in seemingly "safe" bonds during times of uncertainty.

The European Sovereign Debt Crisis (2010-2012)

The European Sovereign Debt Crisis presented a unique challenge, with both bonds and stocks facing turmoil. As countries like Greece, Portugal, and Spain approached potential defaults, bond yields in those countries skyrocketed. Simultaneously, uncertainty about the future of the Eurozone put significant downward pressure on stock markets across Europe. This crisis illustrated the interconnectedness of global financial markets and underscored how regional economic issues can ripple through global asset classes.

The COVID-19 Pandemic (2020-Present)

The COVID-19 pandemic triggered one of the most dramatic showdowns between bonds and stocks in recent memory. Initially, the shock of the pandemic caused a synchronized crash in both markets. However, unprecedented levels of government stimulus and central bank intervention quickly reversed this trend. As the pandemic continues, it remains a case study on the power of monetary and fiscal policy in stabilizing markets during unprecedented global events. It also highlights the importance of managing risks and diversifying portfolios in an unpredictable world.

Lessons from financial showdowns

The head-to-head showdowns between bonds and stocks during historic market crashes offer key lessons for investors. These dramatic battles demonstrate that no asset class is entirely safe from economic shocks. They emphasize the importance of a diversified portfolio that balances risk and return and the need for vigilance in monitoring global economic events.

By reflecting on these past market struggles, investors today can better prepare for future financial storms and make more informed decisions to safeguard their investments amidst market volatility.