Seven Shocking Revelations from The Dot-Com Bubble and the Bear Market It Left Behind

The dot-com bubble of the late 1990s is a classic example of how market euphoria and speculation can drive unsustainable growth. As internet companies soared to incredible valuations, the belief that the tech sector could defy economic realities took hold, creating a bubble that eventually burst, leaving financial devastation in its wake. This article explores seven startling revelations from that era, each providing insights into the dynamics of financial markets and valuable lessons for future investors.

The Illusion of Infinite Growth

One of the most shocking revelations from the dot-com bubble was the widespread belief in endless growth. Investors and analysts alike were convinced that the internet would revolutionize business to such an extent that profits would flow without interruption. This led to the rapid rise of dot-com companies with little regard for their business fundamentals, such as profitability or sound revenue models. When the bubble burst, it became evident that these companies were far from immune to the constraints of economic reality. This revelation serves as a reminder that no industry, even one as revolutionary as the internet, can sustain infinite growth without solid financial foundations.

The Role of Media Hype

The media played a significant role in the dot-com bubble, often promoting internet stocks without scrutinizing the companies behind them. Reports of "the next big thing" created a frenzy, pushing investors to buy into companies that were sometimes little more than ideas on paper. This over-hype contributed to unrealistic valuations. When the bubble popped, the role of media in amplifying unsound investments was laid bare. Investors learned the importance of doing their own research and not relying solely on media-fueled enthusiasm when making investment decisions.

The Danger of Herd Mentality

Herd mentality was another striking aspect of the dot-com bubble. Investors, seeing others profit from tech stocks, jumped into the market without conducting their own analysis. This behavior drove up stock prices to unsustainable levels, creating a cycle of hype and excessive risk-taking. When the bubble collapsed, it became clear that blindly following the crowd can lead to disastrous outcomes. The dot-com crash emphasized the importance of independent thinking and caution when market trends become irrationally exuberant.

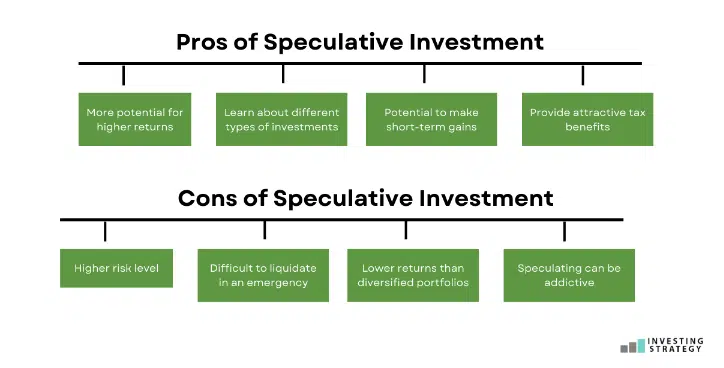

The Impact of Speculative Investing

Speculative investing was rampant during the dot-com boom, with many buying stocks not because they believed in the company’s long-term value, but because they expected to sell at a higher price soon. This speculative mindset contributed to inflated valuations and the eventual market crash. The revelation that speculative investing can create massive financial bubbles highlighted the importance of basing investment decisions on solid fundamentals rather than short-term market trends.

The Vulnerability of the Economy

The dot-com bubble also exposed how vulnerable the broader economy can be to bubbles in specific sectors. The collapse of tech stocks led to a broader recession, affecting not only investors but also businesses, employment, and economic growth. This revealed the interconnectedness of financial markets and underscored the importance of monitoring speculative excesses to prevent systemic economic risks. The dot-com crash taught policymakers and investors alike that unchecked market exuberance can have far-reaching consequences.

The Resilience of the Tech Sector

Despite the devastation of the dot-com bubble, one of the most surprising revelations was the resilience of the tech sector. Many companies failed, but the survivors—including giants like Amazon, Google, and eBay—went on to thrive. The sector rebounded and eventually became a cornerstone of the global economy. This resilience underscores the transformative power of technology and innovation, and it highlights the importance of long-term vision over short-term speculation in investing.

The Lasting Impact on Investor Behavior

The final revelation from the dot-com bubble was its lasting impact on investor behavior. After the crash, many investors became more cautious, leading to increased scrutiny of company fundamentals, particularly in the tech sector. The bubble also led to a more cautious regulatory environment, with greater attention paid to financial disclosures and accountability. The experience of the dot-com collapse reshaped the way investors approach emerging markets, helping them balance excitement for new technology with the realities of financial sustainability.

The dot-com bubble was a period of exuberant speculation and harsh financial lessons. These seven shocking revelations illustrate how easy it is for market dynamics to spiral out of control when optimism overrides caution. Investors and policymakers alike were reminded of the importance of fundamentals, skepticism of hype, and careful scrutiny of new technologies. As we continue to navigate ever-evolving markets, the lessons from the dot-com era remain a crucial guide to avoiding similar pitfalls in the future.