Thrilling Peaks and Valleys: Seven Unforgettable Moments of Market Volatility Amidst the Pandemic

The COVID-19 pandemic not only upended daily life but also caused massive upheavals in the global financial markets. Extreme market swings, with unprecedented peaks and crashes, left both investors and economists on edge. The pandemic’s effect on the markets was unlike anything seen before, shaking the global economy to its core. This article looks at seven unforgettable moments of market volatility during the pandemic, breaking down the causes, effects, and lessons learned.

The Initial Shock

In late February 2020, as the seriousness of the pandemic became clear around the world, financial markets experienced their first major shock. Both the Dow Jones Industrial Average (DJIA) and the S&P 500 saw steep declines, marking the fastest drop into a bear market in history. This sharp downturn reflected growing fears that the pandemic was not just a regional problem but a global crisis. Concerns over a looming global recession triggered a massive sell-off, sending markets into a downward spiral.

The Oil Price War

Amid the pandemic, an oil price war between Russia and Saudi Arabia added further instability. In March 2020, oil prices plummeted by about 30%, marking the worst collapse since the Gulf War in 1991. The price war, combined with falling demand due to lockdowns, resulted in a historic crash in oil prices. This added yet another layer of complexity to the volatile market, shaking investor confidence even further.

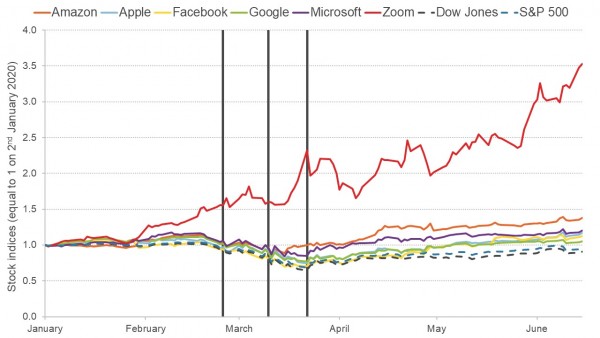

The Tech Stock Boom

While most sectors faced turmoil, the tech industry experienced a remarkable surge. With people working, studying, and seeking entertainment from home due to lockdowns, tech companies like Zoom, Amazon, and Netflix saw a huge rise in their stock prices. This tech boom was a rare bright spot in an otherwise bleak economy, showcasing the resilience and importance of the technology sector in this new, remote-driven world.

The Vaccine Rally

The announcement of successful COVID-19 vaccine trials in November 2020 triggered a major market rally. Stocks soared worldwide as optimism about a return to normalcy spread among investors. This rally highlighted just how sensitive markets were to pandemic-related news and underscored the high level of uncertainty that had defined this volatile period.

The GameStop Saga

In January 2021, the stock market was thrown into chaos by the GameStop saga, where retail investors on Reddit banded together to drive up the price of GameStop stock. This caused major losses for hedge funds that had bet against the company. The event demonstrated the rising influence of retail investors and the disruptive potential of social media in reshaping traditional market dynamics.

The Bond Market Jitters

In February 2021, the bond market saw significant turbulence as yields on 10-year Treasury notes surged. This led to a broad sell-off in the stock market, especially in tech stocks, which tend to be sensitive to rising interest rates. The bond market jitters served as a reminder of how interconnected financial markets are, and how shifts in one asset class can have ripple effects across others.

Lessons Learned

The COVID-19 pandemic has ushered in an era of extreme market volatility, punctuated by unforgettable moments that have reshaped the financial landscape. From the initial market shock to the oil price war, the tech surge, the vaccine rally, the GameStop saga, and the bond market jitters, each event offers valuable lessons for investors and economists. As we continue to face uncertainty, these moments serve as powerful reminders of the market’s resilience and its ability to adjust to even the most unprecedented challenges.