7 Inspiring Tales of Escape: How Debt Consolidation Defeated Massive Financial Quagmires

Financial quagmires can be a daunting experience, often leading to a cycle of debt that seems impossible to break free from. However, there are many inspiring tales of individuals who have managed to transcend these massive financial challenges through debt consolidation. This introductory section sets the stage for seven such stories of triumph over financial adversity, showcasing how debt consolidation can be a lifeline for those drowning in multiple debts. Each story is unique, yet they all share common threads of resilience, strategy, and hope. Through these narratives, we aim to provide practical insights and inspiration to those currently facing financial hardship.

1. The Debt Spiral and the Concept of Debt Consolidation

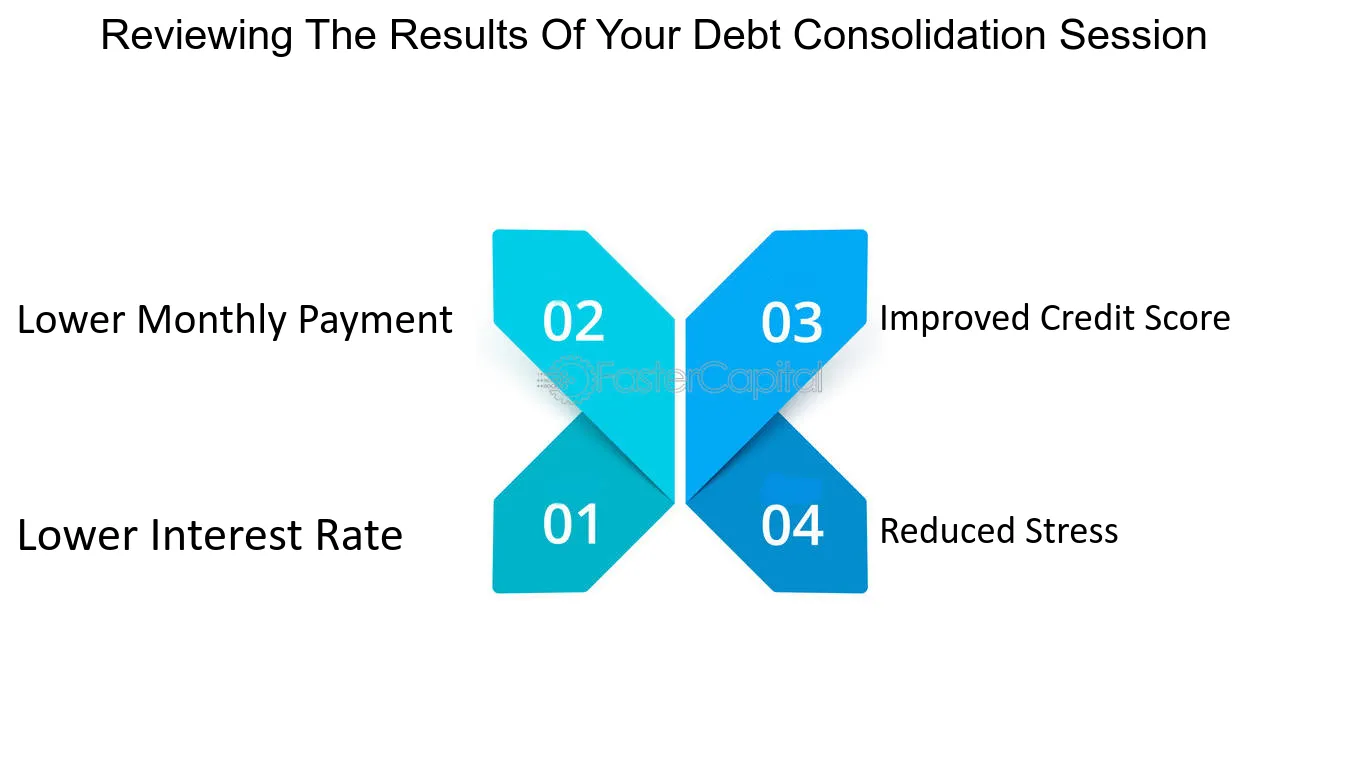

Before diving into the success stories, it's crucial to understand the concept of debt consolidation. It's a strategy that combines multiple debts into a single loan, often with a lower interest rate and a longer repayment period. This section will delve into the intricacies of debt consolidation, explaining how it can be a viable solution for those stuck in a debt spiral. It will also discuss the potential pitfalls and the importance of financial discipline to ensure the success of this strategy.

2. From Bankruptcy to Financial Freedom: John's Story

John was on the brink of bankruptcy, with multiple high-interest credit card debts. This section will narrate how John used debt consolidation to regain control of his finances. It will discuss the steps he took, the challenges he faced, and how he maintained financial discipline to ensure he didn't fall back into the debt trap. John's story is a testament to the power of debt consolidation and the importance of financial literacy.

3. Overcoming Medical Debt: Sarah's Journey

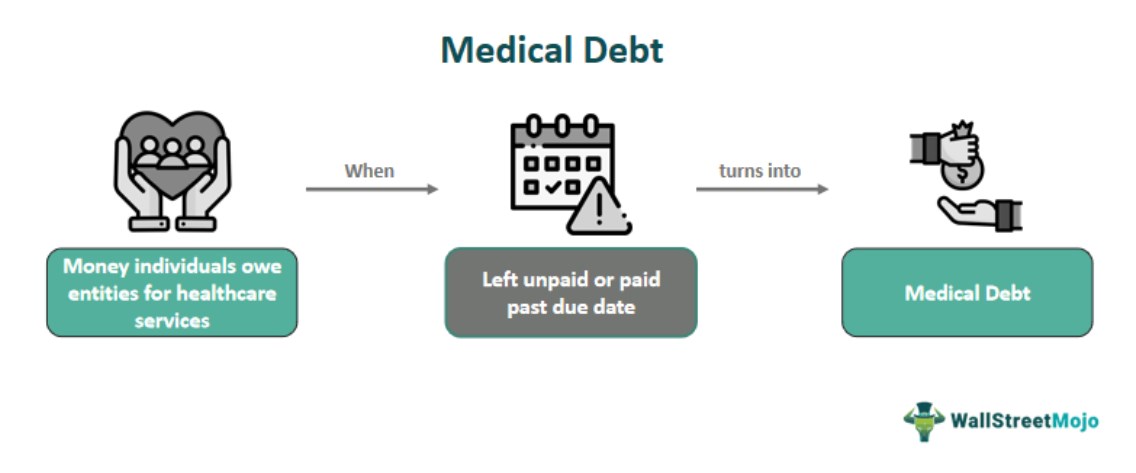

Medical emergencies can lead to significant debt, as was the case with Sarah. This section will detail Sarah's journey, from the shock of a sudden medical emergency to the burden of medical debt, and how debt consolidation helped her regain financial stability. Sarah's story emphasizes the importance of having a financial safety net and how debt consolidation can be a lifeline in times of crisis.

4. Escaping the Student Loan Debt Trap: Mike's Triumph

Student loan debt is a common financial hurdle for many young adults. Mike was one such individual, struggling to keep up with multiple student loan payments. This section will narrate how Mike used debt consolidation to manage his student loans effectively, providing a roadmap for others in similar situations. Mike's story is a beacon of hope for those burdened by student loan debt.

5. Navigating Divorce and Debt: Linda's Victory

Divorce can often lead to financial strain, as Linda discovered. This section will detail Linda's journey, from the financial turmoil following her divorce to her successful use of debt consolidation to regain financial stability. Linda's story highlights the importance of financial planning during life transitions and how debt consolidation can help navigate these challenging times.

6. Breaking Free from the Debt Cycle: Tom's Transformation

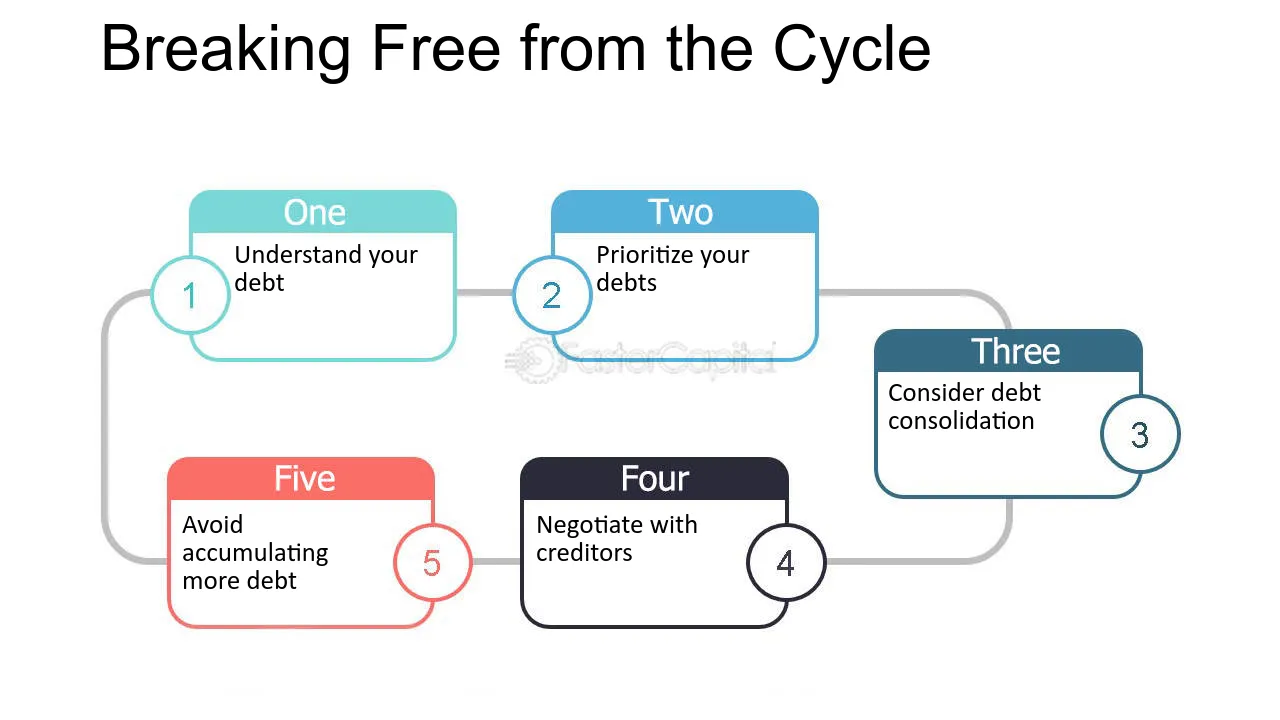

Tom was stuck in a cycle of payday loans, with high-interest rates and short repayment periods. This section will narrate how Tom used debt consolidation to break free from this cycle, providing valuable insights into managing high-interest debt. Tom's transformation is a powerful example of how debt consolidation can provide a pathway out of the debt cycle.

7. Lessons Learned from Debt Consolidation Success Stories

The concluding section will summarize the key takeaways from these seven inspiring tales of transcending financial quagmires through debt consolidation. It will emphasize the importance of financial discipline, literacy, and planning, and how debt consolidation, when used correctly, can be a powerful tool in achieving financial freedom. These stories serve as a reminder that no matter how dire the financial situation, there is always a way out.