Seven Breathtaking Twists in the Tumultuous Tale of the Rogue Trader Who Shattered Barings Bank

Barings Bank, established in 1762, was the oldest merchant bank in London until its unexpected collapse in 1995. The bank didn't fall because of a financial crisis or recession, but because of the actions of one man—Nick Leeson, a rogue trader. This section gives an overview of Barings Bank and introduces Leeson, setting up the story behind one of the most shocking failures in banking history.

Barings Bank had weathered two World Wars, many recessions, and even the Great Depression. But it was unprepared for the chaos Leeson would cause. Leeson, a young man from a working-class family, seemed like an unlikely person to bring down such a prestigious bank. Yet, his reckless trades and deception led to losses of over £827 million, which resulted in the bank going bankrupt.

Nick Leeson - The Unlikely Rogue

Nick Leeson was an unexpected figure to become a rogue trader. Raised in a working-class family in Watford, England, he didn't fit the mold of a typical high-powered banker. This section looks into Leeson's background and early career, showing how he first entered the banking world and eventually landed at Barings Bank.

Leeson started his banking career at Coutts, then moved to Morgan Stanley for a while. He joined Barings Bank in 1989 and quickly climbed the ladder thanks to his bold and profitable trades. However, his success was built on risky decisions and deception, which would ultimately lead to his downfall.

The Double Life of a Rogue Trader

Nick Leeson lived a double life at Barings Bank. On the surface, he was seen as a successful trader, generating massive profits for the bank. But behind the scenes, he was concealing huge losses through a secret account known as 88888. This section reveals how Leeson managed to deceive his supervisors and auditors for an extended period.

Leeson’s secret life began when his risky trades started accumulating significant losses. To cover them up, he used account 88888, which was initially created to handle clerical errors. Over time, Leeson funneled his growing losses into this account without raising suspicion. His deception was so thorough that even the bank’s auditors overlooked the hidden losses for several years.

The Turning Point - The 1995 Kobe Earthquake

The 1995 Kobe earthquake marked the turning point in Leeson’s story. His risky investments in the Nikkei, Japan’s stock market index, backfired after the earthquake caused the market to crash. This section explains how the disaster exposed Leeson’s risky trades and the drastic measures he took to cover up his growing losses.

Following the earthquake, the Nikkei plummeted, leading to losses of over £500 million in just one day for Leeson. In a desperate attempt to recover the losses, he made even riskier trades. His actions mirrored that of a gambler chasing losses, hoping for a massive win but digging himself deeper into trouble.

The Unraveling of the Deceit

Leeson’s elaborate cover-up began to unravel when Barings Bank requested a cash injection of £100 million to meet its margin calls. This section details how the request led to the discovery of Leeson’s secret account and the staggering losses it held.

The request for funds prompted a deeper investigation into Leeson’s trading activities. Auditors finally uncovered the existence of the secret 88888 account and the enormous hidden losses. The discovery sent shockwaves through Barings Bank and marked the beginning of its downfall.

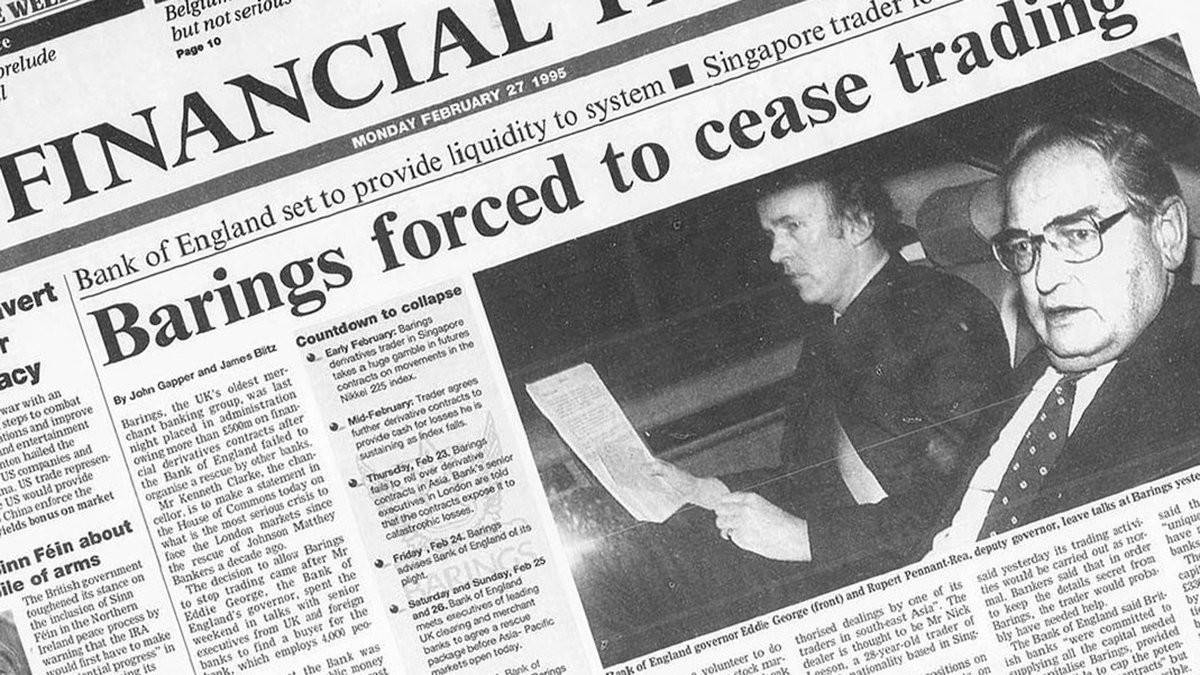

The Collapse of Barings Bank

The exposure of Leeson’s losses ultimately led to the collapse of Barings Bank. Unable to cover the losses, the bank was declared insolvent. This section explores the wide-reaching consequences of the bank’s collapse for its employees, shareholders, and the financial industry at large.

The fall of Barings Bank stunned the financial world. Employees lost their jobs, shareholders were wiped out, and clients scrambled to recover their funds. The collapse also prompted tighter regulations in the banking sector, with greater emphasis on risk management and oversight to prevent similar disasters in the future.

The Aftermath for Nick Leeson

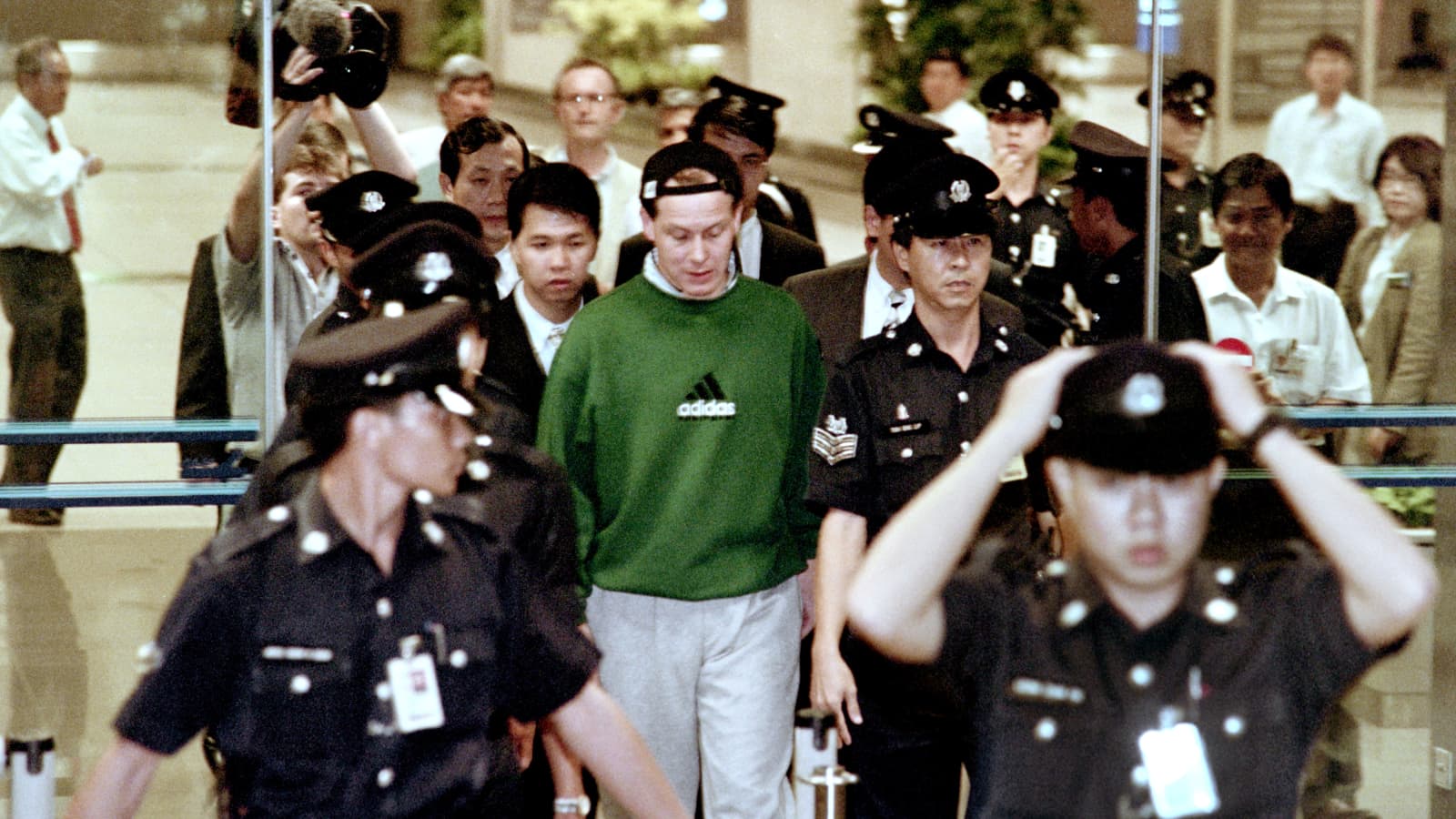

After the collapse of Barings Bank, Leeson fled to Malaysia but was eventually captured and extradited to Singapore. This section follows Leeson’s trial, his time in prison, and his life after release.

Leeson was sentenced to six and a half years in prison for fraud. He was released in 1999 for good behavior, and during his imprisonment, he was diagnosed with colon cancer. Since his release, Leeson has transitioned to a quieter life, working as a motivational speaker and author, sharing his experiences and the lessons he learned from his downfall.

Lessons from the Tumultuous Tale

The saga of Nick Leeson and Barings Bank serves as a stark warning about the dangers of unchecked risk-taking and deceit. This section reflects on the important lessons that can be drawn from this infamous story.

The collapse of Barings Bank was a wake-up call for the financial industry, underscoring the importance of rigorous risk management and internal controls. It demonstrated the catastrophic consequences of unchecked risk and highlighted the need for transparency in financial practices. Though devastating, the story of Nick Leeson and Barings Bank offers valuable lessons for future generations in the banking world.