Seven Critical Insights into Fannie Mae and Freddie Mac's Impact on the Housing Crisis

The 2008 financial crisis was a turbulent time in American history, with its effects rippling through the global economy. At the heart of this economic disaster were two government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. Their involvement in the housing market, and their contribution to the crisis, has been widely discussed. This slideshow will explore seven key insights into Fannie Mae and Freddie Mac’s role in the housing crisis, shedding light on their actions, the impact of their involvement, and the lessons learned.

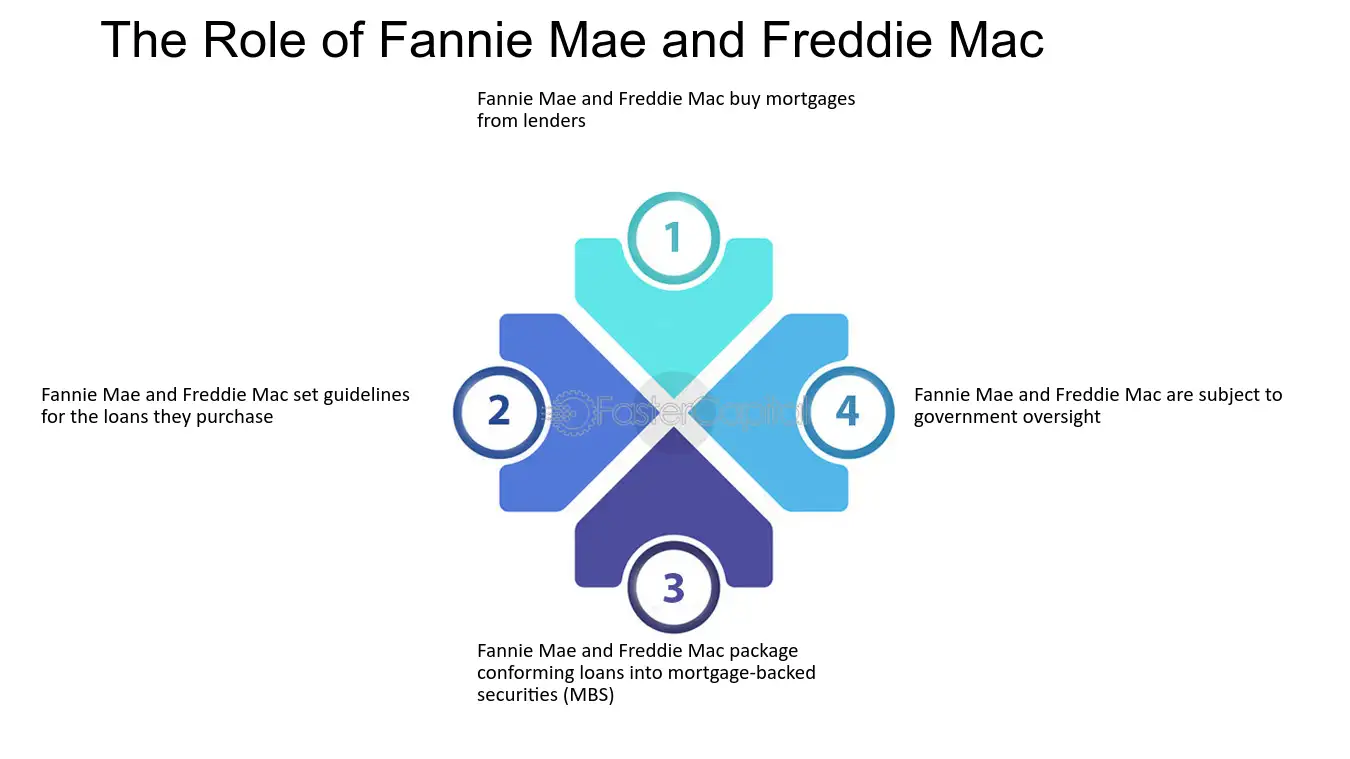

The Role of Fannie Mae and Freddie Mac in the Housing Market

Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) were created to ensure a consistent flow of mortgage funding into the housing market. They do this by purchasing mortgages from lenders, bundling them into securities, and selling them to investors, which provides liquidity for more loans. However, their significant engagement with subprime mortgages—loans given to borrowers with weak credit—became a major factor in the housing crisis.

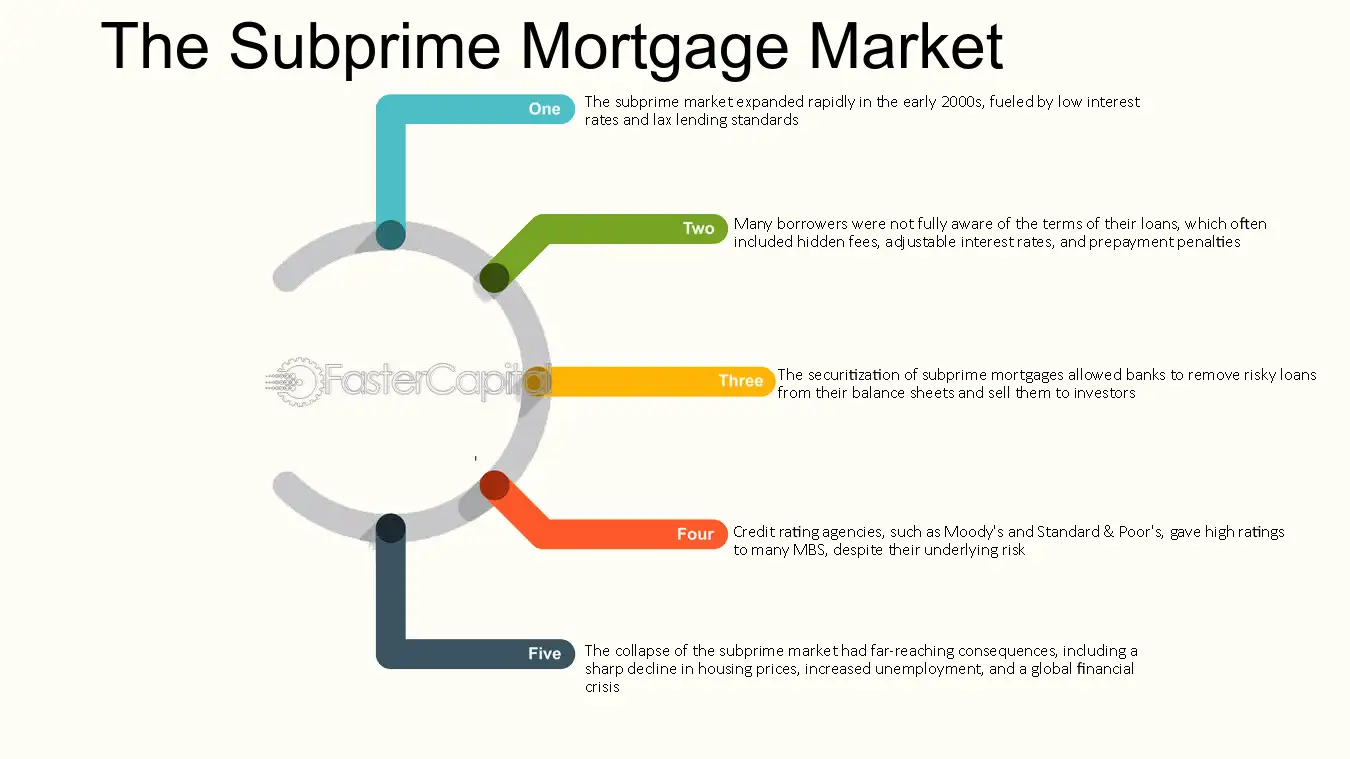

The Boom in Subprime Mortgages

In the early 2000s, Fannie Mae and Freddie Mac ramped up their purchase of riskier subprime mortgages. The explosion of subprime lending was driven by several factors, such as low interest rates, looser lending standards, and the assumption that home prices would keep rising. This section looks at how the involvement of Fannie and Freddie in the subprime mortgage market contributed to inflating the housing bubble.

The Housing Bubble and the Role of Fannie and Freddie

As Fannie Mae and Freddie Mac continued to buy risky mortgages, they inadvertently fueled the housing bubble. Their actions encouraged lenders to engage in reckless lending practices and made investors overly confident in the safety of mortgage-backed securities. When the housing bubble finally burst, the result was a wave of foreclosures, a sharp decline in home prices, and a severe recession.

The Federal Government's Response to the Crisis

The federal government responded to the unfolding crisis quickly and on a large scale. In September 2008, the Federal Housing Finance Agency (FHFA) placed Fannie Mae and Freddie Mac into conservatorship, effectively taking over the GSEs to prevent their failure. This section examines how the government’s intervention stabilized Fannie and Freddie and what this meant for the broader housing market.

The Aftermath and Lessons Learned

The fallout from the housing crisis had long-lasting effects, including millions of foreclosures and the deepest economic downturn since the Great Depression. This section focuses on the critical lessons learned from the crisis, including the need for stricter regulation of the GSEs and the importance of maintaining prudent lending practices to avoid similar catastrophes in the future.

The Future of Fannie Mae and Freddie Mac

Following the crisis, debates about the future of Fannie Mae and Freddie Mac have persisted. Some believe the GSEs should be dissolved, while others argue for significant reforms to minimize risks. This section discusses the various proposals for their future and the potential implications for the housing market if these changes are implemented.

The 2008 housing crisis showed the devastating impact of reckless lending and exposed vulnerabilities in the housing market. Fannie Mae and Freddie Mac, through their integral role in mortgage financing, were at the center of the crisis. As we reflect on their role, it is crucial to carry forward the lessons learned, ensuring that we prevent such a disaster from happening again. This slideshow has offered key insights into how Fannie Mae and Freddie Mac contributed to the crisis, the consequences of their actions, and the ongoing efforts to reform the housing market.