Seven Patterned Alarms that Whispered Warnings of Financial Crashes Before the World Took Notice

Financial crashes, while devastating, are a recurring part of the global economy. Yet, they often take us by surprise, leaving chaos in their wake. Despite the seeming unpredictability, there have been certain patterns and early warnings that, if understood, could have lessened the blow. These indicators, frequently ignored or misunderstood, have historically pointed to looming financial disasters. In this article, we explore seven such warning signs that signaled financial crashes, looking at their significance and the lessons they offer.

The Stock Market Bubble of the 1920s

During the Roaring Twenties, the U.S. enjoyed a booming stock market that seemed unstoppable. But beneath this prosperity were clear warning signs. Price-to-earnings ratios were soaring to unsustainable heights, and more people were borrowing money to invest, driving up margin debt. These were the early signals of an impending collapse that culminated in the stock market crash of 1929 and the onset of the Great Depression. Had these alarms been heeded, the outcome might have been different.

The Japanese Asset Price Bubble of the 1980s

Japan’s 1980s economy is a textbook example of an asset bubble. The clues were obvious: land and stock prices skyrocketed, driven by speculative investment and easy credit. The Bank of Japan eventually tried to rein in the bubble by tightening monetary policy, but it was too late. The bubble burst, and Japan entered a long period of economic stagnation known as the "Lost Decade." Early action might have softened the blow.

The Asian Financial Crisis of 1997

The Asian Financial Crisis of 1997 was caused by several factors, including rising foreign debt-to-GDP ratios, overinvestment in real estate, and weak financial systems. These warning signs were there, but they were overlooked. The crisis began in Thailand when the baht collapsed and spread rapidly across other Asian economies, leading to widespread financial chaos. Recognizing these signals earlier could have changed the trajectory of the region's economies.

The Dot-Com Bubble of the Late 1990s

In the late 1990s, the dot-com boom led to a speculative frenzy, with investors pouring money into internet-based companies. The warning signs were the vast overvaluation of these companies, many of which had no real profits to speak of. When reality hit and investors recognized this, the bubble burst in 2000, leading to a significant market crash. The signs were clear, but optimism blinded many to the risks.

The US Housing Bubble of the Mid-2000s

The U.S. housing bubble of the mid-2000s saw home prices rise to unsustainable levels. Early warnings included risky lending practices, like subprime mortgages and adjustable-rate loans, which made homeownership accessible to people who couldn't afford it. When the bubble burst in 2007, it triggered the global financial crisis of 2008. Paying attention to these alarms could have reduced the catastrophic impact.

The European Sovereign Debt Crisis of 2010

The European Sovereign Debt Crisis was rooted in high government debt and economic stagnation in several European nations. Rising bond yields were the early signals, showing a loss of confidence in these countries’ ability to pay off their debts. The crisis led to widespread austerity measures and social unrest, particularly in countries like Greece, Spain, and Italy. The signals were there, but action came too late to prevent deep economic pain.

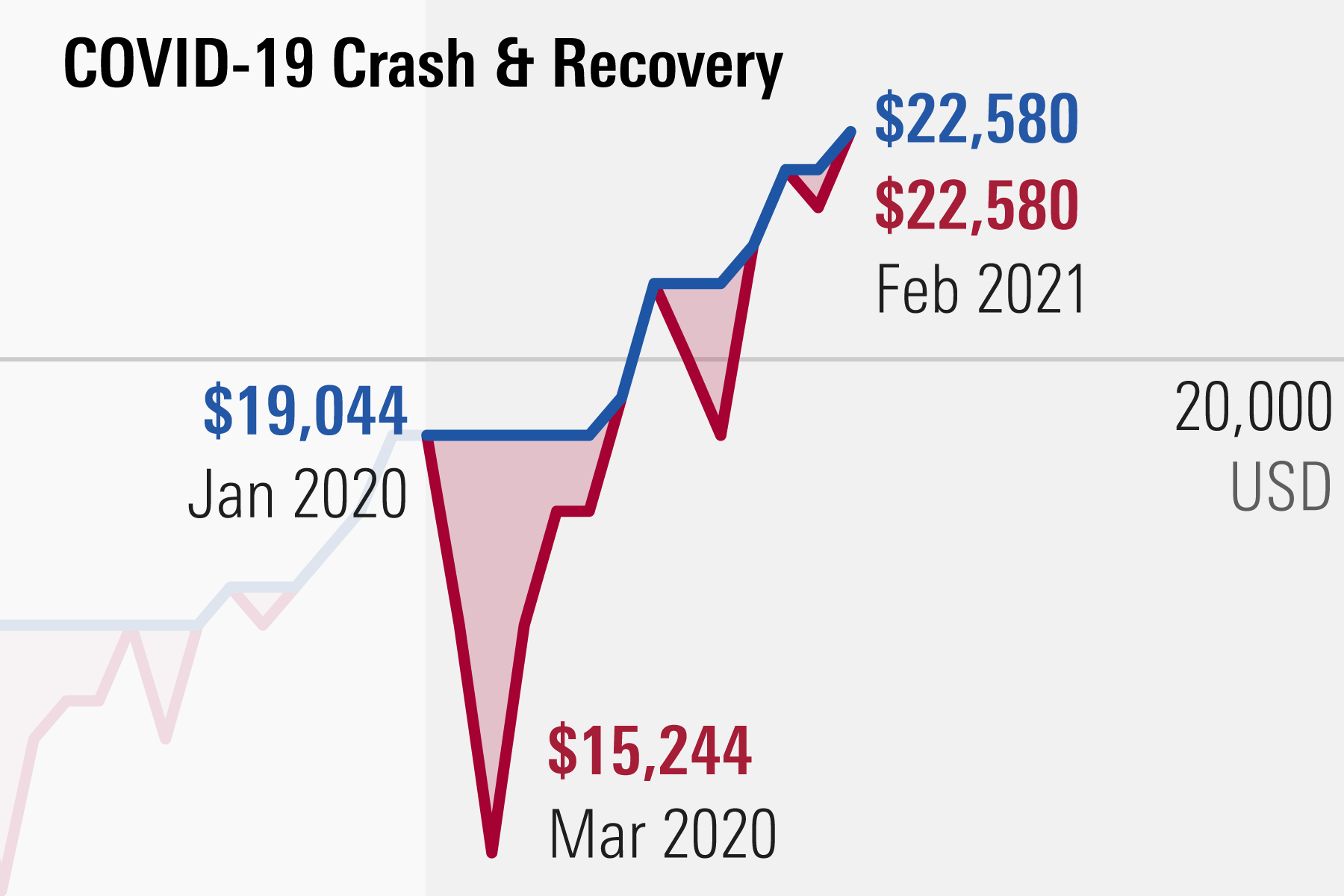

The COVID-19 Market Crash of 2020

While the COVID-19 pandemic was an unexpected trigger, certain economic imbalances had already set the stage for a market crash. Warning signs included overvalued stock markets, record levels of corporate debt, and growing income inequality. The pandemic merely accelerated a downturn that many economists had been warning about for years. Although the crash itself was fast, the recovery has been supported by massive fiscal and monetary responses.

These seven cases show that financial crashes don’t occur without warning. They are often preceded by clear signs, which are either ignored or downplayed. Understanding these early indicators and taking them seriously could help mitigate the impact of future crashes. However, this requires a shift from a reactive to a proactive approach, with a readiness to heed these economic whispers before they grow into full-blown crises.