Seven crestfallen tales from Bernie Madoff's Ponzi Scheme labyrinth and the heavy price of trust

The world of finance has seen its fair share of villains, but few have left such a profound impact as Bernard "Bernie" Madoff. The former chairman of NASDAQ, Madoff orchestrated the largest Ponzi scheme in history, defrauding thousands of investors out of billions of dollars. His crime was not just financial but deeply personal, betraying the trust of friends, family, and charities who had invested with him. This article will delve into seven heart-wrenching stories from Madoff's Ponzi scheme labyrinth, each demonstrating the heavy price of trust.

The Rise of Bernie Madoff

Bernie Madoff wasn’t always a symbol of financial ruin. For decades, he was seen as a highly respected figure on Wall Street, with his investment firm, Bernard L. Madoff Investment Securities, known for providing consistent returns. Madoff had built a reputation as a financial wizard, and people eagerly sought to become his clients, convinced that his expertise would ensure solid and stable investments. However, the success he projected was a facade, hiding the largest Ponzi scheme in history, where funds from new investors were used to pay off earlier ones. For years, Madoff maintained this illusion of wealth and stability, deceiving some of the world’s most sophisticated investors.

The Fall of the House of Madoff

The financial crisis of 2008 marked the beginning of Madoff's downfall. When the economy faltered and investors began withdrawing their funds en masse, Madoff’s scheme collapsed. Unable to fulfill withdrawal requests, Madoff eventually confessed to his sons in December 2008, who then reported him to authorities. His arrest sent shockwaves through the financial world, and he was sentenced to 150 years in prison. The damage extended beyond the financial losses—Madoff's family was left shattered. His wife, Ruth, and his two sons had to face the public disgrace, grappling with the overwhelming fallout from the scandal.

The Victims: Individual Investors

Madoff’s victims ranged from high-net-worth individuals to ordinary people who had trusted him with their entire savings. These included retirees, teachers, and small business owners who believed Madoff’s reputation for safe, consistent returns. Many were financially ruined when the Ponzi scheme collapsed, losing everything they had worked for. The betrayal was deeply personal for these investors, some of whom had known Madoff for years. Their heartbreaking stories illustrate the profound emotional and financial devastation caused by such fraud.

The Victims: Charitable Organizations

Some of the hardest-hit victims of Madoff's deceit were charitable organizations. Institutions like the Elie Wiesel Foundation for Humanity and the JEHT Foundation saw millions vanish overnight, forcing them to shut down operations and abandon their charitable work. These foundations had placed their trust in Madoff, and the loss was not only financial—it also affected the countless individuals and communities that relied on their contributions and services. The collapse of these charities highlighted the far-reaching consequences of Madoff’s fraud, harming not just the wealthy but also the vulnerable populations these organizations served.

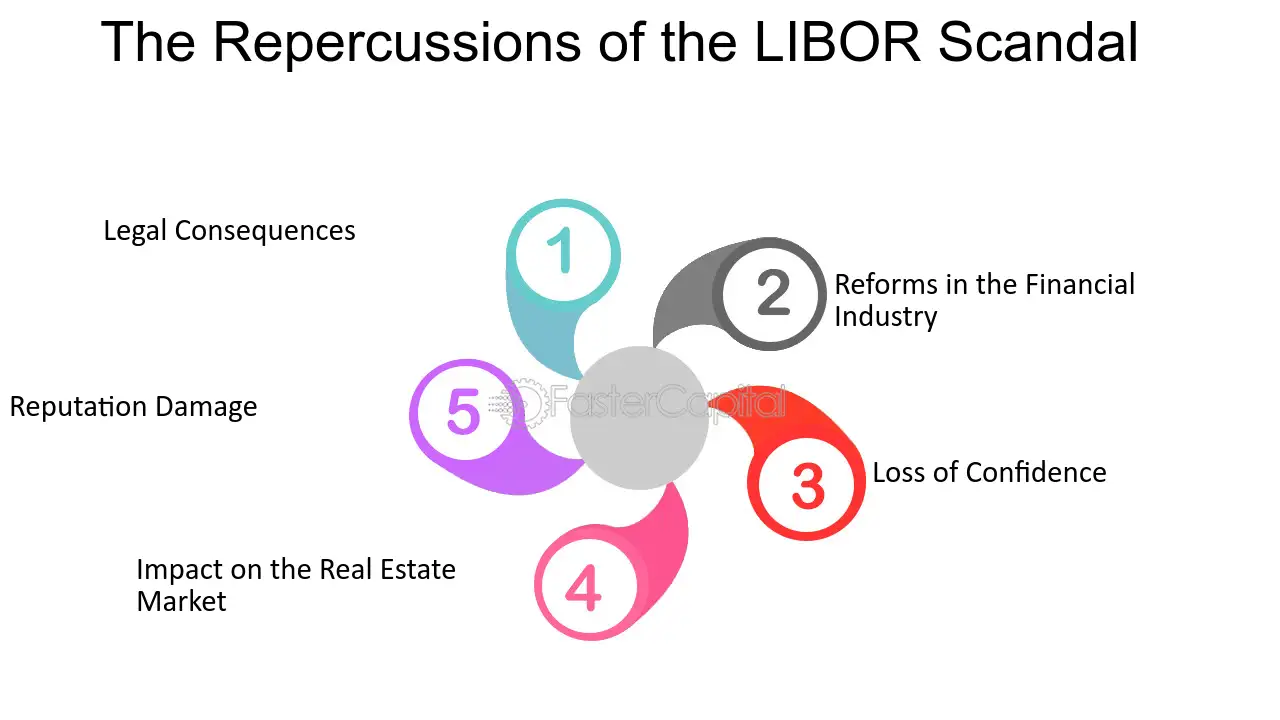

The Aftermath: Financial and Legal Repercussions

In the wake of Madoff's arrest, the financial sector faced harsh scrutiny. Regulatory bodies such as the Securities and Exchange Commission (SEC) were roundly criticized for failing to uncover the scheme, despite multiple warnings and red flags. This led to significant reforms in financial oversight and greater accountability for regulatory agencies. Legal battles also ensued, with Madoff’s bankruptcy trustee, Irving Picard, leading efforts to recover funds for victims. To date, more than $14 billion has been recovered, but many victims are still waiting for full restitution, underscoring the slow and painful process of compensation.

The Price of Trust: Lessons from the Madoff Scandal

The Bernie Madoff scandal serves as a grim reminder of the dangers of placing blind trust in financial advisors. It underscores the critical importance of due diligence and transparency in financial dealings. Investors today are more cautious, and financial institutions are under heightened scrutiny as a result of Madoff’s actions. The emotional and financial toll on Madoff’s victims, however, remains a painful reminder of the heavy price of misplaced trust. While some victims have received partial compensation, the emotional scars left by the betrayal are deep and lasting.

The Legacy of the Madoff Scandal

The legacy of Bernie Madoff’s Ponzi scheme will forever serve as a cautionary tale of greed, deceit, and betrayal in the financial world. The scandal not only exposed serious flaws in the financial regulatory system but also highlighted the importance of vigilance, accountability, and ethical behavior in financial management. As future investors reflect on the devastation caused by Madoff’s fraudulent actions, his story will stand as a stark reminder of the potential for corruption in even the most trusted financial institutions. The hope is that the lessons learned from this scandal will inspire stricter regulations, greater transparency, and more thorough oversight to prevent a similar catastrophe from ever happening again.