Unmasking Fool's Gold: Seven Astounding Aspects of the Bre-X Mining Scandal

The world of gold mining has seen its fair share of scandals, but few have been as impactful or as infamous as the Bre-X scandal of the 1990s. This Canadian company, once considered a beacon of success in the gold mining industry, turned out to be nothing more than a mirage, a case of fool's gold that fooled investors and the world at large. This section sets the stage for a deep dive into the scandal, exploring its origins, the players involved, and the aftermath that reverberates through the industry today.

Bre-X Minerals Ltd., a member of the Bre-X group of companies, was a small mining company based in Calgary, Alberta. In 1993, it became a major player in the gold mining industry when it reported significant amounts of gold deposits in Busang, Indonesia. However, by 1997, it was revealed that the gold samples had been tampered with, and the supposed massive gold deposit was a hoax. This revelation led to one of Canadian history's biggest stock market scandals.

The Discovery

The story of Bre-X begins with the discovery of gold. In 1993, the company's geologist, Michael de Guzman, claimed to have found an estimated 70 million ounces of gold in the Indonesian jungle. This section delves into the initial discovery and the excitement it generated.

The find was hailed as the richest gold mine ever. Investors flocked to Bre-X, sending its stock prices soaring. The company's market capitalization quickly rose to CAD $6 billion. The promise of such vast wealth led to a gold rush, with investors from around the globe wanting a piece of the action.

However, as we now know, this gold discovery was nothing more than a well-orchestrated sham. The supposed gold samples were, in fact, salted with gold dust, creating the illusion of a rich gold deposit.

The Players

Key players in the Bre-X scandal included David Walsh, the founder of Bre-X, and geologist Michael de Guzman. This section explores their roles in the scandal and their ultimate fates.

David Walsh, a stockbroker turned mining entrepreneur, founded Bre-X in 1989. He was the driving force behind the company, leading it to its supposed gold discovery. However, when the scandal broke, Walsh denied any knowledge of the fraud, claiming he was as surprised as anyone.

Michael de Guzman was the mastermind behind the gold salting operation. He committed suicide in 1997, just days before the fraud was exposed, jumping from a helicopter in the Indonesian jungle.

The Fraud

The fraud at the heart of the Bre-X scandal was a classic case of salting, a practice where samples are tampered with to make a site appear richer than it is. This section delves into the mechanics of the fraud and how it was carried out.

De Guzman and his team crushed core samples from the site and mixed them with gold dust purchased from local jewelers. This created the illusion of a rich gold deposit, fooling investors and regulators.

The fraud was only revealed when an independent firm was brought in to verify the results. When they failed to find any significant amounts of gold, the truth began to unravel.

The Fallout

The fallout from the Bre-X scandal was swift and severe. This section explores the aftermath of the scandal, from the collapse of Bre-X's stock to the impact on its investors.

When the fraud was revealed, Bre-X's stock plummeted, wiping out billions of dollars in market value. Investors were left with worthless shares, and many lost their life savings.

The scandal also had a profound impact on the mining industry, leading to stricter regulations and oversight to prevent such frauds from happening in the future.

The Legal Battle

The legal battle that followed the Bre-X scandal was lengthy and complex. This section explores the lawsuits, trials, and settlements that stemmed from the scandal.

Investors launched numerous lawsuits against Bre-X, its executives, and even the Indonesian government. However, most of these lawsuits were unsuccessful, as the courts ruled that the investors had not done their due diligence before investing.

David Walsh died in 1998, before any legal action could be taken against him. His wife, Jeannette, was left to deal with the legal fallout. She eventually settled with investors for $120 million.

The Legacy

The legacy of the Bre-X scandal continues to be felt today. This section explores how the scandal changed the mining industry and impacted investor trust.

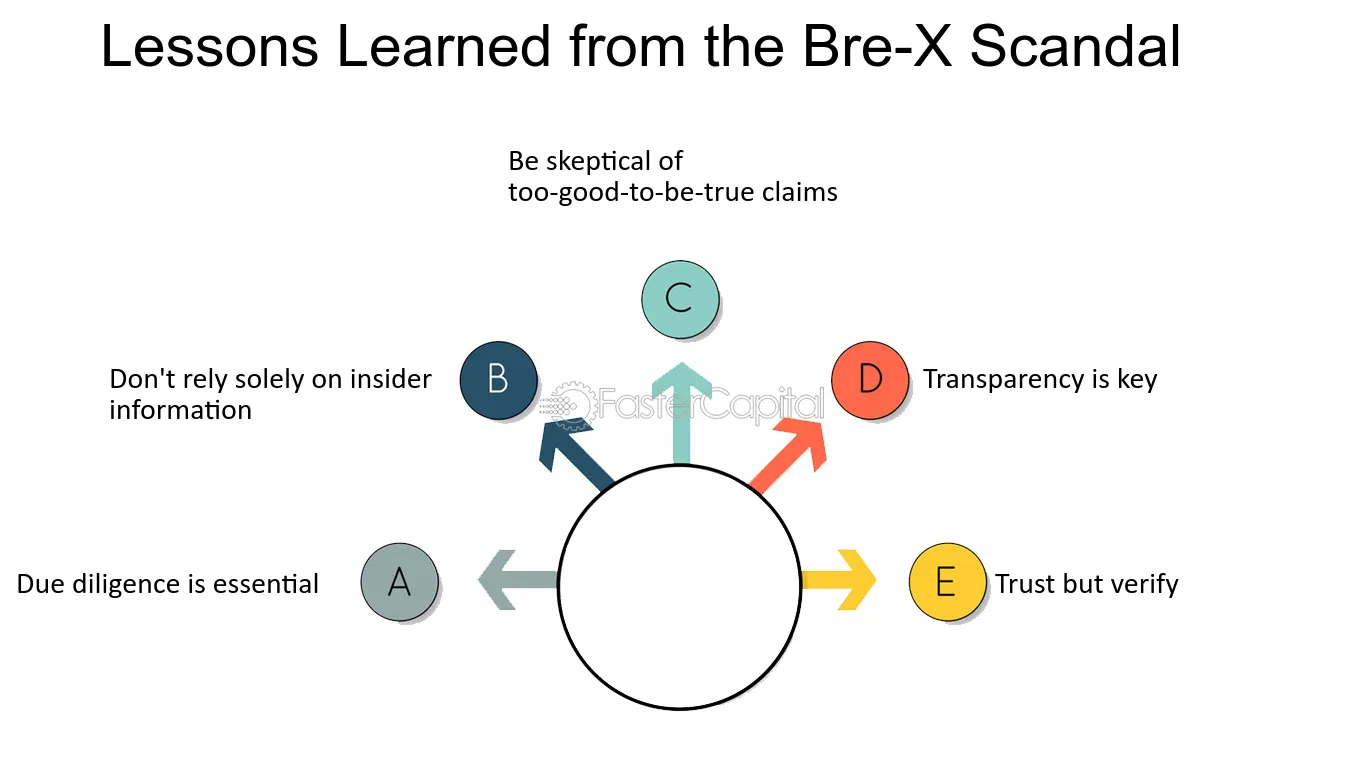

The scandal led to stricter regulations in the mining industry, with more rigorous checks and balances put in place to verify the authenticity of mineral deposits. It also led to a loss of investor trust in the industry, with many wary of similar scams.

Despite these changes, the Bre-X scandal remains a stark reminder of the risks of investing in the mining industry, and the potential for fraud and deception.

The Bre-X scandal was a shocking case of deception and fraud that rocked the mining industry and the world. It serves as a cautionary tale for investors and a reminder of the importance of due diligence.

Despite the scandal's fallout, the allure of gold and the potential for vast wealth continues to attract investors to the mining industry. However, the memory of Bre-X serves as a sobering reminder of the potential risks and the importance of transparency and accountability in the industry.