Sailing Through Market Chaos: The Seven Resilient Trading Techniques in The Post-COVID Era

As the world grapples with the aftermath of COVID-19, financial markets have been thrown into disarray, making traditional trading strategies less reliable. Investors are now searching for new ways to navigate these uncertain waters. This article dives into seven trading techniques that have proven effective in the post-COVID era. These strategies are not just theoretical—they’re practical tools, based on real-world experience, that can help traders adapt, survive, and even thrive in today’s unpredictable market.

Embracing Volatility

The first strategy involves embracing volatility. Before the pandemic, volatility was seen as a risk that needed to be minimized. Now, it’s a reality that traders must lean into. Understanding what drives market fluctuations—such as economic news, geopolitical events, and shifts in market sentiment—can help traders turn volatility into an opportunity.

Adopting this strategy requires a shift in mindset. Instead of fearing unpredictability, traders must accept it as part of the game. A more flexible and adaptive approach to trading can help navigate the chaos with more confidence and less anxiety.

Diversification

The second technique is diversification. In unpredictable markets, putting all your investments into one area can be risky. Diversification spreads the risk across various asset classes, industries, and regions, which can help cushion against significant losses.

In the post-COVID world, diversification isn’t just about different assets; it also includes a variety of trading strategies. For example, blending long-term investments with short-term trades or combining technical analysis with fundamental analysis can create a more balanced and resilient portfolio, better able to weather market storms.

Technological Adaptation

The third strategy is adapting to new technology. The pandemic has sped up the digitization of financial markets. Technologies like AI, machine learning, and blockchain are changing the landscape, offering new tools for analyzing data, making decisions, and managing risk.

Traders who embrace these technological advancements can gain a competitive edge. This isn’t just about mastering new tools; it’s about understanding how these innovations are shifting market dynamics. Being open to tech-driven changes and investing in learning these tools will help traders stay ahead of the curve.

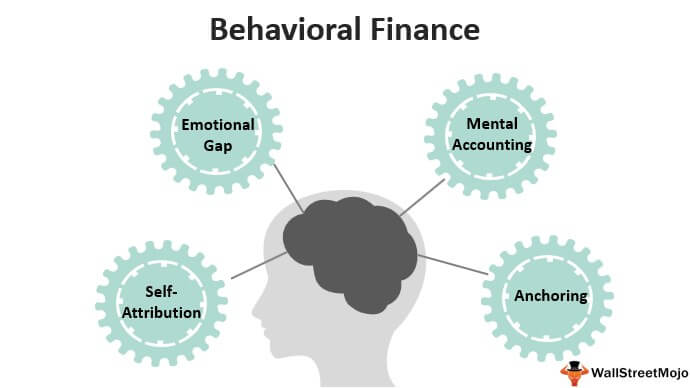

Behavioral Finance

Next is leveraging behavioral finance. This approach looks at how psychological factors influence financial decisions. In the current volatile market, understanding the emotional drivers of market participants can help traders stay grounded and avoid knee-jerk reactions.

This strategy involves recognizing and managing cognitive biases, such as overconfidence or the fear of losing money, and understanding how market sentiment can affect prices. By applying behavioral finance principles, traders can avoid making emotionally charged decisions and focus on rational, well-informed choices.

Risk Management

The fifth technique is implementing strong risk management practices. In turbulent markets, protecting your investments becomes even more crucial. This includes setting clear risk parameters, using tools like stop-losses, and regularly reviewing your risk tolerance based on market conditions.

Risk management also means maintaining a disciplined approach, regularly analyzing your performance and stress-testing your strategies. By being proactive in managing risks, traders can safeguard their capital and stay in the game for the long term.

Continuous Learning

The sixth technique is committing to continuous learning. The post-COVID era is marked by constant change, making it essential for traders to stay informed. Keeping up with market trends, economic indicators, and new trading technologies is key.

Learning doesn’t stop at reading news—it’s about engaging with the trading community through webinars, workshops, and forums. Staying curious, learning from others, and sharing insights can help traders adapt and keep up with rapidly changing markets.

Sailing through Market Chaos

Navigating today’s market requires resilience, adaptability, and the willingness to embrace change. The seven techniques outlined here reflect a new approach to trading—one that is more flexible, diversified, and tech-savvy than before.

While these strategies don’t guarantee success, they provide a solid framework for managing risk and finding opportunities in volatile markets. By incorporating these techniques, traders can chart a path toward a more stable and prosperous trading journey in the post-COVID world.