Turning Pennies into Fortunes: Seven Remarkable Stories of Compound Interest Powering Generational Wealth

Compound interest, often called the eighth wonder of the world, has been a powerful tool in wealth creation for centuries. It is the key that has turned pennies into fortunes, enabling ordinary people to amass extraordinary wealth. This principle is the foundation of many financial success stories, demonstrating how small, consistent investments can grow into significant sums over time. But what is compound interest, and how does it work? Simply put, it's the process where the interest you earn on a sum of money gets added to your principal, creating a snowball effect that can result in exponential growth over time. In this article, we will delve into seven remarkable stories of compound interest powering generational wealth, showcasing the transformative power of this financial principle.

The Magic of Compound Interest

The magic of compound interest lies in its simplicity. It's not about making quick, risky investments but about patience, consistency, and time. The story of Ronald Read, a janitor from Vermont, perfectly illustrates this. Despite never earning more than $12 an hour, Read accumulated a fortune worth $8 million by the time of his death. His secret? Regularly investing small amounts in blue-chip stocks and letting compound interest do its work. His story serves as a testament to the power of compound interest and the wealth it can build, even for those with modest incomes.

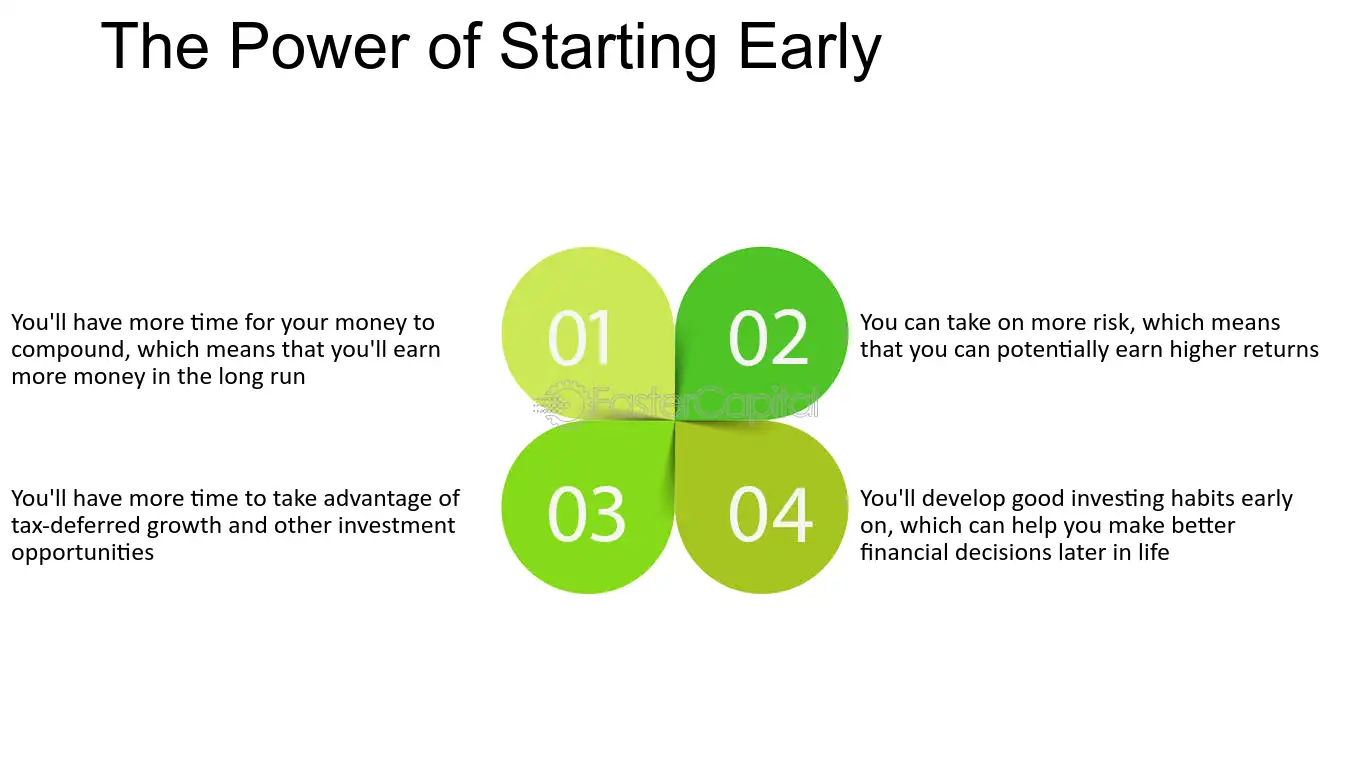

The Power of Starting Early

Compound interest is most effective when given time to work. The story of Grace Groner is a perfect example. In 1935, Groner bought three shares of Abbott Laboratories stock for $180. She held onto these shares for 75 years, reinvesting the dividends. When she died in 2010, her initial investment had grown to $7 million. Groner's story underscores the importance of starting early and the incredible wealth that can be generated with time and patience.

Consistency is Key

Consistency in investing is another critical factor in leveraging compound interest. Take the case of Anne Scheiber, a retired IRS auditor. Scheiber started with a $5,000 investment in 1944 and consistently invested her savings, despite her modest income. By the time of her death in 1995, her portfolio was worth $22 million. Scheiber's story is a powerful example of how consistent investing, coupled with the power of compound interest, can result in substantial wealth.

The Rule of 72

The Rule of 72 is a simple way to understand the power of compound interest. It states that if you divide 72 by the annual rate of return, you'll get the number of years it takes for your investment to double. This rule is beautifully illustrated by the story of the Rothschild family. Starting in the 18th century, they used compound interest to build a financial empire that still exists today. Their story illustrates how understanding and utilizing financial rules can significantly impact wealth accumulation.

The Power of Reinvesting Dividends

Reinvesting dividends is another strategy to maximize the power of compound interest. The story of the Walton family, founders of Walmart, demonstrates this. They reinvested their profits back into the business, allowing it to grow exponentially. Today, the Walton family is one of the wealthiest in the world, thanks to the power of compound interest and the strategy of reinvesting dividends.

Compound Interest and Generational Wealth

Compound interest plays a crucial role in building generational wealth. It allows wealth to grow over generations, as evidenced by the Rockefeller family. Through consistent investing and reinvesting dividends, the Rockefellers have maintained their wealth for over a century, demonstrating how compound interest can power generational wealth.

The power of compound interest is undeniable. It has turned pennies into fortunes, helped build financial empires, and powered generational wealth. The stories of Ronald Read, Grace Groner, Anne Scheiber, the Rothschild family, the Walton family, and the Rockefeller family all serve as testament to this. They show that with patience, consistency, and a deep understanding of how compound interest works, anyone can build substantial wealth. These stories inspire us to start investing early, invest consistently, understand the financial rules, and reinvest dividends. They remind us that the power to build wealth lies not in the size of the investment, but in the power of compound interest.