7 Banking Secrets Your Financial Institution Hopes You Never Figure Out

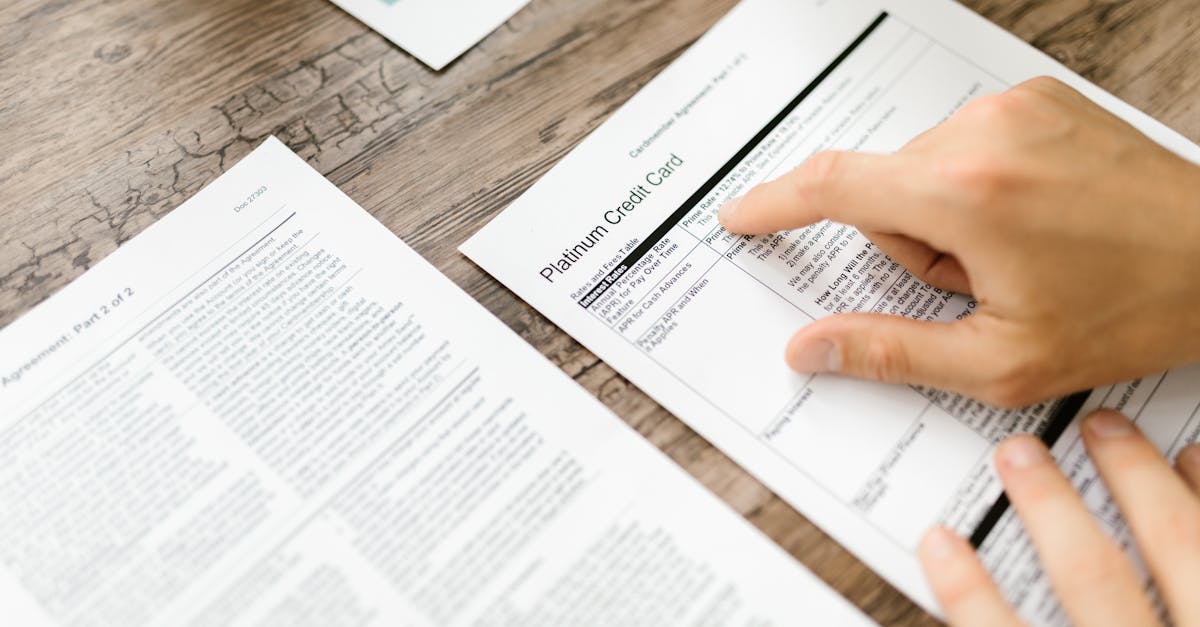

In the complex and often opaque world of financial institutions, banks hold a trove of secrets that they prefer their customers remain blissfully unaware of. These secrets are not just about the fees and interest rates you see on your monthly statements; they delve deeper into practices and policies that can significantly impact your financial well-being. Understanding these secrets can empower you to make more informed decisions, potentially saving you money and helping you navigate the financial landscape with greater confidence. This article will unveil seven of these closely guarded secrets, shedding light on the less visible aspects of banking that can affect your financial life.

The Truth About Overdraft Fees

One of the most lucrative secrets banks keep under wraps is the true nature of overdraft fees. These fees are often presented as a service to help customers avoid the embarrassment of declined transactions. However, what banks don't emphasize is how these fees can quickly accumulate, turning a small miscalculation into a significant financial burden. Many banks reorder transactions to maximize these fees, processing larger debits before smaller ones to increase the likelihood of an overdraft. By understanding the mechanics behind these fees, customers can take proactive steps to manage their accounts more effectively and avoid costly penalties.