Diving into the Profits: Seven Banks that Turned the Tables with Libor Rate Manipulation

The London Interbank Offered Rate (Libor) is a benchmark interest rate that is used globally to set the price of everything from student loans to derivatives. However, in the late 2000s, a scandal emerged that implicated some of the world's largest banks in a scheme to manipulate this critical rate. This scandal revealed the dark underbelly of the banking industry, exposing a culture of greed and deception that had far-reaching implications for financial markets and the global economy. This article will delve into the details of this scandal, focusing on seven banks that were at the heart of this controversy and how they turned the tables to profit from the manipulation of the Libor rate.

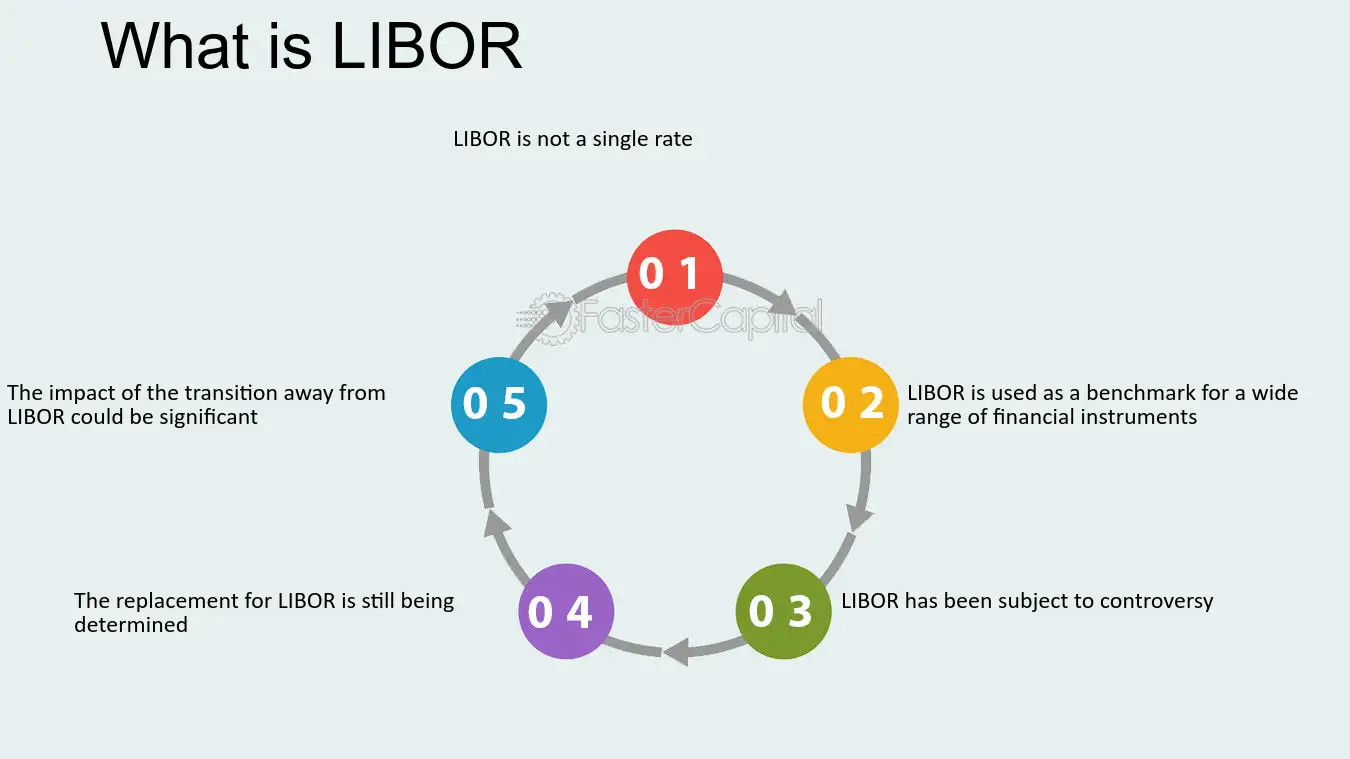

Understanding the Libor Rate

The Libor rate is the average interest rate at which major global banks borrow from one another. It is calculated daily by the British Bankers' Association (BBA) based on submissions from a panel of banks. These banks estimate the rate at which they could borrow unsecured funds from other banks in the London interbank market. However, the scandal revealed that these estimates were not always accurate and were often manipulated to benefit the banks' trading positions.