Legendary Investors and their Genius in Asset Allocation during Turbulent Times

In the world of finance, the ability to navigate through turbulent times is a feat that only a few can master. The economic landscape is often marred by crises, recessions, and market downturns. However, amid these challenging periods, some individuals have not only weathered the storm but have also managed to thrive. These are the legendary investors who have demonstrated an unparalleled genius in asset allocation during turbulent times. This article explores the strategies of 6 such investors, their unique approaches and how they managed to turn crisis into opportunity. Their stories serve as a beacon of hope and a guide for budding investors to navigate through economic uncertainties.

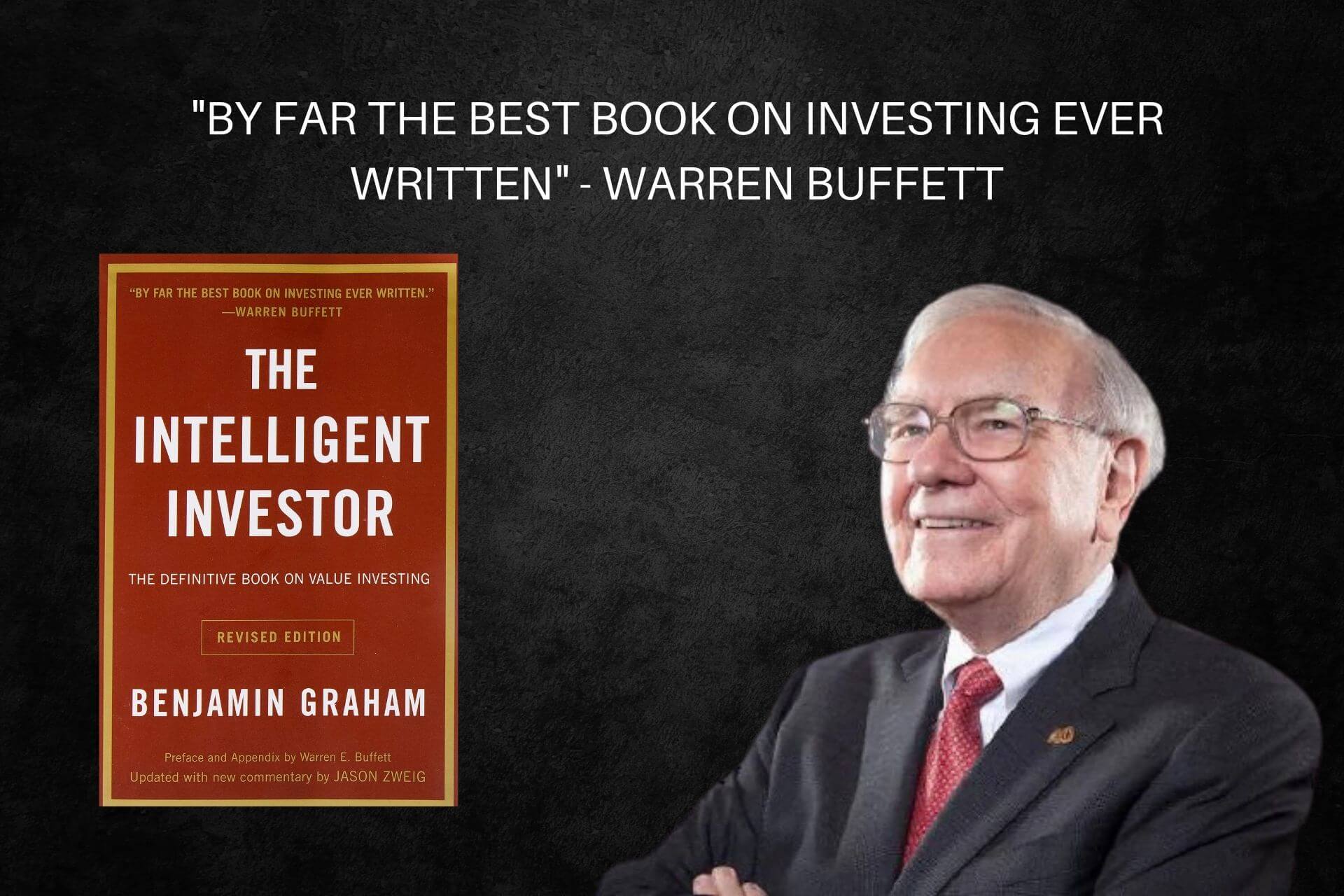

1. Benjamin Graham and the Value Investing

Benjamin Graham, often referred to as the "father of value investing," had a knack for identifying undervalued stocks during market downturns. Graham believed in the philosophy of buying stocks at a price less than their intrinsic value, thereby creating a margin of safety. During the Great Depression, when most investors were panic-selling, Graham saw an opportunity. He meticulously analyzed the financials of companies, focusing on their assets and earnings potential. By doing so, he managed to invest in fundamentally strong companies at bargain prices, which later resulted in substantial returns.