Decoding the Billion Dollar Savings: Top Seven Capital Gains Strategies Adopted by the Wealthiest Individuals

Strategy 2: Tax-Loss Harvesting

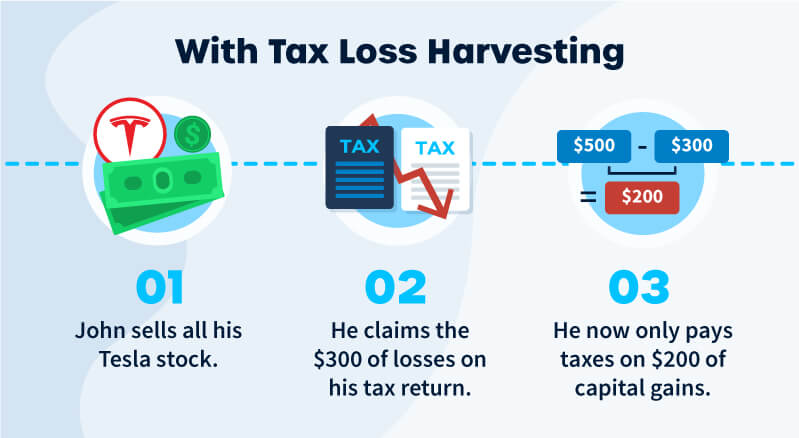

The second strategy is tax-loss harvesting, a method that involves selling securities at a loss to offset a capital gains tax liability. This strategy can effectively lower taxable income, reducing the amount of tax owed. Wealthy investors often use this strategy in conjunction with the buy and hold strategy, selling off underperforming assets to offset the gains from their long-term investments. It's a delicate balancing act that requires careful timing and strategic planning.