Seven Major Regulatory Transformations Triggered by Crypto Failures and Their Ripple Effect on the Global Financial Landscape

The world of finance is in a constant state of evolution, and the advent of cryptocurrencies has accelerated this transformation. The inception of Bitcoin in 2009 was a pivotal moment that triggered a seismic shift in the global financial landscape. However, the journey hasn't been smooth. Various crypto failures have led to significant regulatory transformations that are reshaping the world of finance. This article aims to delve into seven major regulatory changes triggered by crypto failures and their ripple effect on the global financial landscape.

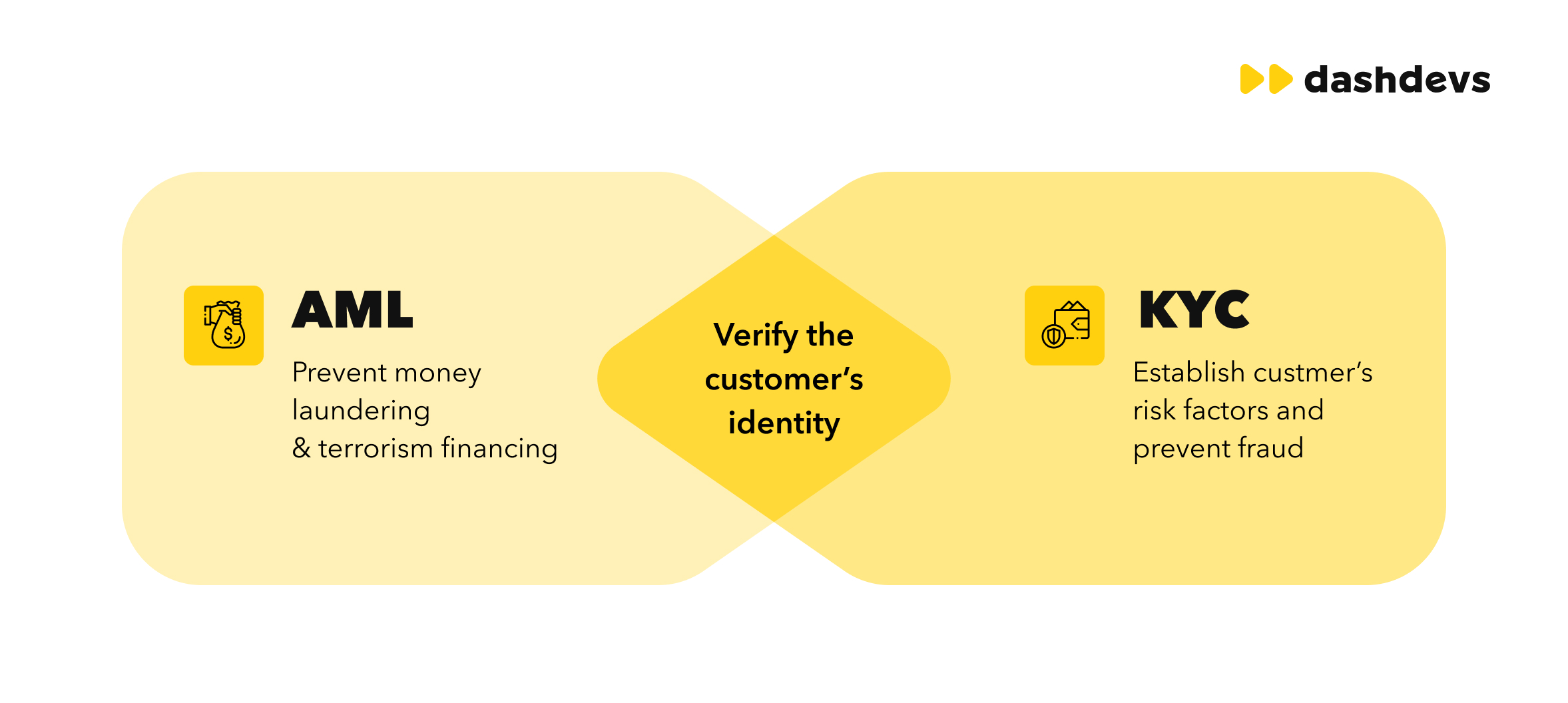

Regulatory Transformation 1: Stricter KYC and AML Regulations

The first transformation is the stricter enforcement of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Following several high-profile cases of money laundering involving cryptocurrencies, regulators worldwide have tightened the noose around KYC and AML. This has led to crypto exchanges and other service providers implementing more rigorous customer identification and verification processes. While these measures have increased operational costs for service providers, they have also enhanced the overall security of the crypto ecosystem, making it less attractive for illicit activities.