6 Critical Insights into Fannie Mae and Freddie Mac's Impact on the Housing Crisis

The 2008 financial crisis was a turbulent time in American history, with its effects rippling through the global economy. At the heart of this economic disaster were two government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. Their involvement in the housing market, and their contribution to the crisis, has been widely discussed. This slideshow will explore seven key insights into Fannie Mae and Freddie Mac’s role in the housing crisis, shedding light on their actions, the impact of their involvement, and the lessons learned.

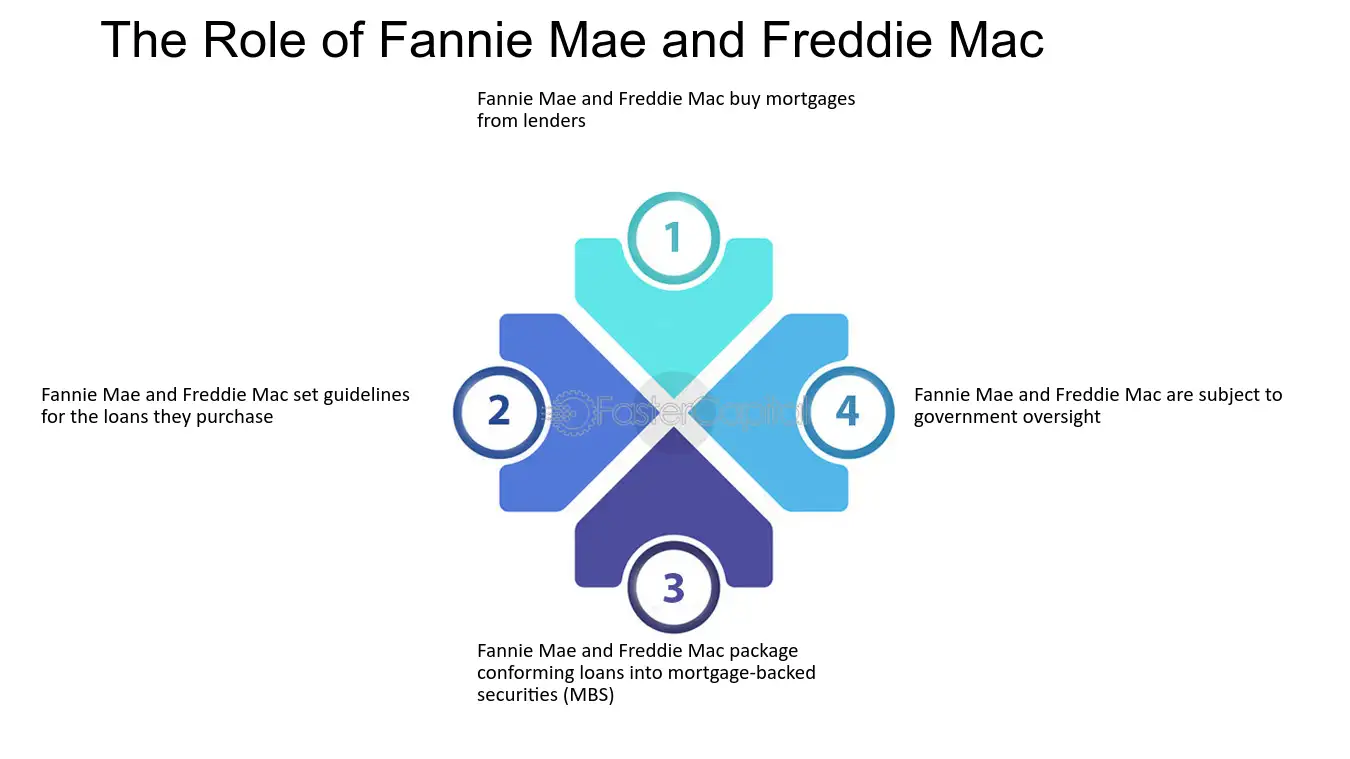

1. The Role of Fannie Mae and Freddie Mac in the Housing Market

Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation) were created to ensure a consistent flow of mortgage funding into the housing market. They do this by purchasing mortgages from lenders, bundling them into securities, and selling them to investors, which provides liquidity for more loans. However, their significant engagement with subprime mortgages—loans given to borrowers with weak credit—became a major factor in the housing crisis.