Decoding the Lehman Brothers Catastrophe: Seven Global Aftershocks That Shook the World

The 2008 financial crisis was a tumultuous period in global history, marked by severe economic instability and a widespread sense of uncertainty. The collapse of Lehman Brothers, a titan in the financial world, was a pivotal event that sent shockwaves across the globe. The Lehman Brothers catastrophe didn't just mark the largest bankruptcy filing in U.S. history, but it also triggered a series of global aftershocks that shook the world. This article aims to decode the Lehman Brothers catastrophe and explore the seven global aftershocks that had far-reaching implications.

The Lehman Brothers, founded in 1850, had grown into a behemoth in the global banking sector by the early 21st century. However, their heavy investment in mortgage-backed securities and involvement in the subprime mortgage crisis led to their downfall. The bankruptcy of Lehman Brothers was a key catalyst that precipitated the 2008 financial crisis, leading to a domino effect that impacted economies worldwide.

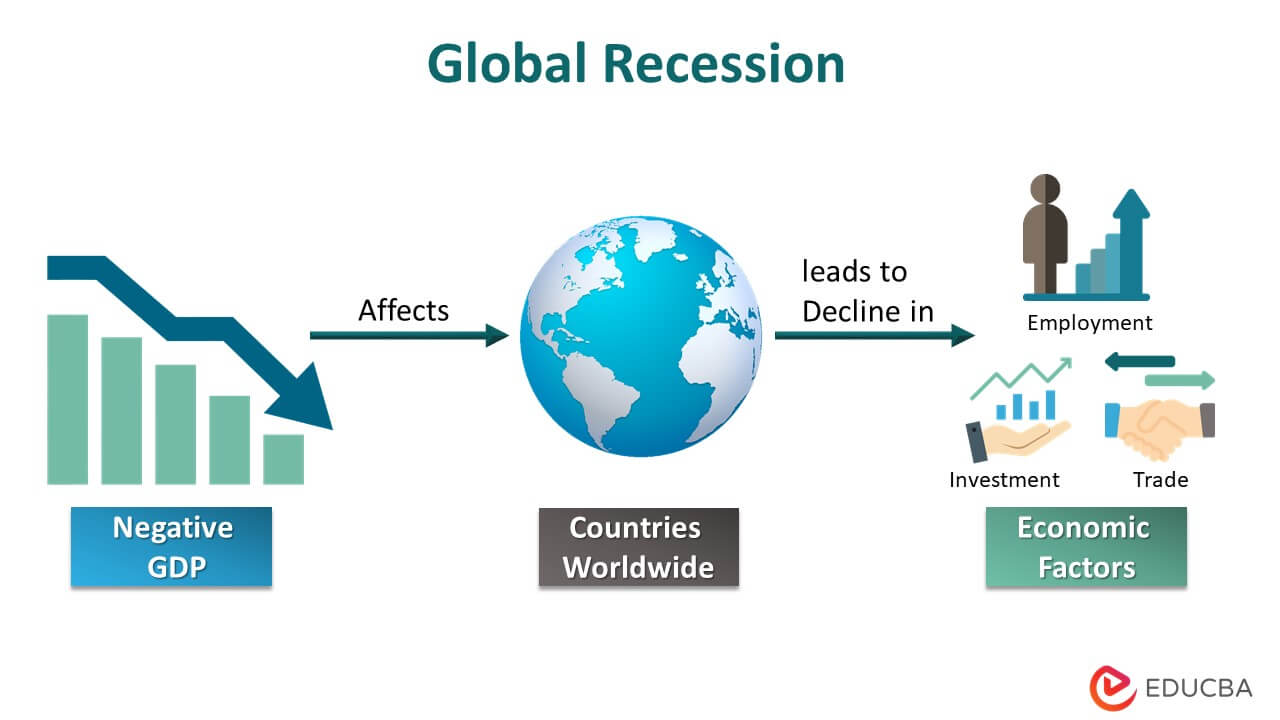

Global Recession

The first major aftershock of the Lehman Brothers collapse was the onset of a global recession. Economies worldwide contracted as credit markets froze, consumer confidence plummeted, and businesses scaled back production. Unemployment rates soared as companies, struggling to stay afloat, laid off employees in droves. The recession was a direct result of the financial instability caused by the collapse of Lehman Brothers and the subsequent loss of confidence in the global banking system.

Countries like Spain, Italy, and Greece were hit particularly hard, with unemployment rates reaching record highs. The global recession also led to a significant increase in government debt as countries pumped money into their economies to stimulate growth and prevent further economic decline.