Sailing Through the Stormy Waters: Top 7 Economic Crises Sparked by Skyrocketing Interest Rates

In the world of economics, few things can cause as much upheaval and uncertainty as skyrocketing interest rates. These dramatic increases can lead to a domino effect, causing a cascade of economic crises that can impact countries and individuals alike. This article will explore seven of the most significant economic crises sparked by soaring interest rates, providing a comprehensive look at the causes, impacts, and aftermath of each event. By examining these crises, we can gain a deeper understanding of the complex relationship between interest rates and economic stability, and perhaps glean insights into how to navigate future financial storms.

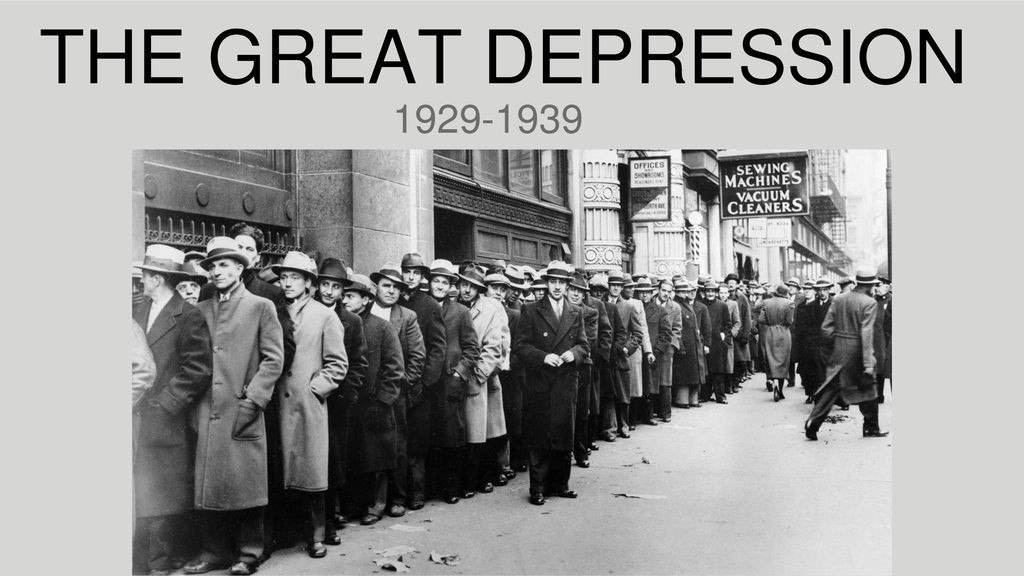

The Great Depression (1929-1939)

The Great Depression, which began in 1929 and lasted until 1939, is often cited as the most devastating economic crisis in Western history. While many factors contributed to this crisis, a key trigger was the US Federal Reserve's decision to raise interest rates in 1928 and 1929. This move was intended to curb stock market speculation but ended up causing a severe contraction in the economy. The fallout was immense, with widespread unemployment, bank failures, and a significant decrease in economic activity. The Great Depression serves as a stark reminder of the potential consequences of sudden interest rate hikes.