7 Economic Bubbles That Burst and Forever Altered the Course of History

The world of economics is a complex web of trends, patterns, and cycles, with one of the most fascinating and devastating phenomena being the economic bubble. A bubble forms when the price of an asset, such as real estate or stocks, skyrockets well beyond its actual value, creating an unsustainable situation that ultimately collapses. When the bubble bursts, it triggers widespread financial turmoil. This slideshow will take you through seven of the most significant economic bubbles in history, each of which caused immense financial damage in its time and left a lasting impact on both economic and social structures.

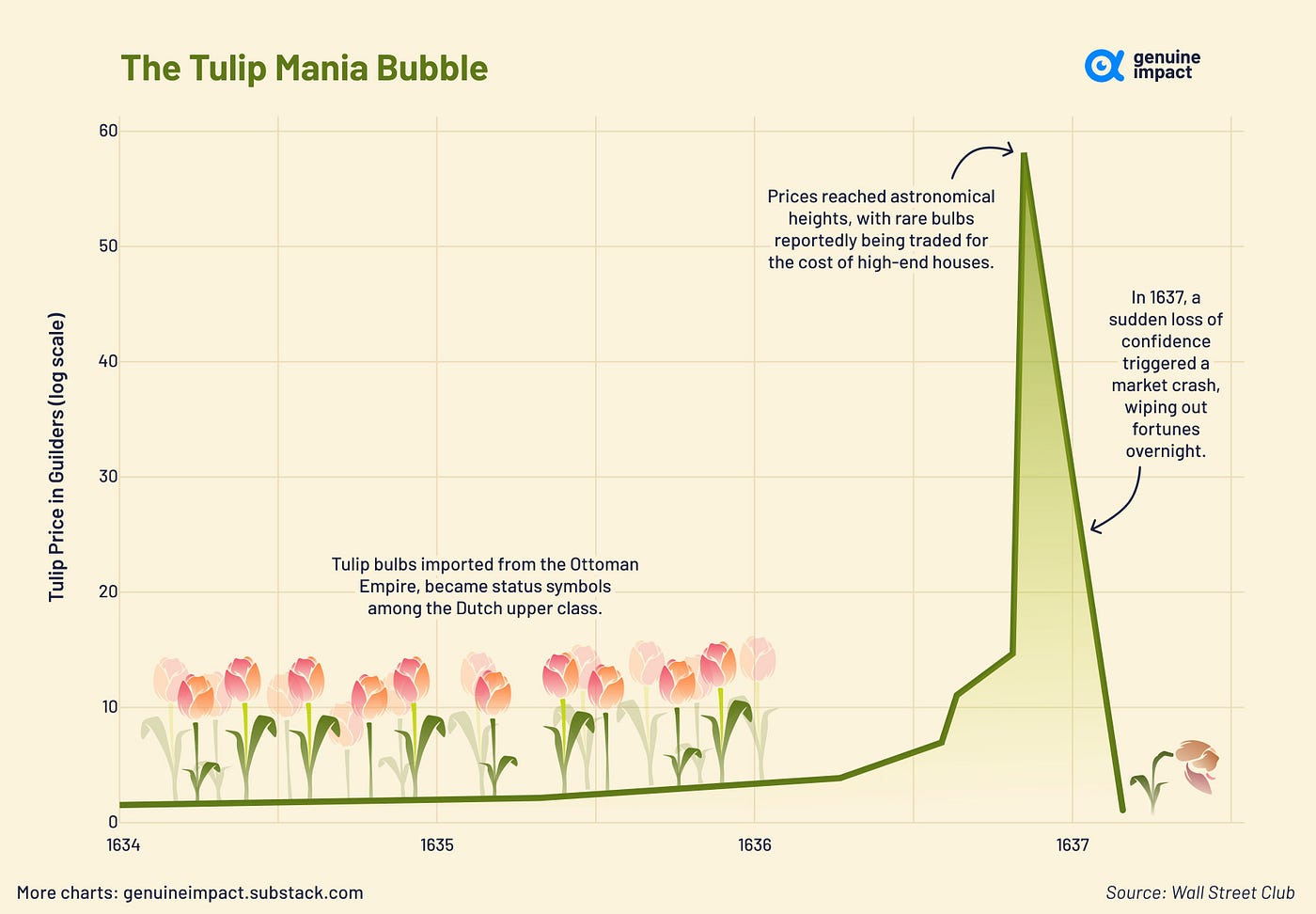

1. The Tulip Mania (1637)

The first recorded economic bubble was the Dutch Tulip Mania of the 17th century. Tulip bulbs became highly sought-after status symbols among the Dutch elite, driving their prices to absurd levels. At the peak of the frenzy, a single tulip bulb could be worth more than a house. However, the market crashed in February 1637, leaving many investors in financial ruin. Tulip Mania stands as a classic example of how speculation can cause asset prices to become detached from reality. The aftermath led to changes in Dutch economic policy and a lasting skepticism toward speculative investments.