Sailing Along the Edge: Seven High-Profile Tax Evasion Sagas That Skirted Legal Boundaries

Tax evasion—the illegal act of not paying or underpaying taxes—is a global issue that costs governments trillions every year. Some high-profile individuals often find themselves in the spotlight for these activities, skirting the line between legal loopholes and outright fraud. In this slideshow, we’ll explore seven high-profile tax evasion stories, each with its own mix of secrecy, legal battles, and public scandals. These cases provide a window into the world of tax evasion, its consequences, and how authorities fight back.

The Case of Al Capone

Al Capone, the infamous American gangster, made millions during the Prohibition era but never paid taxes on his illegal income. His tax evasion eventually led to his downfall. In 1931, Capone was convicted of tax evasion and sentenced to 11 years in prison. His story is a classic reminder that even the most feared and powerful individuals can be brought down by failing to pay taxes.

The Wesley Snipes Saga

Hollywood actor Wesley Snipes landed in serious trouble in 2008 when he was convicted for not filing tax returns. Snipes had failed to file returns for several years, costing the U.S. government millions. His case highlights that even celebrities with fame and fortune are not above the law when it comes to taxes.

The Lionel Messi Incident

In 2016, soccer superstar Lionel Messi and his father were found guilty of tax fraud in Spain. They had used offshore companies to avoid paying taxes on Messi's endorsement income. Despite their wealth and international fame, they weren’t able to escape the reach of the law.

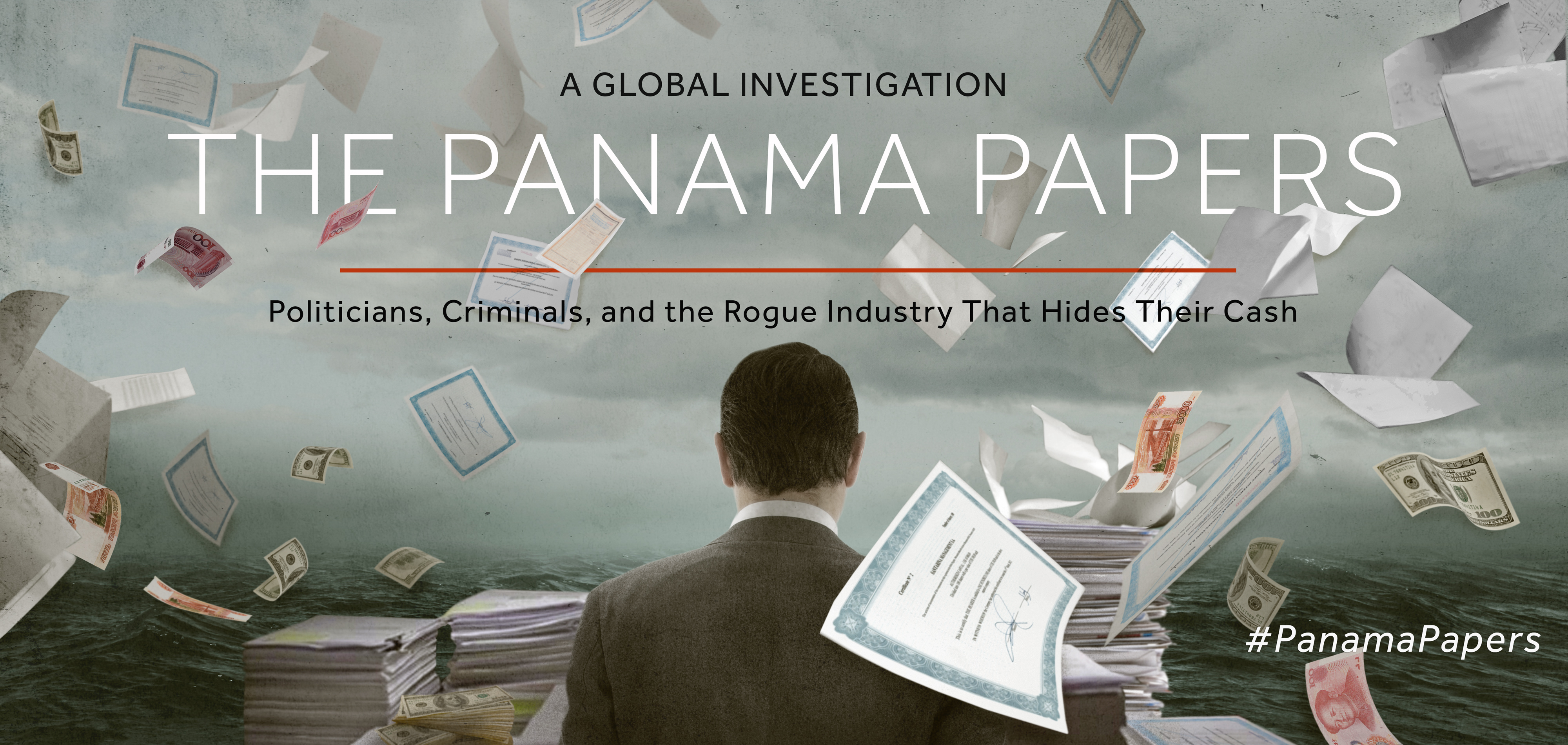

The Panama Papers Leak

One of the most significant tax evasion revelations came with the Panama Papers leak in 2016. The leaked documents exposed a global network of offshore companies used by wealthy individuals to hide their money and avoid taxes. This leak triggered multiple investigations and raised awareness about how widespread tax evasion really is.

The Paradise Papers Scandal

Following the Panama Papers, the Paradise Papers leak in 2017 revealed even more about tax evasion among the rich and powerful. The documents exposed how politicians, celebrities, and business leaders used offshore financial schemes to evade taxes. The public outrage that followed led to calls for tighter tax regulations.

The Case of Paul Manafort

Paul Manafort, the former campaign chairman for President Donald Trump, was convicted of tax fraud in 2018. He had concealed millions of dollars in offshore accounts to avoid paying taxes. His case shows the potential political fallout that can result from tax evasion scandals.

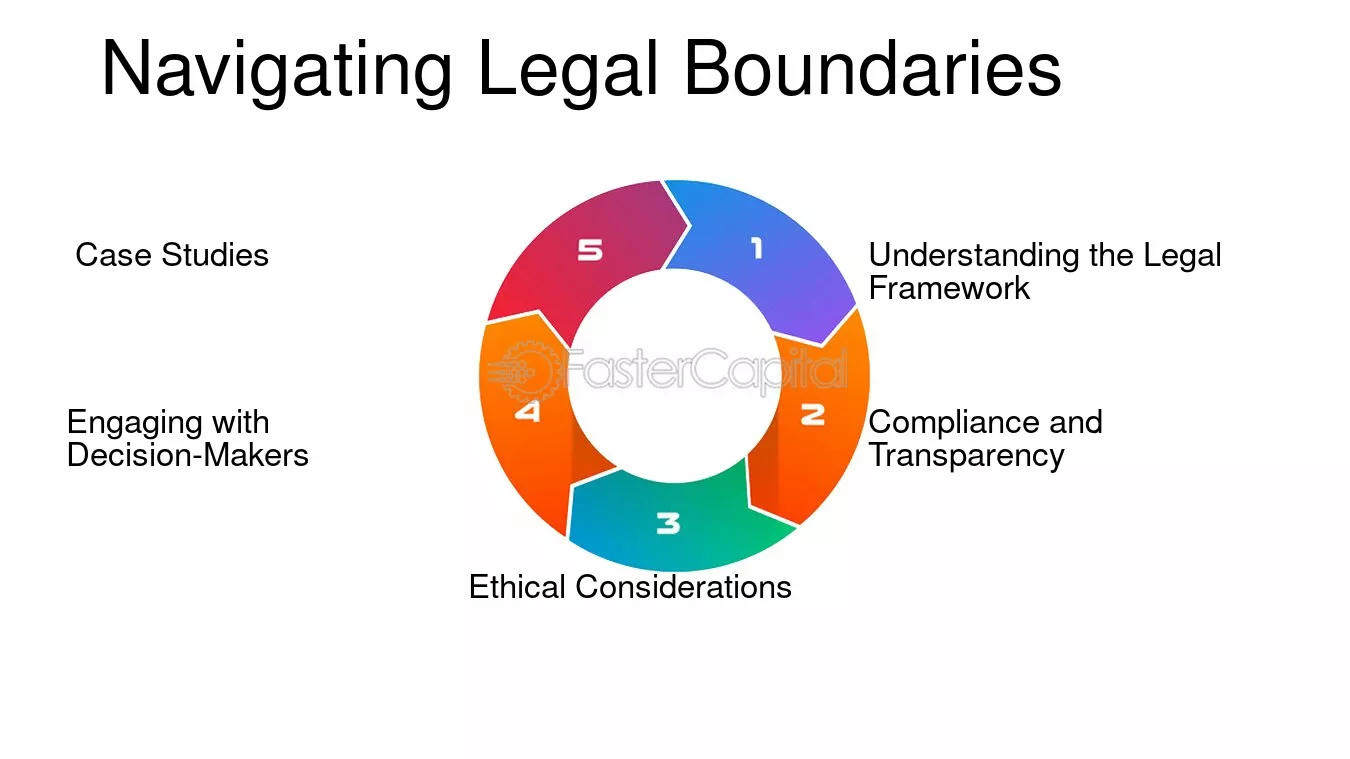

Navigating the Legal Boundaries

These high-profile tax evasion cases illustrate the lengths some individuals will go to avoid paying taxes and the wide-reaching impact of their actions. They also serve as a clear message: no matter how powerful or famous, nobody is above the law. As governments continue to crack down on tax evasion, this issue will remain a major topic in both public and political conversations.